With the US election now behind us and Obama locked in for another 4 years, it is time to evaluate our portfolios and the economic issues that will impact returns.

The debt ceiling will be raised, as it always has. This issue alone will have little impact on the value of the US dollar (USD), but it will lead to further monetary easing by the Fed, which significantly impacts the USD. By definition, the expansion of money supply should devalue the USD. When the USD goes down, gold and all commodities go up. Inflation is the only option for the US as a prolonged deflationary recession could bring the country to its knees. The Fed is well-aware of this possible outcome if it doesn't continue to intervene. The debt has been piled too high and in a deflationary scenario, America could lose its standing as the creator of the world's reserve currency, which would likely lead to a default or bankruptcy.

There is a strong consensus that the 'fiscal cliff' (expiration of the Bush Tax Cuts) will lead to a recession in 2013. While we believe there is a 50/50 shot at a recession in 2013 (at this moment in time), it can certainly be avoided, despite all the doom and gloom forecasts.

Obama is adamant that if there are cuts to his budget, revenue must increase for the federal government by increasing taxes on the wealthy. The Republicans are already looking to the mid-term election in 2014, and if they want to appeal to a broader audience, compromise is needed. Compromise comes in the form of tax hikes and willingness to let Obama implement some of his desired spending programs. On Friday, Obama reinforced his belief that the country needs to invest in its infrastructure and clean energy programs. If he gets some compromise from the Republicans, which we believe he will, this should bode well for commodities and increase the likelihood of heightened inflation.

China Creating Real Growth The pragmatic investor has to look at potential game changers to his or her investment portfolio. Being ahead of the key trends should be every investor's goal. The consistent rise of China's middle class will continue to be the engine which drives demand for commodities. While the US can push inflation globally, China provides the fundamental support for commodities through its economic growth. The urbanization of China (and India for that matter) will continue. Did you know that China's copper demand in 2012 is expected to be the highest yet? And this is during a year which has seen the Eurozone fight off a near economic collapse and mediocre growth in the US. China's rising middle class and a raging currency war will fuel higher prices for commodities in the coming quarters.

It can be argued that China's election, which saw power transfer from Hu Jintao to Xi Jinping as the new secretary-general of the Communist Party and Premier Wen Jiabao replaced by Li Keqiang, was the most important of the year. There are many reasons, from a global perspective, why this may end up being the most important election of not only the year, but entire decade. The continued work of the Chinese government to stimulate and grow its middle-class has not gone unnoticed by our team.

President Hu Jintao stated this week that China must double per capita income by 2020. The target was set for the country's incoming generation of leaders.

If China is to double its per capita income by 2020, shortly thereafter it would likely become the largest economy on earth. This would give it a serious bargaining chip with which to claim the world reserve currency. Keep in mind, Asia is slowly becoming the financial hub of the world.

China's increased levels of consumption, from oil to copper and many base metals in-between, is mind boggling. With the EU situation deteriorating each and every month, Japan running a government deficit of over 200% debt to GDP and a total deficit including households and financials of over 500% debt to GDP (the highest in the world), there is a clear opening for China. When you consider that the US will be forced to raise the debt ceiling once again (and likely not for the last time), with downgrades likely to follow, it becomes obvious there are few fiscally responsible alternatives to China.

China will not catch the US overnight. It will have to more than double its GDP to catch the US, which reported GDP of over $15 trillion in 2011. However, China has been gaining at a rapid pace, increasing its GDP by almost $1 trillion from 2010 to 2011. China's GDP exploded in 2011 to $7.29 trillion from $5.87 trillion in 2010.

Imagine if, in ten years from now, China has the largest consumer market in the world and the US nor Eurozone have gotten their fiscal act together. Do you know how much bargaining power China would have on a global level? The US, Eurozone and just about every country in the world would desperately need access to China's consumer market, which in turn could lead to a new world reserve currency controlled by the Chinese. Today that might sound crazy, but it is a serious threat. And China is well aware of the possibility, which is a big reason it wants to double per capita income in its country by 2020.

China's Common Man It is quite simple to put in perspective just how poor rural China remains to this day. China was ranked 121st in gross national per capita income for 2010 by the World Bank. The annual per capita income in China is just $4,260. This compares to countries such as Jordan in the middle east or Thailand in South East Asia. Most importantly, it is less than 1/10 of the United States' $47,140. Nevertheless, with China's 1.6 billion population and counting, a double in its per capita income will have a dramatic impact on the landscape of global trade.

If Hu's goal is realized and China's per capita income can double between now and 2020, it would likely make China the largest economy in the world not long after. As an investor, how one may benefit from China's continued rise must be examined. If China's middle class can continue increasing its per capita income, there is just no way a hard landing is in store for the country.

Canada, home to one of the largest resources of oil, natural gas and almost every commodity in the world, is poised to benefit from China's continued rise.

A perfect Canadian example is the proposed $15.1-billion energy deal between Chinese-controlled CNOOC and Calgary's Nexen. After squashing the $39 billion BHP / Potash deal a couple years ago, this is clearly high on Stephen Harper's political agenda and his own legacy when it comes to global

recognition of the oil sands. Harper's passion to maintain a strong Canadian economy, despite a weak US economy, puts him in a difficult social and political position. With plenty of opposition on a global level, when it comes to dealing with the Chinese, it will be very interesting to see if the Nexen bid is given the okay by Harper's Conservatives. The reality is that money talks. And Harper doesn't want to lose international interest in Canada's plethora of natural resources. As China continues to expand, its demand for resources will force the country to pay huge premiums to secure what it needs. Resource rich countries like Canada and Australia, who compete for Chinese investment, understand this.

The rise of China's middle class, combined with a global currency war, supports our theory that the commodity super-cycle will continue. Despite major headwinds in the US, and a possible recession in 2013, the commodity bull market will survive. Precious metals may remain in an upswing, even during the potential recession, as nations take unprecedented monetary action to stave off deflation and bankruptcy (through money creation and inflationary manipulation).

China Helping the US Economy Fight off a Recession The United States has been reaping rewards from China's rise. In 2010 Obama announced the National Export Initiative in his State of the Union address and set the ambitious goal of doubling U.S. exports by the end of 2014.

The US is slowly gaining momentum with its export goal, but that may benefit China more than most realize.

For China to finally control its own destiny, its domestic demand for goods has to increase. As the Chinese middle class becomes wealthier and Americans' wealth deteriorates, eventually the US will rely on exporting goods to the Chinese market. This is a shift long overdue as America has been drowning in multibillion dollar record trade deficits month after month. The US goods and services trade deficit with China was $282 billion in 2011.

US exports to China have risen 542% from 2000 to 2011, going from $16.2 billion annually to a record $103.9 billion in 2011. In 2011 the US imported $411 billion worth of goods from China, quadruple what China imported from the United States.

For Obama's initiative to be successful, exports will have to increase by more than 20% in 2012, 2013 and 2014. This will not happen without increased demand from China.

The director of international economics at the Institute for International Economic Research, a think tank under the National Development and Reform Commission, Wang Haifeng recently explained that the positive export figures reveal a great opportunity.

He went on to state that,

"The fact that a record was set in US exports to China, which shows the great potential of US exports, not only reduces the trade imbalance between the top two economies but also alleviates unemployment in the US and speeds up the US' economic recovery." Gold Time Bomb Excerpt from our Weekly Vol. 286, titled, "

Navigating The TSX Venture, Gold and Bad Credit Markets"

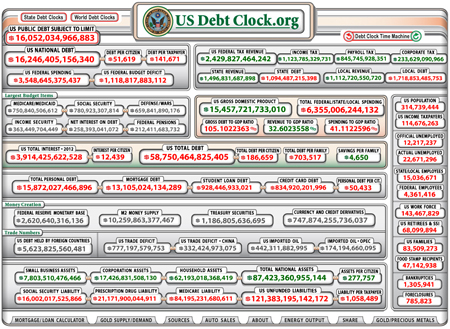

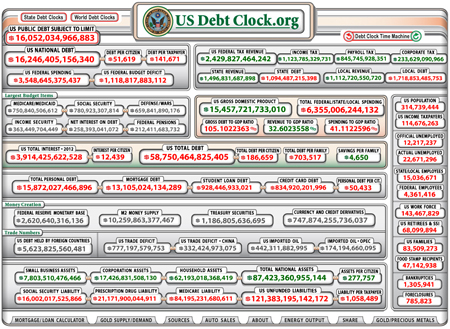

"With the S&P (rating agency) beginning to stretch its legs, a downgrade will soon be on deck for the United States. This will likely come after the debt ceiling is hit and immediately raised by Congress. US National Debt stood at $16.17 trillion at the close on Friday, Oct 12th. With only $220 billion left on the US credit card, before hitting the 'debt ceiling' limit, uncertainty is increasing in the market. Be ready for this to ratchet up the fear gauge and come to the forefront immediately following the election. Although this may have a short-term negative impact on equities, it will be tremendously bullish for gold and commodities just as it was in August 2011.

Upon the obvious outcome of Congress raising the debt ceiling, investors should prepare for gold to break out, potentially to new all-time highs."

As of November 9, 2012, the US National Debt stood at $16.24 trillion. There is now a little more than $100 billion left on the US credit card. The debt ceiling will be raised. As the money supply continues to expand, a period of inflation will be thrust upon us. How can faith in the USD be restored when the debt ceiling is popped to $18 or $19 trillion? How can the US continue to take on more debt without more easing from the Fed? The answer to both questions is that it can't. When the debt ceiling is raised, gold will react as it did in 2011, by soaring to new highs.

In these market conditions a new all-time high for gold is needed to awaken the junior resource sector. We are weeks, if not days, away from the debt ceiling creeping back into the headlines and less than two months from it being raised once again.

All the best with your investments,

It can be argued that China's election, which saw power transfer from Hu Jintao to Xi Jinping as the new secretary-general of the Communist Party and Premier Wen Jiabao replaced by Li Keqiang, was the most important of the year. There are many reasons, from a global perspective, why this may end up being the most important election of not only the year, but entire decade. The continued work of the Chinese government to stimulate and grow its middle-class has not gone unnoticed by our team.

It can be argued that China's election, which saw power transfer from Hu Jintao to Xi Jinping as the new secretary-general of the Communist Party and Premier Wen Jiabao replaced by Li Keqiang, was the most important of the year. There are many reasons, from a global perspective, why this may end up being the most important election of not only the year, but entire decade. The continued work of the Chinese government to stimulate and grow its middle-class has not gone unnoticed by our team. recognition of the oil sands. Harper's passion to maintain a strong Canadian economy, despite a weak US economy, puts him in a difficult social and political position. With plenty of opposition on a global level, when it comes to dealing with the Chinese, it will be very interesting to see if the Nexen bid is given the okay by Harper's Conservatives. The reality is that money talks. And Harper doesn't want to lose international interest in Canada's plethora of natural resources. As China continues to expand, its demand for resources will force the country to pay huge premiums to secure what it needs. Resource rich countries like Canada and Australia, who compete for Chinese investment, understand this.

recognition of the oil sands. Harper's passion to maintain a strong Canadian economy, despite a weak US economy, puts him in a difficult social and political position. With plenty of opposition on a global level, when it comes to dealing with the Chinese, it will be very interesting to see if the Nexen bid is given the okay by Harper's Conservatives. The reality is that money talks. And Harper doesn't want to lose international interest in Canada's plethora of natural resources. As China continues to expand, its demand for resources will force the country to pay huge premiums to secure what it needs. Resource rich countries like Canada and Australia, who compete for Chinese investment, understand this.