The Silver Megathrust Stephen Bogner

posted on

Apr 30, 2012 01:22PM

Edit this title from the Fast Facts Section

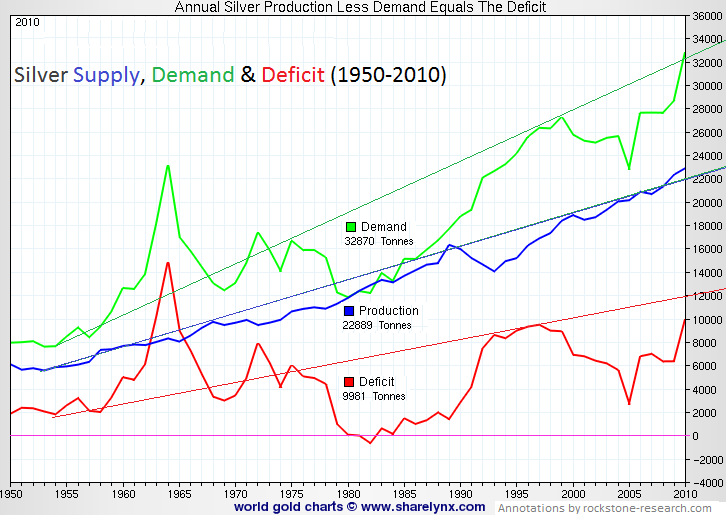

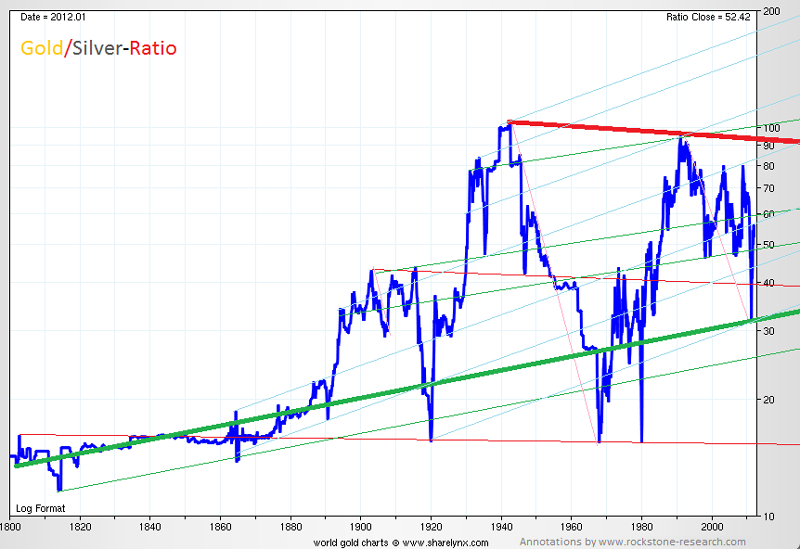

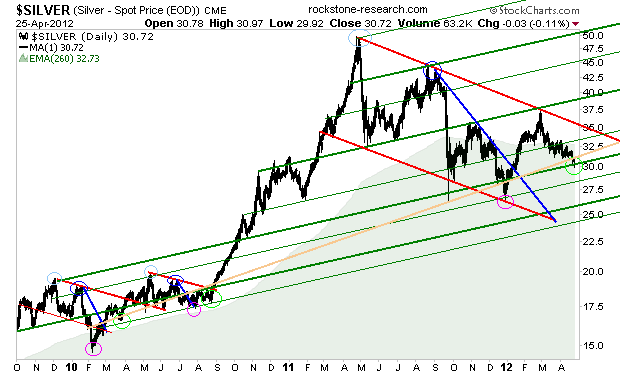

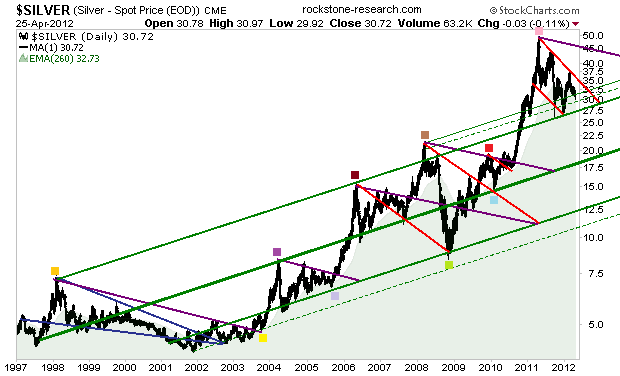

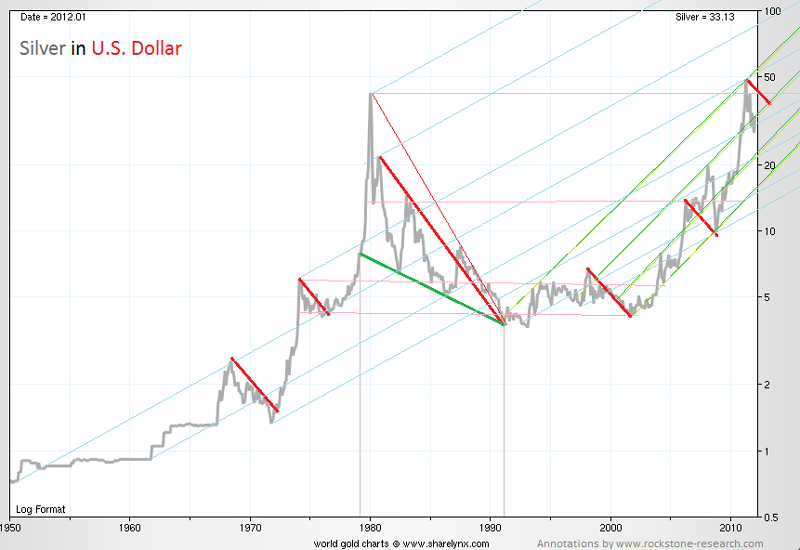

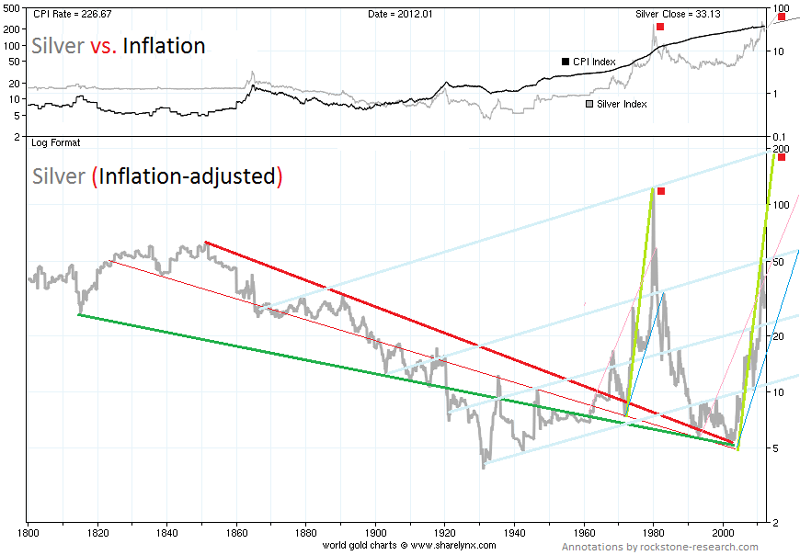

Between 1970 and 1979, the silver price was increasing steadily from $1.50 to $6, before taking off in September 1979 from $10 to $50 within 5 months. During that bull cycle, demand for silver did not increase but actually declined (sharply in 1979). It was as late as 1983 when demand increased confidently from 12,000 to 27,000 tons per year until 2000 - yet the silver price was in a 20 year bear market during that time. In 2003, when silver started its new bull market, the demand actually dropped to 23,000 tons until 2005 - during which 2 years silver almost doubled from $4.50 to $8. Since 2005, demand is rising stronger than ever, having reached 33,000 tons in 2010, whereas the silver price is rising strongly as well. The initial comparisons indicate one important phenomenon in the silver market, namely that (industrial) silver demand is "price inelastic": that is, changes in price have a relatively small effect on the quantity demanded. The demand for other commodities is known to be "price elastic": that is, changes in price have a relatively large effect on the quantity demanded (if tomato prices blow up, go bananas). This basically translates into: no matter if the silver price crashes or explodes, demand - unimpressed - will keep its own dynamic pace, because demand does not respond to price changes. Firstly, silver is the most broadly used metal, because of its unique characteristics, such as highest thermal and electrical conductivity of all metals. In most of its few thousand application fields, silver is considered a non-substitutable product. In contrast for example, when the platinum price increases too strongly, automotive demand traditionally substitutes for cheaper palladium thus potentially driving down the platinum price. Secondly, silver typically makes up only a relatively small component in the total of the product and the total of its costs. Both these demand characteristics/inelasticities (not substitutable and small cost component) are crucial to understand the silver price, because they remind that no matter if price explodes or crashes, (industrial) demand virtually does not care, but keeps on consuming as per its own factors/fundamentals. Notwithstanding, an increased demand principally has a positive effect on the price, of course (GFMS expects fabrication demand in 2012 to rise by approx. 3-5% to around 29,000 tons silver, whereas fabrication demand accounts for more than 80% of total demand; fabrication demand includes industrial applications, photography, jewelry, coins and silverware). Now let's have a look at the price elasticity of supply - a way to show the responsiveness ("elasticity") of the quantity supplied to a change in its price. What happens to the silver supply if the price crashes or explodes? Nothing much either. Surely, if price explodes people tend to melt their forks and knives besides selling their silver investments, hence private and commercial recycling and selling will increase in the short-term (yet silver is already being recycled "where possible", and most of the silver ever consumed by industry can be considered as lost respectively not recyclable). More importantly, core supply (mining) does not change significantly if the silver price changes. This shows us a second important phenomenon of the silver market, namely that silver is supplied predominately as a bi-product during the mining of other metals, such as gold, copper, zinc and lead (in 2011, mining accounted for 73% of total supply, whereas primary silver mines only contributed 29%). This implies that the silver mining output does not depend on the silver price, but rather on the price of the primary metals, such as gold, copper, zinc and lead. For example, if the copper price doubles, copper mining typically expands generating more silver output. If the copper price is cut in half, silver output shrinks no matter if silver price doubles or quadruples. The mining and consumption of primary metals like copper and zinc is dominated by the automotive and electrical industry thus largely depending on economic growth in developed and/or non-developed countries. If economic growth collapses in the future, less silver is mined which principally translates into higher prices. If economic growth flourishes in the future, more silver is expected to be mined - however, so much more silver must be mined to even meet demand that it is (more or less) safe to consider it as not realistic (in today's terms): In 2010, total silver supply was 23,000 tons and total demand was 32,000 tons. The difference is called (supply-demand) deficit, whereas the "chronically missing silver" comes from destocking. Why is someone filling up the gap as the price shall "correct the deficit" by way of rising thus decreasing demand? Because it would not work, of course (as we have seen above). Thus, when destocking has come to an end and industries do not get supplied with sufficient silver (no matter where the price may trade or be fixed at), the respective (silver-containing) product can not be produced in "unlimited" quantities anymore thus (increasingly) limiting the production output and its economies of scale. Hence, it is the price of this "limited edition" (silver-containing) product that will increase in order to get supply and demand balanced out, whereas the silver price principally does not to change as it would not effectively increase supply or decrease demand (as we have seen above). Notwithstanding, a decreased supply principally has a positive effect on the price, of course. The difference between gold and silver, and every thing in general, is its present supply and demand respectively its valuation/perception and ultimately its price. Firstly, silver (0.08 ppm = 8 gram in 1,000 tons) occurs on average 20 times more often in earths continental crust than gold (0.004 ppm). On earth (incl. hydrosphere, atmosphere and crust to a depth of 16 km), silver (0.13 ppm) occurs 26 (=13x2) times more often than gold (0.005 ppm). Hence, (below-ground) gold is more rare than silver. Secondly, gold deposits form near surface and at depth, whereas silver predominately forms near surface and not at depth. Thus, fewer silver deposits will be discovered in future due to technological breakthroughs since 1950s having discovered most near-surface deposits already. Hence, (below-ground) silver trends to be more rare than gold. Thirdly, most of all gold ever mined (approx. 90% of 150,000 tons total) still "exists" (marketable) as dominantly being hoarded as a hedge against money (either fiat-money or gold-backed money). Most of all silver ever mined (1.6 million tons total) has already been lost as typically being irrecoverably consumed by the industry. Hence, (above-ground) silver is more rare than gold? Not quite there yet - as estimates calculate around 600,000 tons still "existing" marketable in form of coins, medals, bars, jewelry and other silverwares. Assuming yearly silver demand at 45,000 tons, no mine output, and no (other) destocking, it would take 10 years until there is around the same amount of (above-ground) silver left as gold (150,000 tons) and another 3 years until the rest is lost as well (this includes the assumption that the owners of the 600,000 tons silver would sell consistently with higher prices). In the end, silver may be more rare than gold as below- and above-ground silver is (currently) being vanished into thin air. Amazingly, there still is a price correlation alive between both metals as both seem to get daily priced in tandem. This may be explained that both backed money in history and are - from times to times - considered as "money" - by some or many. If the Dollar was backed by gold (and/or silver), then you may call it "money" as you may be officially allowed to actually also use physical bullion as "legal tender"(for whatever today unimaginable reason you would want to do that instead of using handy light-weight, foldable and quickly acceptable paper money backed by gold; respectively you trust such paper being worth a certain amount of gold as you could redeem this lose paper against massive gold anytime you wanted (during opening hours at your local FED). Yet what makes (standardized) gold/silver truly precious is not only that - theoretically - you can call it "money" and even use it as such, but practically value it as a priceless, natural and proven "safety feature" (or you may call it "a hedge against money/power") that the paper money you use is not inflatable. It's like with an airbag - you don't want see it inflate, but if you did, you truly feel fortunate to have it as it may save your life again. Or as per the article "The Sword above the Damocles-Dollar": the value of the (gold/silver) sword is not that it falls (usage as "real money"), but that it threatens to fall (appreciation as "safety feature" / hedge) resulting in total stability. Gold and silver always shared being an effective hedge against money (either fiat money or gold/silver-backed money), but it's their differences that present unique price appreciation potentials. If you study the history of gold, you always find silver. Both metals mainly occur together in ores, both are the first mentioned metals in the bible, and both are used in sacred rituals. Since thousands of years, gold and silver are considered precious and valuable. More than 6,000 years ago, Egyptians determined a gold/silver-ratio of 13.3 - and indeed, the ratio traded at an average of 15 in the millenniums thereafter. The Egyptians were the best (proven) analysts ever!? However, their 13.3. ratio figure was not based on technical or fundamental data as we use, but the fact that the moon moves 13.3 times faster in the zodiac than the sun. Many of the beliefs in India, whose people are notoriously known to traditionally hoard and hang themselves in gold, pray to the sun, whereas the moon enjoys a high relevancy in Muslim beliefs. According to Greek historians, King Croesus of Lydia was the first ruler (560-546 BC) issuing a bi-metallic gold/silver currency. There were 2 silver coins: one with 10.72 gram silver and the other half that much resp. 5.36 gram - if you multiply the first one with 10 and the other one with 20, you get 107.2 gram. The known gold/silver-ratio was kept at 13.3; 107.2 gram / 13.3 = 8.04 gram for the one and only gold coin. Thus, 10 big (10.72 gram) silver coins equal 1 gold coin of 8.04 gram and 20 small (5.36 gram) silver coins equal 1 gold coin of 8.04 gram. Taking a look at the (above) gold/silver ratio since 1800, it strikes the eye that in the beginning it was seemingly constant at around 15, whereas it rose around 3-fold and fluctuates heavily around 45 points since the end of the 1800s. Despite rising as high as 100 in the 1930s and 1990s, the 15-level held as strong support during times of strong corrections in the 1910s, 1960s and 1980s. Currently, it trades at 52 points and thus right in between the resistive (red) triangle leg at approx. 93 and the supportive (green) leg at approx. 33. Since the 1990s, the ratio traded near the red leg between 50 and 90, whereas recently it fell strongly to the green leg at 33 points. After this short but successful "pullback" to the green leg (now confirmed as new support), the ratio rebounded strongly to the current level. Let's assume a gold price of $2,000 for the next years: at a gold/silver ratio of 100 silver would trade at $20, at a ratio of 50 silver costs $40, at a ratio of 30 it stands at $66, and at 15 points silver sells for $133. If gold rises to $5,000, silver costs $50 at a ratio of 100, stands at $100 if ratio remains at 50, whereas silver trades at $166 at 30 points, and $333 at 15 points. Taking the silver price since late 2009 into perspective (below), it strikes the eye that the "strong" and "long" price appreciation from $15 to $50 (3.3-fold) between February 2010 and April 2011 occurred after sideways consolidations along red trendlines - and that another such (red) consolidation period formed thereafter (yet with the difference of being much larger and enduring much longer leading to the conclusion that the price appreciation is set to be much stronger and much longer this time; if the red resistance currently at $35 is broken successfully). The (below) silver price started to fluctuate within a (green) upward-trendchannel in 1997. In late 2010, the resistive uppermost (green) trendline was broken at approx. $23, whereafter a breakout took the price to the $50 level. The subsequent pullback has the goal of testing and potentially confirming this (formerly resistive) trendline (as new support) - in order for a new and longer-termed upward-trend to begin thereafter (if successful). Thus, a major sell-signal is not given until breaching this trendline currently at approx. $27.50. Thus, a buy-signal is active above this support, whereas a major buy-signal is generated when rising above the red and violet resistances currently at $35 and $45. The below chart shows the beginning of the last silver bull (1970-1975) and there may be a similar pattern in play when comparing with the above price actions of the beginning of the current bull (since 1997). The silver price nearly doubled between 1974 and August 1979, before rising sharply from $10 to $50 within the following 5 months. Silver rose 6.65-fold (13.3/2) from $6.45 in February 1974 to a monthly average of $43 in January 1980. Thus, if you take the 2011 high of $50 and multiply with 6.65, you get silver at $333 (as we have seen above, this can translate into gold trading at $5,000 with a gold/silver ratio of 15; or gold at $33,300 with a ratio of 100). The below chart shows that a "long-term" upward trend (blue) is active since 1950. The strong price increases in the 1970s and 2000s are so-called "thrusts" out of (red-green) triangles respectively after sideways-consolidation periods beneath the red resistances. The largest and longest triangle formed after the 1960-80s bull enduring around 13 years before the thrust to the upside started in 1992 at $4 (yet notably rising strongly since 2002). In 2011, the thrust reached $50 thus having appreciated 13-fold. Principally, the goal of a thrust is to break the resistive high of the triangle ($43 monthly or $49.45 daily) and transform it into new support - in order for a new and longer-termed upward-trend to begin thereafter. If you bought silver in the last month of the last bull market ($43 in January 1980) and recently sold at $50, you may now sleep proudly as having finally sold with a (nominal) profit. Far from reality but happy? Yes, but net you really lost, because you would need a silver price of more than $100 today in order to get you out plus-minus zero. The reason is inflation - as silver is priced in dollar which currency lost purchasing power over the past. If you want to find out any historic silver price in todays (dollar) terms, you may use a "dollar-inflation-adjusted silver price". When you do so, kindly check the definition of "inflation" as this is the basis of the whole idea. Today, the CPI (Consumer Price Index) is the official inflation barometer and most market participants (still) act according to this index. As per the below CPI-inflation-adjusted dollar silver price since 1800, a 200 year long (red-green) triangle formed between $50 and $4. In the 1960-80s, the price broke the resistive (red) triangle leg at around $8 and the subsequent "breakout" took the price to >$100. Thereafter, the "classical pullback" started taking the price back into the triangle and to the apex at around $5 in 2003. Since then, the thrust to the upside is active. The goal of this thrust is to break the high of the triangle ($50) and its breakout ($100) and to transform both resistive levels into new support - in order for a new and longer-termed upward-trend to begin thereafter. At the top of the below chart is the (not dollar-inflation-adjusted) silver price next to the (black) CPI, whereas it is considered as a very bullish sign when the price has achieved breaking above the CPI curve - as a strong move up from there may occur (again as per the last bull cycle). The CPI basket has been changed in a way that does not seem to represent real inflation anymore. An increasing number of market participants estimate real inflation higher than the official 2-3% p.A. (CPI). The SGS (Shadow Government Statistics) index is felt to better reflect real inflation, whereas it uses the same definition/calculation of inflation as official government agencies used in 1980. Currently, the annual SGS inflation rate stands at 6% p.A. If we now adjust the dollar by SGS-inflation (instead of CPI) and look back at "the old all-time high" of the last bull cycle in January 1980, we note the "SGS real" silver price traded at almost $500 (in today's dollar terms, whereas these terms are defined by an inflation measure that was used in 1980 and not today). This translates into: if I wanted to sell silver today at the same price level as in January 1980 considering todays purchasing power of the dollar, silver would need to trade at around $500 today. Or the other way around: if I bought silver at the peak of the last bull market, its price must really/today trade at around $500 to get me out without a real/net loss. "Finally and with the sky apparently not being the limit, you may kindly fasten your seat belt as the silver rocket is on its way home to the moon." Stephen Bogner "Crashing the Unknown" by Chesley Bonestell (1950)

The Silver Megathrust

![]() Stephen Bogner

Stephen Bogner

26 April 2012![]() "History does not repeat itself, but it sure does rhyme." (Mark Twain)

"History does not repeat itself, but it sure does rhyme." (Mark Twain)