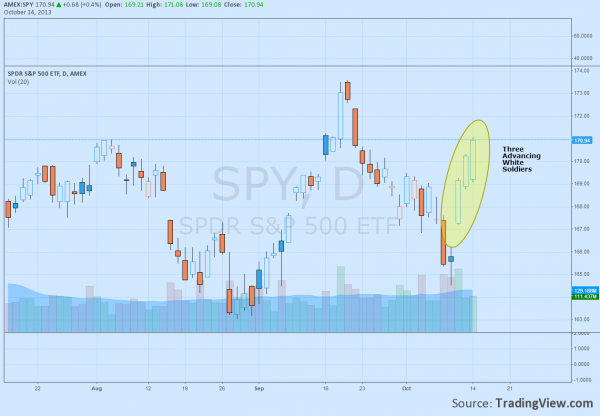

There are many varieties of Technical Analysis ranging from purely quantitative to chart reading to the esoteric, like Wyckoff, Gann and even reading lunar cycles. One style that i like to use to compliment classical western technical analysis is Japanese Candlestick charting. Removing all the bells and whistles and then applying these techniques can reveal a lot. Monday, completed what was called a Three Advancing White Soldiers pattern in the major index ETF’s. Here is the $SPY.

Steve Nison in his text Japanese Candlestick Charting Techniques, describes the pattern as “a group of three long white candles with consecutively higher closes. If the pattern appears at a low price area or after a period of stable prices, then it is a sign of strength ahead. The Three White Soldiers are a gradual and steady rise with each white line opening within or near the prior session’s white real body. Each of the white candles should close at, or near, its highs.” This certainly fits the SPY. But a quick glance shows it fits the $QQQ, $IWM and $DIA as well. There is strength ahead in each of the 4 major market indexes. March On!