Oil Sands Cost Cutting ‘Close to Bone’ as Crude Stalls

posted on

Sep 30, 2016 03:52PM

Energy for Today and Tomorrow

After two years of slashing costs to cope with plunging oil prices, shares began rebounding as the market appeared to hit a bottom earlier this year. Now, with the commodity recovery taking longer than expected -- even with this week’s agreement by OPEC to limit supply -- and the pace of reductions slowing, a correction could be in store for oil-sands shares.

“We’re getting close to the bone” with cost cutting, said Martin Pelletier, a fund manager at TriVest Wealth Counsel in Calgary, in an interview. He pointed to a “huge gap” between companies’ valuations and the price of oil. Without a solid recovery kicking in soon, companies are "going to go lower."

It’s a lot harder for oil-sands producers to cut costs than it is for their shale-rock drilling brethren. Shale producers can just stop drilling wells, idling rigs and dispensing with all the equipment and labor that goes along with them. Canadian oil-sands companies such as Suncor Energy Inc. and Cenovus Energy Inc., with the massive facilities required to mine and process tar-like bitumen, can’t scale down so easily.

Shale drillers also deploy new technology more regularly, boosting efficiency with each new well. Oil-sands developments take years to plan and build and cost billions of dollars. With the low commodity prices, new projects have been canceled or delayed, hampering companies’ ability to introduce the latest, cost-saving equipment.

That’s left oil-sands producers to rely mainly on slashing operating costs such as labor, non-essential maintenance and spending on garbage trucks and road repairs, to cope with low oil prices in the near term, according to consulting firm Wood Mackenzie Ltd. In the future, new projects will take advantage of technology advances to help reduce capital costs, but that’s an unlikely scenario for the next few years, Pelletier said.

In the meantime, share-price gains are expected to outpace crude in the coming quarters, raising pressure on producers to deliver better profits. The West Texas Intermediate U.S. benchmark oil price is forecast to rise 2.6 percent by the second quarter next year, while the average target price for a Canadian S&P sub-index of Canadian energy companies is expected to gain almost 14 percent, according to analyst estimates compiled by Bloomberg. The price-to-earnings ratio for the 50-member S&P/TSX sub-index has risen to 350 from 98 in the first quarter.

WTI was little changed at $47.83 a barrel at 9:56 a.m., gaining about 4.2 percent this week after the Organization of Petroleum Exporting Countries’ agreement to reduce the collective’s production to as low as 32.5 million barrels a day.

Oil-sands producer Cenovus will have cut more than C$1 billion in capital, operating and administrative expenses by the end of the year. Since the end of 2014, operating costs have fallen 31 percent at its oil-sands business, helped by laying off almost a third of the company’s work force -- all with the goal of being able to “make money” at $50 a barrel oil, according to Chief Financial Officer Ivor Ruste in a Sept. 7 presentation in New York.

“The question, is are these permanent reductions? Or are they cutting down to the bare bones to just withstand the downturn?” said Stephen Kallir, a research analyst at Wood Mackenzie in Calgary.

Cenovus isn’t finished yet, said spokesman Brett Harris. “We believe we can continue to reduce our overall cost structures,” he said.

By lowering operating expenses, the impact goes “right to the bottom line,” boosting margins for existing operations, said Kevin Birn, director at industry consultants IHS Cera’s energy group in Calgary. “So you’re going through everything and scrutinizing everything you need,” he said.

Companies are also pushing for higher production in a bid to lower per-barrel costs, he said. “We’ve seen more barrels coming from existing facilities than historically they’ve been able to achieve.”

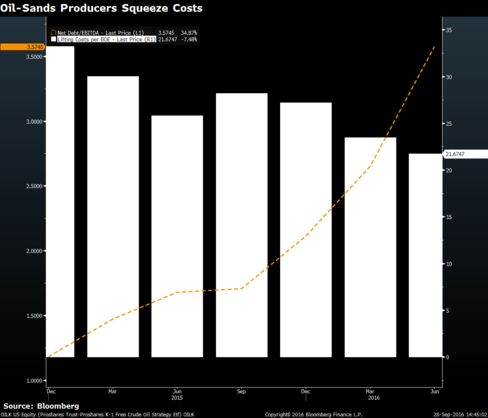

The average cost to produce a barrel of oil, called the lifting cost, for the five largest oil-sands producers has fallen 35 percent since the beginning of 2015, according to data compiled by Bloomberg. At the same time, net debt to earnings before interest, tax, depreciation and amortization has surged three times as profit fell.

Larger competitors Imperial Oil Ltd., Canadian Natural Resources Ltd. and Suncor, also have taken billions of dollars out of their operations.

Imperial Oil, Exxon Mobil Corp.’s Canadian affiliate, has reduced unit costs by 35 percent since 2014 at the company’s production operations. At its Cold Lake site, costs have fallen 40 percent, helped by lower prices for natural gas and more use of equipment automation, said Bart Cahir, senior vice president of upstream operations.

Overall costs to produce a barrel of oil are now below C$20 “but we know we have much more work to do,” Cahir said during a Sept. 21 presentation.

Suncor has managed to lower oil-sands operating costs in the third quarter to “well below” C$24 a barrel, Chief Executive Officer Steve Williams said in a Sept. 7 presentation to analysts in New York.

“We can run for the next 25 years at less than $40 a barrel WTI, so we’ve got a long future ahead,” he said in an e-mailed response to questions. Suncor is one of the lowest-cost producers and achieved that by “focusing on what we could control” as well as continuing to invest in production “when others did not,” he added.

Canadian Natural is “confident that there are ongoing opportunities for further cost reductions,” the company said in an e-mail response to questions about whether more cost cuts are possible, without quantifying reductions.

Eventually companies will have to invest in new projects and introduce new, more efficient technology to really capture cost savings, said IHS’s Birn. “You can push operating costs down so far, but you will hit a limit.”