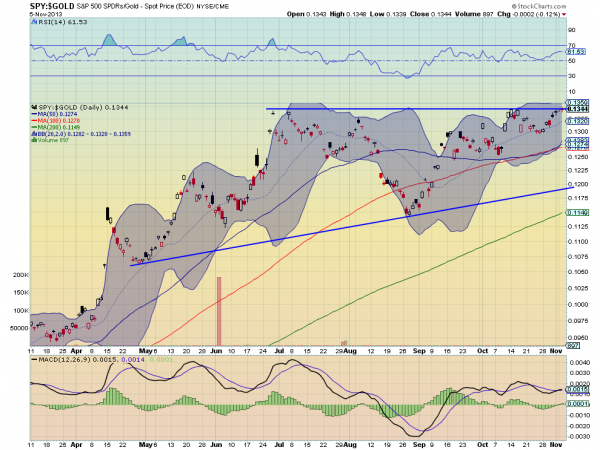

How many times have you been told by someone on the television or elsewhere that Stocks are at a peak and that when the great unwind happens from the QE infinity that Gold is the only thing you want to own? Well, hard evidence says that Peter Schiff and others are just dead wrong. The chart below shows the ratio of the S&P 500 ($SPY, $SPX) to Gold ($GC_F, $GLD) is pressing against what has been resistance since late June. With the momentum indicators (RSI and MACD) both supporting a move higher as shown by the RSI rising and the MACD about to cross up, it suggests this is the

time to tell Peter Schiff to go F’ himself, sell your Gold and buy Stocks. Sorry for picking on Peter Schiff if you are one of his customers (please send me something to convince me is not a total retard and I will recant – well maybe) but WTF? Stocks are rising. Gold, at best, is not rising, and when you look closely is falling. This chart from a technical perspective suggest that a move to a ratio of 0.1630 could be in store from an ascending triangle break out over 0.1345. That is 21% higher. If Gold just stands still that implies the S&P 500 rises to over 2125. If the S&P stand still it implies that Gold continues to fall to 1080. So what are you doing with your money?