Sorry, but that's how this game is played.

Global currency devaluation has been holding equities in a

depressionary box and coddling the illusion of economic growth since late 1999.

The purchasing power of the US dollar has been sliding hard since 1934 (see chart 1)

Chart 1: Purchasing Power of the USD

Global capital adapts to the currency devaluation by seeking inflation hedges such as fractional ownership of global assets, i.e. stocks (see chart 2).

Chart 2: Dow Jones Industrial Average (DJIA) and Z Scores of Secular Trends

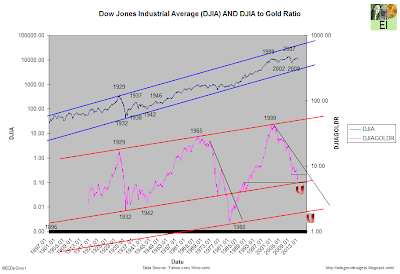

Flow of capital also adapts to the skill of centralized economic management. When confidence centralized management declines, capital adapts by seeking return of rather than on capital. The cyclic out performance of gold (return of capital) over equities (return on capital), illustrated in chart 3 and chart 4, reveals this adaptation.

Chart 3: Dow Jones Industrial Average (DJIA) AND DJIA to Gold Ratio

Chart 4: Dow Jones Transportation Average (DJTA) AND DJTA to Gold Ratio (DJTAGOLDR)

The secular bull market in gold is not over. The majority retail players, nevertheless, won't survive the churning process.