Invest In Lithium Before The Battery Rush

posted on

Oct 27, 2011 12:24PM

Edit this title from the Fast Facts Section

As the world ramps up the production of electric cars, and as the mobile web takes center stage, the cost of lithium, used in the electric batteries of both industries, is rising along with demand. Current supply will not meet demand in the next few years.

Lithium is the lightest of all metals and is able to hold more energy per unit of weight than any other material, Lithium is already powering the mobile web boom as it ramps up. It is also now accepted that lithium will power the electric vehicle revolution, and that revolution is getting into full swing.

According to MSN, 428 million mobile web devices were sold in Q1 2011 alone. As the world becomes saturated with such devices, as well as millions of other smart devices, battery-grade lithium can only increase in value. Your iPhone, iPad, iPod, Android device, BlackBerry, etc, is probably powered by lithium right now. If it is not, it soon will be.

You will hear many echo the fact that lithium, in it's raw form, is abundant. That is an undeniable fact. Lithium is found in many places in the environment, including in our oceans. However, the extraction and processing of the end product is another matter entirely. As with most enterprises, it takes technical expertise, engineering, good science, and investment to produce battery-grade lithium.

Lithium producers can currently be separated into "brine" producers, such as those producing lithium from salars (salt lakes) in the Atacama desert of Chile and Argentina -- one of the richest lithium-producing areas on the planet -- and pegmatite producers, which extract lithium from rock, like those in Canada and Australia. Both methods have their pros and cons. Suffice to say that a company that gets first mover advantage in both methods of production will have a huge advantage in supplying the future electric vehicle market.

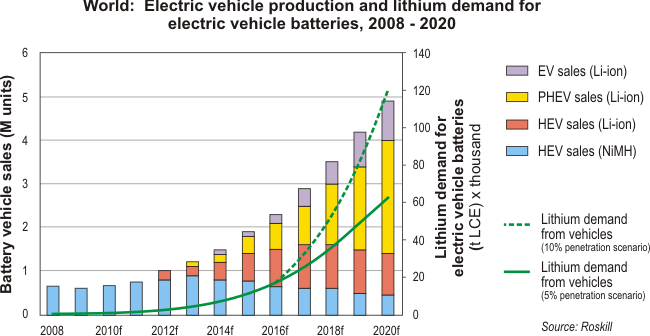

China alone expects to be producing 5 million fully electric cars by 2020. The Communist/Capitalist Asian tiger will lead the charge as the world moves methodically towards the electric car age. Every major auto manufacturer is now either producing an all-electric car or has one on its drawing board. Hybrid electric vehicles like the Chevrolet Volt are now seen as the cross-over between gasoline and electric-powered vehicles.

Technology is advancing in leaps and bounds. Lithium-powered batteries are becoming more powerful, longer-lasting and lighter. Cities around the world are already setting up charging stations in urban areas. Delivery fleets of vans, such as the Ford Transit Connect, are now on the streets of North American cities. Mass production will bring down prices for such batteries as time moves on, just like any other technology. The one part of such batteries that will not see a decrease in price is the lithium used to store the energy.

During 2011, the price of lithium has increased by 20% to about $6,000 usd per ton. This is at a time when there is still no trading market for this valuable substance.

Some of the large suppliers, like SQM (SQM), Chematell and FMC (FMC) still sell their lithium on the spot market. Because they are brine producers, which basically produce their lithium carbonate as a byproduct of their larger potash operations. Because of this, they are reluctant to sign contracts with major battery companies, as brine production is not as constant as production from pegmatites. Brine production is cheaper, as mother nature does most of the work; however, production cannot be guaranteed on a regular basis, something which car and battery manufacturers require on a continuing basis for thier production lines.

The obvious answer is a pegmatite producer which has the capacity to supply the market on a regular basis, backed up by brine production, which drops the price of production overall. The closest company to this approach is Talison Lithium (TLTHF.PK) of Australia, which is the largest pure lithium producer in the world now.

As the chart shows, SQM produces slightly more, but is not a pure lithium play, as potash production is itsmain business. Talison is focused on a reversal of the SQM model, as it is primarily a lithium producer (having produced lithium at its Greenbushes operation in Western Australia for the past 25 years. But it plans on producing potash as a byproduct from its extensive lithium brine properties, which it obtained when it bought out Salares Lithium last year. Talison acquired the Salares 7 project in the Atacama desert of Chile, which encompasses 7 top-quality brine salars in the best lithium-producing region on the planet.

According to Wikpedia, "Around the world, there were about 806 million cars and light trucks on the road in 2007, consuming over 260 billion US gallons (980,000,000 cubic meters) of gasoline and diesel fuel yearly." Four years have gone by since those numbers were posted, so it is assumed those numbers have risen, and that does not take into account trucks, buses, ships, trains etc. If you don't believe that electric vehicles won't make up a percentage of this huge market in 10 years, you are not paying attention.

According to the KPMG global auto executive summary for 2011, "hybrid systems and batteries are already receiving the greatest investments" of the auto majors. The same report goes on to say that the industry is in overcapacity of gasoline-powered vehicles, and Chinese brands are in front.

Are you invested in a quality lithium producer, or even a junior with a rich deposit? If not, consider such an investment now, before the rush.

Disclosure: I am long TLTHF.PK, RDNAF.PK, WLCDF.PK. I have been acquiring positions in Talison Lithium, Rodinia Lithium and Western Lithium since 2009