madhedgefund...lithi... article

posted on

Apr 06, 2011 10:44AM

Edit this title from the Fast Facts Section

Featured Trades: (SPECIAL BATTERY ISSUE),

(XIDE), (BYDFF), (SQM), (SNE), (GM), (XOM)

1) The Great Race for Battery Technology. One hundred years from now, historians will probably date the beginning of the fall of the American Empire to 1986. That is the year President Ronald Reagan ordered Jimmy Carter’s solar panels torn down from the White House roof, and when Chinese Premier Deng Xiaoping launched his secret “863” program to make his country a global technology leader.

The End is Near for the US

-

Some 34 years later, the evidence that China is winning this final battle is everywhere. China dominates in windmill power, controls 97% of the world’s rare earth supplies essential for modern electronics, is plunging ahead with “clean coal”, and boasts the world’s most ambitious nuclear power program. It is a dominant player in high speed rail, and is making serious moves into commercial and military aviation. It is also cleaning our clock in electric cars, with more than 30 low cost, emission free models coming to the market by the end of 2011.

Our only entrant in this life or death competition is the Tesla, little more than a rich man’s toy. At $100,000 per vehicle production is capped at 1,000 units a year. Its cheaper S-1 sedan isn’t coming out for two more years. General Motors’ (GM) pitiful entrant in this sweepstakes, the Chevy Volt, only just became available in limited numbers, and won’t see true mass production for at least a year. By then it will be easily overtaken by superior, cheaper technologies offered by multiple Chinese models, Japan’s Nissan Leaf, and a third generation Toyota plug-in Prius.

Tesla

-

This is all far more than a race to bring commercial products to the marketplace. At stake is nothing less than the viability of our two economic systems. At the moment, China’s state directed socialism is winning. By setting national goals, providing unlimited funding, focusing scarce resources, and letting engineers run it all, China can orchestrate assaults on technical barriers and markets that planners here can only dream about. And let’s face it, economies of scale are possible in the Middle Kingdom that would be unimaginable in America.

Nissan Leaf

-

The laissez faire, libertarian approach now in vogue in the US creates a lot of noise, but little progress. The Dotcom bust dried up substantial research and development funding for technology for a decade. A ban on government funding of stem cell research, for religious reasons, left us seriously behind in that crucial field. An administration that believed that global warming was a leftist hoax, coddled big oil, and put alternative energy development on a back burner. Never mind that the people supplying us with 2 million barrels of crude a day are trying to kill us through whatever means possible. But Americans are finally figuring out that we can’t raise our standard of living selling subprime loans to each other, and that a new direction is needed.

Toyota Prius

-

Mention government involvement in anything these days and you get a sour, skeptical look. But this ignores the indisputable verdict of history. Most of the great leaps forward in US economic history were the product of massive government involvement. I’m thinking of the transcontinental railroad, the Panama Canal, Hoover Dam, the atomic bomb, and the interstate highway system. If the government had not funneled billions in today’s dollars into early computer research, your laptop today would run on vacuum tubes, be as big as a skyscraper, and cost $100 million.

Meet My New Laptop

-

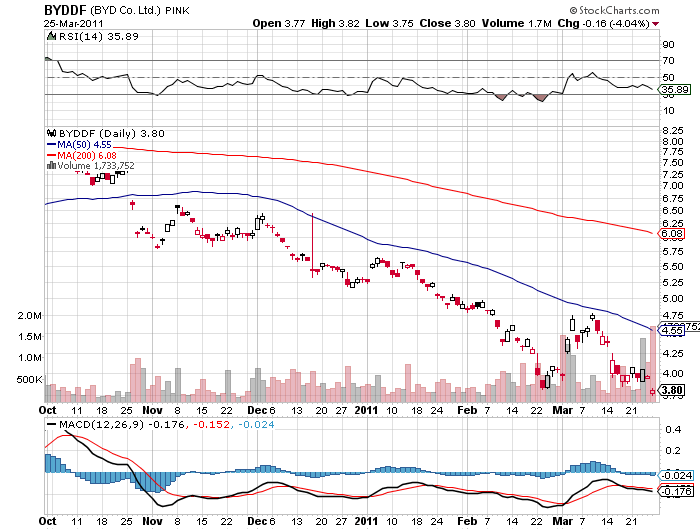

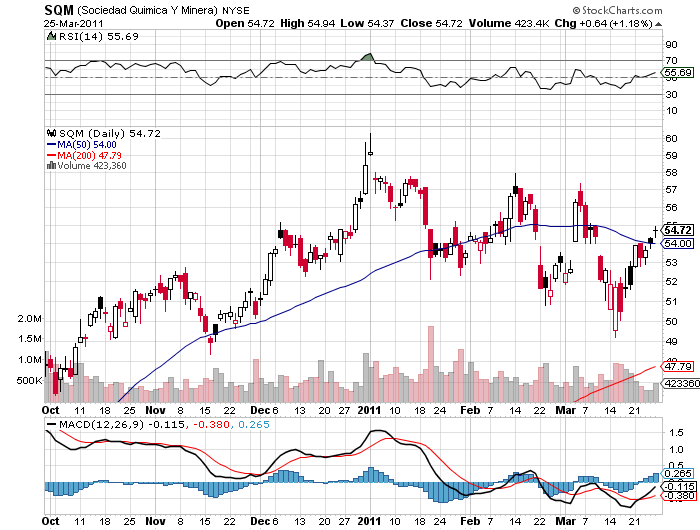

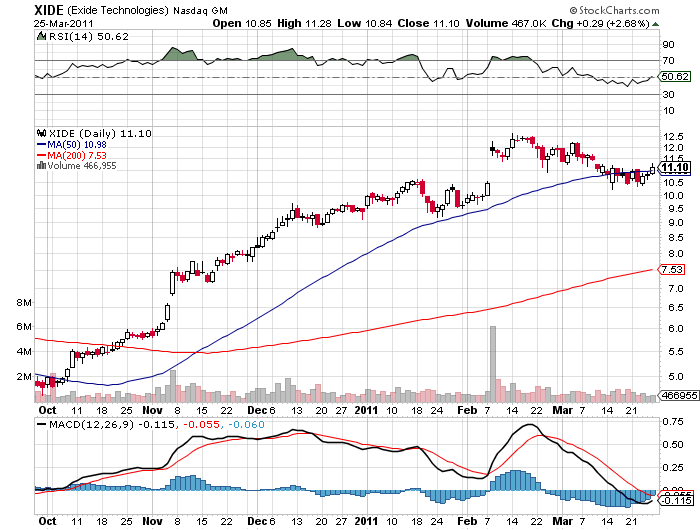

I mention all of this not because I have a fascination with obscure automotive technologies or inorganic chemistry (even though I do). Long time readers of this letter have already made some serious money in the battery space. This is not pie in the sky stuff; this is where money is being made now. I caught a 500% gain hanging on to Warren Buffet’s coat tails with an investment in the Middle Kingdom’s Build Your Dreams (BYDFF) two years ago (click here for the piece). I followed with a 250% profit in Chile’s Sociedad Qimica Y Minera (SQM), the world’s largest lithium producer (click here). Next came Xide Technologies (XIDE), with a 70% pop (click here). These are not small numbers. I have been an advocate and an enabler of this technology for 40 years, and my obsession has only recently started to pay off big time.

We’re not talking about a few niche products here. The research boutique, HIS Insights, predicts that electric cars will take over 15% of the global car market, or 7.5 million units by 2020. Even with costs falling, than means the market will then be worth $225 billion. Electric cars and their multitude of spin off technologies will become a dominant investment theme for the rest of our lives. Think of the auto industry in the 1920’s. (BYDDF), (SQM), and (XIDE) are just the appetizers.

All of this effort is being expended to bring battery technology out of the 19th century and into the 21st. The first crude electrical cell was invented by Italian Alessandro Volta in 1759, and Benjamin Franklin came up with the term “battery” after his experiments with brass keys and lightning. In 1859, Gaston Planté discovered the formula that powers the Energizer bunny today.

I Don’t Look 151 Years Old, Do I?

-

Further progress was not made until none other than Exxon developed the first lithium-ion battery in 1977. Then, oil prices crashed, and the company scrapped the program, a strategy misstep that was to become a familiar refrain. Sony (SNE) took over the lead with nickel metal hydride technology, and owns the industry today, along with Chinese and South Korean competitors.

BYD F3

-

We wait in gas lines to “fill ‘er up” for a reason. Gasoline has been the most efficient, concentrated, and easily distributed source of energy for more than a century. Expect to hear a lot about the number 1,600 in coming years. That is the amount of electrical energy in a liter (0.26 gallons), or kilogram of gasoline expressed in kilowatt-hours. A one kilogram lithium-ion battery using today’s most advanced designs produces 200 KwH. Stretching the envelope, scientists might get that to 400 KwH in the near future. But any freshman physics student can tell you that since electrical motors are four times more efficient than internal combustion ones, that is effective parity. The additional savings that no one talks about is that an electric motor with five moving parts has no maintenance cost versus the endless bills generated by the 300 overcooked parts in a gasoline engine.

This kind of performance doesn’t come cheap. Lithium-ion batteries currently cost $1,000 per KwH to produce. That means that the 600 pound, 24 KwH battery pack that will power my soon to be delivered Nissan Leaf costs $24,000, more than two thirds of the vehicle’s total $32,000 price tag. Hence, the need for government subsidies to get private industry over the cost/production hump. Nissan, Toyota, Tesla, Fisker, and others are all betting their companies that further progress and economies of scale will drive that cost down to $300 per KwH. That will make electric cars cheaper than conventional hydrocarbon powered ones. Take crude up to $150-$200/barrel, which I believe is a virtual certainty in coming years, and the global conversion to electric happens much faster than anyone thinks.

Yes, it seems to be all over for the US but the crying, unless Nobel Prize winner and Energy Secretary Dr. Steven Chu has anything to say about it. In a desperate attempt to play catch up, President Obama has lavished money on alternative energy, virtually, since the day he arrived in office. His stimulus package included $167 billion for the industry, enough to move hundreds of projects out of college labs and into production. However, in the ultimate irony, much of this money is going to foreign companies, since it is they who are closest to bringing commercially viable products to market. Look no further than South Korea’s LG, which received $160 million to build batteries for the Volt. Also, Finland’s Fisker, which scored $528 million to refurbish an abandoned GM Pontiac and Saturn plant in Joe Biden’s home state of Delaware in order to build its hybrid electric Karma vehicle.

Karma

-

Fortunately, the US, with its massively broad and deep basic research infrastructure, a large military research establishment (remember the Darpa Net), and dozens of still top rate universities, is in the best position to discover a breakthrough technology. The Energy Department has financed the greatest burst in inorganic chemistry research in history, with top rate scientists pouring out of leading defense labs at Los Alamos, Lawrence Livermore, and Argonne National Labs. There are newly funded teams around the country exploring opportunities in zinc-bromide, magnesium, and lithium sulfur batteries. A lot of excitement has been generated by lithium-air technology, as well as much controversy.

In the end, it may come down to whether our Chinese professors are smarter than their Chinese professors. In 2007, the People’s Republic took the unprecedented step of appointing Dr. Wan Gan as its Minister of Science and Technology, a brilliant Shanghai engineer and university president, without the benefit of membership in the communist party. Battery development has been named a top national priority in China. It is all reminiscent of the 1960’s missile race, when a huge NASA organization led by Dr. Werner Von Braun beat the Russians to the moon, proving our Germans were better than their Germans.

Anything for a Green Card

-

Consumers were the ultimate winners of that face off as the profusion of technologies the space program fathered pushed standards of living up everywhere. I bet that’s how this contest ends as well. The only question is whether the operating instructions will come in English—or Mandarin.

Its Easy, Just Read the Manual

This is not a solicitation to buy or sell securities.

For full disclosures click here at http://www.madhedgefundtrader.com/disclosures.

The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office

The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office.

Futures trading involves a high degree of risk and may not be suitable for everyone.