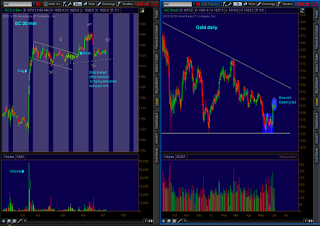

This post is in response to a question from reader Trystan on the flag continuation pattern post here: http://scottpluschau.blogspot.com/2012/06/continuation-pattern-developing-on-gold.html

(click on chart to enlarge)

1. Bull flag had a breakout on "weak" volume.

2. There has now been a normal throwback to the breakout area due to the weak volume breakout.

3. A rising trendline has been tested allowing a stop to be trailed AFTER the reaction in order to reduce the risk in lieu of a weak volume breakout.

4. A failure to take out the recent high near 1643 could also form a potential bearish "Head and Shoulders", but it is very early, there is no H&S or bearish play here. (My mind has seen patterns develop beforehand too many times to count so I am always way ahead in preparing to react to each and every scenario that I can see and that is all. I am hesitant to even mention it.)

The big picture is still one of randomness making swing and day trading more risky than what I would prefer.

Bottom line is there is no play at this time using my methodology but a hold. This is a wait and see approach.

Let's see what develops, as the auction and supply and demand can change in a heartbeat.