gbg art.

posted on

Oct 21, 2010 03:40PM

Edit this title from the Fast Facts Section

Send Message

Great Basin Gold's (GBG) stock has just broken out to the high side and they have doubled their market capitalization in the short time space of two months. See the calculations in the table following:

Great Basin Gold's (GBG) stock has just broken out to the high side and they have doubled their market capitalization in the short time space of two months. See the calculations in the table following:

Table 1: Great Basin Gold - Market Capitalization. At October 19th, 2010, all the warrants are in the money and debentures may be converted to shares.

(Click to enlarge)

What do you suppose the market is saying here? Well, ladies and gentlemen, this is a prime example of a mining company sitting in the sweet spot of the value curve when bringing their new mine into production. For a fuller explanation of the sweet spot for a mining Junior click here.

Great Basin does not just have one mine coming into production but two. Their large prime mine in the Witwatersrand Basin of South Africa, Burnstone has started milling ore, this fall. Their smaller sister Nevada mine, Hollister has been test mining for over one year and has just recently this summer stabilized their milling operations.

The market is finally acknowledging this mining production progress and is beginning to recognize the value of Great Basin and has responded by assigning a higher share price. This is not a trivial matter, in the creation of a $600 million valuation increase, by bringing these mining projects into production. This is the culmination of a long time struggle with mine building and financial markets resulting in rapid revaluation of Great Basin Gold's share price.

Interview with Mr. Ferdi Dippenaar, CEO of Great Basin Gold

The author has followed Great Basin closely, and further background may be obtained from these articles here on Seeking Alpha. It was with surprise and pleasure, when Mr. Michael Curlook, Manager of IR and Corporate Development called and said that Mr. Ferdi Dippenaar, President and CEO of Great Basin Gold was willing to talk to me about Great Basin's future prospects. The interview following is verbatim from notes and was conducted by telephone with Mr. Dippenaar in South Africa on October 19th, 2010.

The author asked Mr. Dippenaar to brief us on Great Basin's outlook going forward as to exploration priorities among their existing mine sites of Hollister, and Burnstone and also their green field explorations in Tanzania and Mozambique. Note: further information about the Tanzanian and Mozambique properties are in the March 31, 2010 Annual Information Form here.

Ferdi Dippenaar: If we have a look at the Mozambique property. It is in the Tsetsera area, it is a green belt. It is an area that has seen some mining. What we have is... we actually have a property, which we've done some dirt sampling, grab sampling, we've looked at some trenches, and tried to get...this is even ...if I qualify, this is even before we put out a drilling program.

Marco G.: Right.

Ferdi Dippenaar: The whole idea was to do a lot of surface work, and the mapping. I forgot to say we've done the actual mapping, which we've spend quite a bit of time on. So we have the...we could have let go of the property, we've decided against that, because just based upon the initial results, even if it's only from the initial surface exploration, was such that we felt that it's definitely worth follow-up. The follow-up would be ....probably more trenching and then first pass drilling.

Marco G.: First pass drilling?

Ferdi Dippenaar: First pass drilling, yes.

Marco G.: That will be exciting for investors.

Ferdi Dippenaar: Yeah, I think it definitely will, we are looking forward to it. We actually think it could be extremely exciting.

Marco G.: Yes, you say the property is 17 square kilometers, and from the information on your site, it has been worked historically by artisanal miners and that there is exposure on the surface.

Ferdi Dippenaar: There is definitely exposure on the surface, but it is also trying to...there is not a huge amount of ground cover. But it is also to bring it a bit further ....to understand the extent of the mineralization.

Marco G.: Okay, that's Mozambique, how about the other area, Rusaf... GBG Rusaf.

Ferdi Dippenaar: Yes GBG Rusaf , yeah that is quite interesting. I think if you access the actual reports, technical reports, that were placed on the web site... did you get them.

Marco G.: Yes, we have gone through them.

Ferdi Dippenaar: In our minds, it is basically the two areas, and that would be the Lupa area, which we own a significant land package, which ........definitely after the first pass drilling. That's basically, what we did two years ago. It is having to firm up. Now it is the second pass drilling because we've identified some target areas.

Marco G.: Okay,

Ferdi Dippenaar: I don't want to repeat everything that are in the actual reports as well.

Marco G.: I understand... I guess what we are kind of looking for, and maybe GBG plans aren't yet there. October 15th has just barely gone past last Friday. What with the warrants, now there is a fresh infusion of funds into the company.

Ferdi Dippenaar: Exactly, you are quite right. The whole intention is...so let's just go through the various areas in Tanzania. We've discussed the...we call it the N’kuluwisi gold property in southern Tanzania. That's bordered the Lupa area. I think that you'll see the measured and indicated and inferred resource, it probably around ...well let's just take the grade of 1.5 g /ton that's currently 67,000 ounces. That's with the first pass drilling, that took place. If one has a look at the northern section, which you've got the Lubando area. I don't know if you saw that technical report?

Marco G.: I may have, but it is not at my fingertips presently.

Ferdi Dippenaar: I just trying to deal with the size and the actual resource. So, that's nearly 200,000 ounces but the one that probably excites us more is the Imweru report, where we have the resource of 629,000 ounces. Yeah, that's fairly large. And bear in mind that is just first pass drilling. So that's was our prioritization of target areas, it would probably be in Imweru and then the southern portion which is the Lupa target area. And that's in N’kuluwisi, that technical report.

Marco G.: All right.

Ferdi Dippenaar: So, here we are talking exploration, and the prioritization thereof. I would put the Hollister property right on top.

Marco G.: Wow, Okay,

Ferdi Dippenaar: So the Hollister property is the most important, bear in mind that we've made three discoveries, the Hatter Graben, the Gloria veins system and the extended Gwenivere veins system... all really prospective.

Marco G.: Right.

Ferdi Dippenaar: We actually believe, that even from underground, we could achieve... we've focused and targeted another area. Which is probably...it is the subject of exploration, that still has to take place later this year.

Marco G.: Okay, as soon as that.

Ferdi Dippenaar: Yeah, as soon as that. Each year we do a lot of infill drilling at the Hollister property. But we do believe that ...our thinking is that if we drill a fairly long hole out to the Velvet area from underground. We actually think that we could be passing through a number of structures that could be hosting mineralization.

Marco G.: Yes, I see that in your reports, where you hit one area and then you hit a new vein system with one drill hole. I guess that is the advantage of going underground and drilling underground,

Ferdi Dippenaar: Yeah, again drilling underground is of course a lot easier. It's the ability to drill, to put out a long hole. It just makes a lot more sense and lot more cost effective.

Marco G.: Right, not only are you... sometimes you can even do the infilling and you may hit things that you were not expecting, which is great...blue sky.

Ferdi Dippenaar: Exactly, I believe there is a significant amount of blue sky at the property. Hollister is just so extremely prospective! It is slightly more expensive to drill in North America, than what it would be in South Africa or Africa, but just due to the prospective nature of the property, I believe there is good pay back there.

Marco G.: Right, to add to the existing mine life and increasing resources. I recall reading somewhere, that you say you are looking for 3 million ounces, so that is adding 2 million before putting in your own mill.

Ferdi Dippenaar: Yeah, that would be the idea. That would definitely be...expand the current operation and also the life of mine. I think that it is a bit of both.

Marco G.: One of the best articles that I have read about your mine was the Northern Miner article, from February of this year. I think it was a lady that wrote it, a Gwen Preston from a site visit to your Hollister mine.

Ferdi Dippenaar: Oh yes, that's right.

Marco G.: They went over quite a bit of exploration. I recall that the Hatter Graben, from one of your conference calls , that one of the analysts was very interested in that. They were asking you, I think it was earlier this year.

Ferdi Dippenaar: You are quite right. She did that visit. Yes, anybody that tend to visit the site gets the ...I sense....they see and they enjoy the what they see.

Marco G.: Like from her article, it says here that GBG's plan was to head towards that area with an underground decline .

Ferdi Dippenaar: Yeah, that is still the plan. The whole idea is to rather do a bit more exploration because exploration is obviously a lot cheaper than doing the development.

Marco G.: Right, and that would serve a double purpose. The decline would help in exploration and later it would be part of the infrastructure.

Ferdi Dippenaar: Exactly, that is still the thinking.

Marco G.: As part of this article, may I ask you are looking for the mine, a second raise it says. Is that still happening presently?

Ferdi Dippenaar: The second raise... oh yes, the Alimak raise, that is currently being developed as we speak.

Marco G.: This is a vertical raise to help with ventilation and maybe other usages as well.

Ferdi Dippenaar: Absolutely.

Marco G.: I haven't seen anywhere else, but this article touches upon the prospectively of the Esmeralda property that you folks were very fortunate to latch onto.

Ferdi Dippenaar: Yeah, the Esmeralda property, we believe in terms of priority, it would be Hollister and then Esmeralda. The principal or the main focus after we acquired Esmeralda was to get the mill up and running. Of course after we get the mill up and running, we can then start focusing on actually ...after the mill, is to try and see how... that is to look at more of Esmeralda but underground . Bear in mind that we have a number of declines on the site, and the declines ...especially the Prospectus decline ...it was flooded by ordinary ground water. It is something that could be easily be de-watered. And they did just stop the mine, stopped mining so there is some mineable material and stopes available for mining which can contribute to production, while we are busy with more exploration. There is production upside at Esmeralda and exploration upside

Marco G.: Wow, okay. I suppose I am a little bit too early. As I've said your plans aren't yet in place yet.

Ferdi Dippenaar: Yes, it will be basically determined by the availability of funding. So, if there is funding available, we will then go out and do the exploration at Esmeralda. But only after we've allocated funding to do the exploration at Hollister.

Lastly, there is Burnstone. At Burnstone, we have a significant ore body. It is already in excess of 13 million ounces. We can drill more holes and we continue to drill more holes and find more but ultimately at the end of the day you can only mine so much in the short term. I just believe that one could do better by spending a bit more money on the ...you know you get more return for your exploration dollar if it was spent at Hollister and Esmeralda in the short term.

Marco G.: Okay, short term it is Hollister and Esmeralda. But what is the potential though, at Burnstone? It's the reef area and you are fortunate that in the Burnstone mine that it is the up lifted portion of the reef. But there must be a deeper portion on the other side of the faults.

Ferdi Dippenaar: No, it actually becomes shallower again. The deepest portion of that basin is probably about 1200 to 1300 meters below surface. That is the deepest portion; bear in mind that after 19 years of mining we only get down to 750 meters below surface. So this is in 25 years maybe we get down to 1200 meters below surface. There is a lot of mining to do. A lot of shallow areas still that can be explored. You know, we have ....remember that this ore body is extremely shallow. We are mining on the shallowest part.

Marco G.: It is quite uncharacteristic of the deep South African mines.

Ferdi Dippenaar: Very, very different. Bear in mind ... the very different basin; we own the largest land holdings in this South Rand basin. The reef starts at 216 meters below surface.

Marco G.: That's very shallow. Mr. Dippenaar, may I enquire a little bit? Your company is just bringing two mines on, into production and you have these mine building teams in place. What might be the outlook going forward. You are doing the exploration for further reserves and resources at both mines, in Hollister and Burnstone. And Hollister is probably higher priority and more bang for the buck as you say. Are there any thoughts as to how to further leverage these mine building capabilities of your teams.

Ferdi Dippenaar: Yeah, I definitely think so. If you have a look at the fact that the teams are there. They have the necessary experience and then to go out to expand the current operations or then build new mines. We do have the capacity and management and the experience to actually to do that.

Marco G.: The only thing holding you back is getting the production complete and the markets to re-rate Great Basin Gold as a Mid-Tier producer.

Ferdi Dippenaar: Yeah, I tend to agree with that. I just think we need to settle down both Hollister and then Burnstone. And as soon as we settle them down, I think we are ready to go. So, to me it's just taking a bit of a breather.

Marco G.: Sure.

Ferdi Dippenaar: In terms of getting a bit of consistency at the operations.

Marco G.: May I ask, that Hollister, again, I read somewhere, that the main holdback for expansion isn't mining, its actually milling capability. For expansion of the milling circuit, you would be able to increase production.

Ferdi Dippenaar: Exactly, that's exactly why acquiring or ending up with a mill significantly larger than what we have would be the ideal situation.

Marco G.: Would it be possible to continue like what you've done in the past, the contract milling. Like say either at Midas or the Yukon Nevada operation, in parallel with your Esmeralda or is it just the costs don't warrant it? The costs and complexity.

Ferdi Dippenaar: I wouldn't like to send any more ore to the Midas mill, the costs of milling it there are just too expensive. You just pay too much or lose too much by doing it. My focus would rather be to find either a milling capacity... If we do find milling capacity, we would be able to grow either operations, Hollister or Esmeralda. That is the target.

Marco G.: The target is to find milling capacity. In previous years, I understand other companies were looking at and examining Hollister in terms of resources and in terms of ...before the mine was actually where it is now. It was three, four years ago where that they had an interest, maybe now it might the other way around. You are working now and you have an interest in... You have expertise in this narrow vein mining and there are probably other mines in there that could use that.

Ferdi Dippenaar: That is true. But as I said, let's first get the current operation up and running and then we'll be able to get a better idea of where it is we go in the future.

Marco G.: All right, well, I want to thank you again, Mr. Dippenaar. You are taking time, and it is the end of a very busy day for you, in the middle of your busy schedule. This is really an exciting time for you I' m sure, that these things are coming to fruition. Burnstone pouring Gold and Hollister being stabilized as an actual operation.

Ferdi Dippenaar: Yeah.......It is definitely an exciting time to be around. Yeah.....it is a great time to be around.

Marco G.: And also, certainly helps that there seem to be an increased emphasis on the Gold and precious metals. Here you have two mines coming into full production right in the midst of that big trend.

Ferdi Dippenaar: Yeah...it is a nice change. We've been working on this extremely hard. And it just seems like it is coming together pretty nicely.

Marco G.: Well, my hat's off to you and your folks. You folks have really brought it in. This is probably just the beginning for Great Basin.

Ferdi Dippenaar: I believe that. I think we are at a very, very interesting time in the Company's development.

Marco G.: I kind of hear what you are saying about Burnstone, you have already 12-13 million ounces of Gold there. The money has more bang for the buck, say elsewhere as at Hollister where it may be possible to expand production with the grades and the expertise that you have at being able to mine the narrow widths.

Ferdi Dippenaar: Absolutely.

Marco G.: Well, that is just great. I hope that this interests our readers and maybe new investors.

Ferdi Dippenaar: Thank you, I appreciate it.

Well, dear readers, there you have it, the CEO of Great Basin, that is in the process of ramping up two high quality production Gold mines.

Outlook for Great Basin Gold in Production

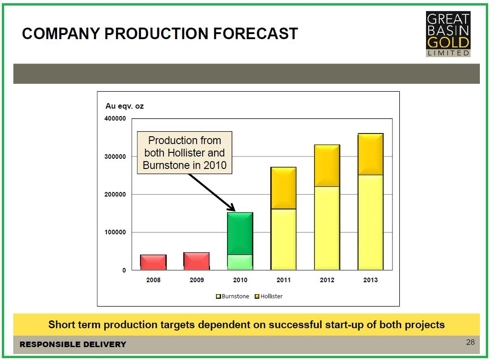

The author borrows information from Great Basin's presentation at the recent September 20th, 2010, Denver Gold Show to display the company outlook forthcoming. The production forecast is in the chart following:

Figure 1: GBG Production Estimate. Note the increase this year from Burnstone coming online and Hollister being stabilized.

Great Basin's Hollister mine is now in full production with their Esmeralda mill tuned up for full recoveries. Added to Hollister's production is the start of milling at the Witwatersrand Burnstone mine this month. Great Basin is estimating production of about 150,000 ounces of Gold for fiscal 2010. That means sometime in the 4th quarter of 2010, Great Basin Gold will turn the corner into profitability.

Then the outlook for 2011, in production is about 270,000 ounces of Gold.

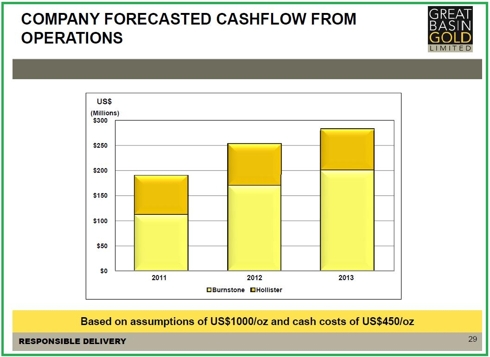

Outlook for Great Basin Gold in Cash Flow

The chart following displays the estimated cash flow for the next few years: (click to enlarge).

Figure 2: GBG Cash Flow Forecast. Note the rapid jump to almost $200 Million in 2011.

It is estimated that Great Basin after turning profitable towards the end of 2010, will now turn cash flow positive in 2011 with almost $200 million for the year. This is due to the quick ramp up in production of the Hollister and Burnstone mines. This is a time of rapid change for the good in the financial affairs of the company. As Mr. Dippenaar commented in the interview above:

"Yeah.......It is definitely an exciting time to be around. Yeah.....it is a great time to be around."

Great Basin Gold is now in High Growth Stage of Cycle

Great Basin is in an opportune spot, as displayed in the classic model of a mining company along the route of mine development in the chart below: (click to enlarge).

Figure 3: Classic Mining Company Ramp Up. Note the potential for a company that sits in the sweet spot of between point 6 and 7. The high growth stage of GBG may be just starting.

That opportune sweet spot is just when the mining company turns the corner into profitability and is now poised for high growth. Great Basin has just completed the mine construction and is now at the production start-up point. As the theoretical model shows, there now appears to be great upside, as the company enters the high growth stage of its life.

Marco G.'s Opinion

The author looks to satisfy two prime criteria for investing in a mining company. The first criteria is the quality, competence and perseverance of management. Mining is difficult, and the results will boil down to how the management will create value for the investor.

The second criteria consists of the prospects of mining in terms of production, reserves & resources and exploration upside. Obviously, Great Basin is increasing production with the commissioning of the Burnstone mine. The Burnstone mine is a shallow, low cost and long life golden nugget for Great Basin Gold.

For reserves and resources, recently in September 2010, Great Basin has released new NI 43-101 technical reports for both their Burnstone and Hollister mines.

As for exploration, now that the mine building emphasis may be shifted, funding for exploration should resume. This was what the interview with Mr. Dippenaar was about; where are the exploration opportunities for Great Basin? There are many drilling prospects as disclosed in the interview, but the highest priority will be the underground drilling from Hollister due to be reported upon this year. Why is Hollister the highest priority, you may ask? The Gold mining grades at Hollister are among the highest grades in the world for a production gold mine and may be considered "bonanza" grades, as reported in the September 2010 NI 43-101 report:

At a cut-off grade of 0.25 oz/ton (8.57 g/t Au), the combined measured and indicated mineral resources contain 1.64 million gold equivalent ounces grading 1.305 oz/ton (44.73 g/t Au) for gold and 10.3 oz/ton (355 g/t) for silver

The high grade is not just a lucky hit but the calculated average over the whole resource definition. Hollister is the second bright nugget for Great Basin Gold.

Disclosure: The author is long Great Basin Gold -GBG.

Disclaimer: The information and opinions contained within this document reflect the personal views of the author and should be viewed as food for thought and amusement only. The author may from time to time have a position in any of the securities mentioned. There are no guarantees of the accuracy, reliability or completeness of the information contained herein. Independent due diligence and discussions with one’s own investment and business advisor is strongly recommended. These writings are not to be construed as an offer or solicitation with respect to the purchase or sale of any security or as an endorsement of any product or service. We do not request or receive compensation in any form in order to feature companies in this publication. It is prohibited to copy or redistribute this document to any type of third party without the express permission of the author. This document may be quoted, in context, provided proper credit is given.

Disclosure: Long Great Basin Gold - GBG