Tuesday, January 10, 2012

I had mentioned I wouldn't be "trading" silver to the long side prior to a reversal pattern forming, or an initiative move taking place from horizontal development, in order to increase my probabilities for success. (Investing is a different ballgame) The link to that article can be found here: http://scottpluschau.blogspot.com/2011/12/silver-futures-head-and-shoulders.html.

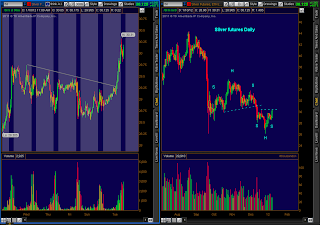

The opportunities to get long on favorable bullish setups in silver are finially heating up again. The daily chart has now formed a Bullish "Inverted Head and Shoulders" pattern that I have noted on the daily chart on the right hand side below. A breakout of the neckline, which I have drawn with a dashed blue trendline, will put pressure on the Bears who are short from the prior Bearish "Head and Shoulders" pattern that has not gotten fulfilled yet. H&S patterns are reliable five point reversals. This sets up a potential short squeeze, and I love to do my part to squeeze the shorts in the precious metals.

A move above that right shoulder on the prior Bearish H&S near $35 would likely send silver to $45 before it hits $25.

The left hand side chart is a 30 minute chart and it shows an explosive move off the break in a multipoint trendline.

Many charts are in great shape for traders.

(click on the chart below to expand)