Is Copper the New Red Gold?

posted on

Dec 17, 2012 11:43AM

Edit this title from the Fast Facts Section

Federal detention centers in the San Francisco Bay area are slowly filling up with a new type of criminal. Thousands of illegal immigrants and petty drug dealers are being joined by a rising tide of copper thieves raiding abandoned government facilities for their heavy gauge copper electrical wire. At current prices a decent night’s haul can net crooks up to $20,000 at black market recycling centers.

Long known as “Dr. Copper”, because it is the only commodity with a PhD in economics, the red metal has been an excellent forecaster of economic activity around the world. Hedge fund managers have been impressed by copper’s ability to hold up, and even advance in the face of the “fiscal cliff”.

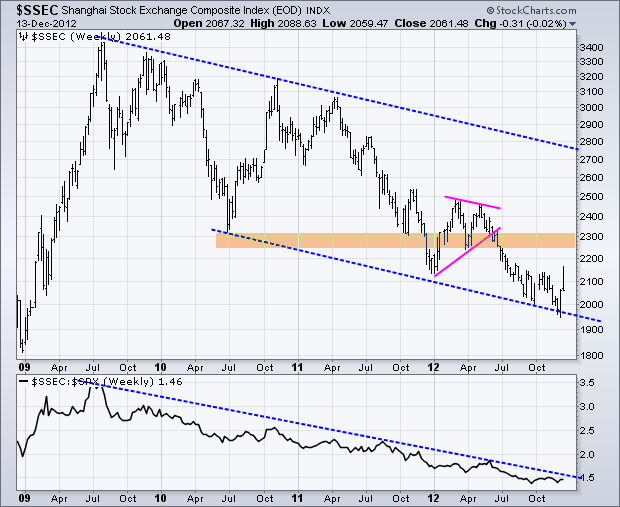

Demand for American home construction is slowly crawling out of the basement, and demand from China is starting to turn around as well. On Friday, we received further confirmation of this reversal when the Middle Kingdom announced its Purchasing Managers’ Index was at 50.9, a 14 month high, and its third month over the boom/bust level of 50.

It helps that they’re not making copper anymore. Some of the world’s largest mines are reaching the end of their useful lives, with increasing amounts of capital being poured into ripping a declining grade of ore from the earth. This is a problem, because the opening of a new mine can take as long as 15 years, once the time required for government approvals, infrastructure, water supplies, transportation, and yes, bribes, is added in. What’s in the pipeline is all there is for the next five years.

Copper is also benefiting from its accelerating “monetization.” International investors, disgusted with the choices available in global stock and bond markets, are increasingly diversifying into the red metal, as well as other “hard” assets like gold, silver, coal, oil, nickel, iron ore, and others. This is one reason why the big metals exchanges are finding their inventories at a low ebb. It’s anyone’s guess, but perhaps half of the current $4.40/pound in the copper price is accounted for by investor, as opposed to, end user demand.

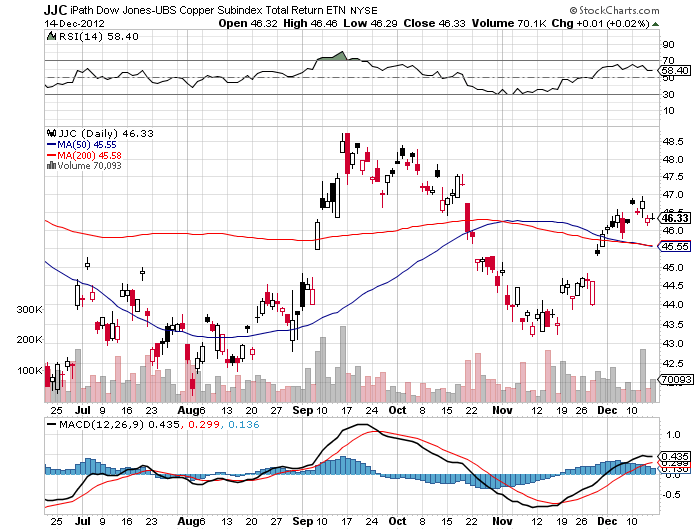

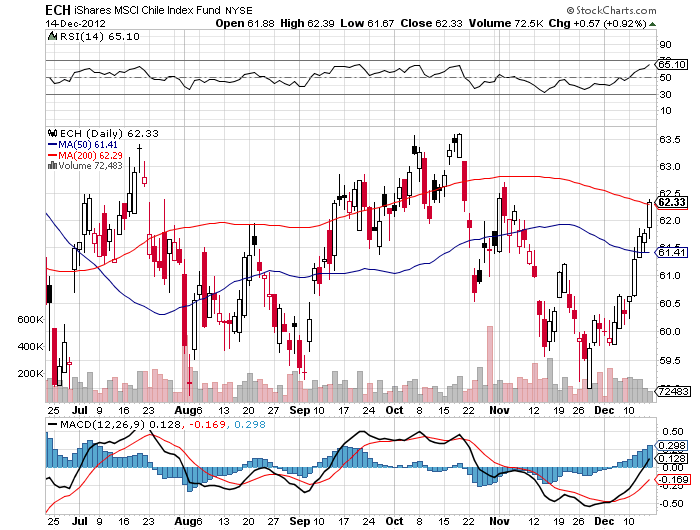

The obvious plays here are in the dedicated copper ETN (JJC), and the base metal ETF (DBB). Another candidate is Chile’s ETF (ECH), the world’s largest copper producer. And you can look at Freeport McMoRan (FCX), the world’s biggest publicly listed copper producer (click here for Time to Get Back Into Copper?). And yes, you can even buy .999 fine copper bullion bars at Amazon by clicking here.

I have some hedge fund friends who have discretely stashed thousands of copper bars in warehouses around the country, expecting the red metal to hit $6/pound within the next three years. If it doesn’t work out, I guess they can always eat their inventory by pursuing a new career as electricians. Hey, a good union and a steady $70/hour paycheck, what’s so bad about that?