We have said for some time now that Silver will only benefit in a period in which inflation is the main fear and not deflation. That of course implies that the bond and note markets will begin pushing rates HIGHER out of inflation fears.

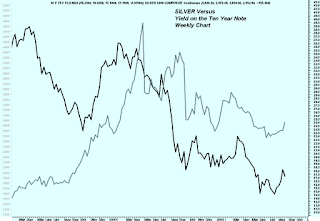

With this is mind, observe the following chart comparing the price action of Silver to the Yield on the Ten Year Treasury Note. The Silver price is the lighter colored line while the black line is the yield on the ten year. Note how uncannily similar the chart patterns are of the two beginning near the month of October 2010. Why is this? Simple - if interest rates are rising the fears of a slowdown are receding. Silver tends to benefit in such an environment.

Today we were treated to a FOMC statement which hinted at a majority moving towards further action on the bond buying program should economic data warrant such. Perversely for the Fed, any attempt to engage in such a program, which by its nature is designed to PUSH DOWN longer term interest rates, will have the result of sending huge money flows into the commodity sector in general and the precious metals in particular. This will get the attention of the bond vigilantes who will then attempt to sell into the Fed buying driving rates higher instead of lower. After all, whom, besides the Fed, wants to own a bond during a time in which the main fear is inflation???