Ubique Transitioning from Mineral Exploration to Production; To Acquire 90% of a Mining Company in Namibia

posted on

Sep 06, 2022 10:31AM

a Zinc exploration company

Ubique Minerals Limited ("Ubique" or the "Company") (CSE:UBQ) announces that Ubique Zinc Limited (the "Purchaser"), a wholly-owned subsidiary of the Company, and the Company have signed a Share and Asset Purchase Agreement (the "SPA") to acquire 90% of the shares in Namib Lead and Zinc Mining (Proprietary) Limited ("NLZM"), which owns the Namib Lead and Zinc Mine in Namibia, from CL US Minerals LLC (the "Vendor"), together with certain indebtedness of NLZM owed to the Vendor.

Background

On the 30th of May 2022, Ubique signed a non-binding term sheet outlining a proposed acquisition of a 90% interest in a company with a past producing zinc mine in Africa, subject to completion of due diligence, execution of binding documentation, and approval by all parties thereto.

Since June, the Company has undertaken extensive due-diligence work including site visits, obtained third-party opinion reports and conducted workshops with the management team, to validate NLZM's business plan. The parties have now executed the binding document and are in the process of notifying the relevant authorities. Pursuant to the SPA, the closing of the transaction is subject to the parties obtaining the necessary regulatory approvals, as well as the approval of the shareholders of the Company, as well as certain other customary closing conditions.

Transaction

The total purchase price to be paid to the Vendor will be as follows:

About the Project

The Project consists of a lead-zinc mine located near Swakopmund, Namibia that was built in 2018-2019 and operated until April 2020. The Project was put into care and maintenance due to health and safety concerns related to the Covid-19 pandemic as well as the closure of the border with South Africa, from where the Project sourced key supplies. Since April 2020, the Project has been maintained in a ready-to-restart status, including maintaining access to the mine and intermittent functional checks of process plant components.

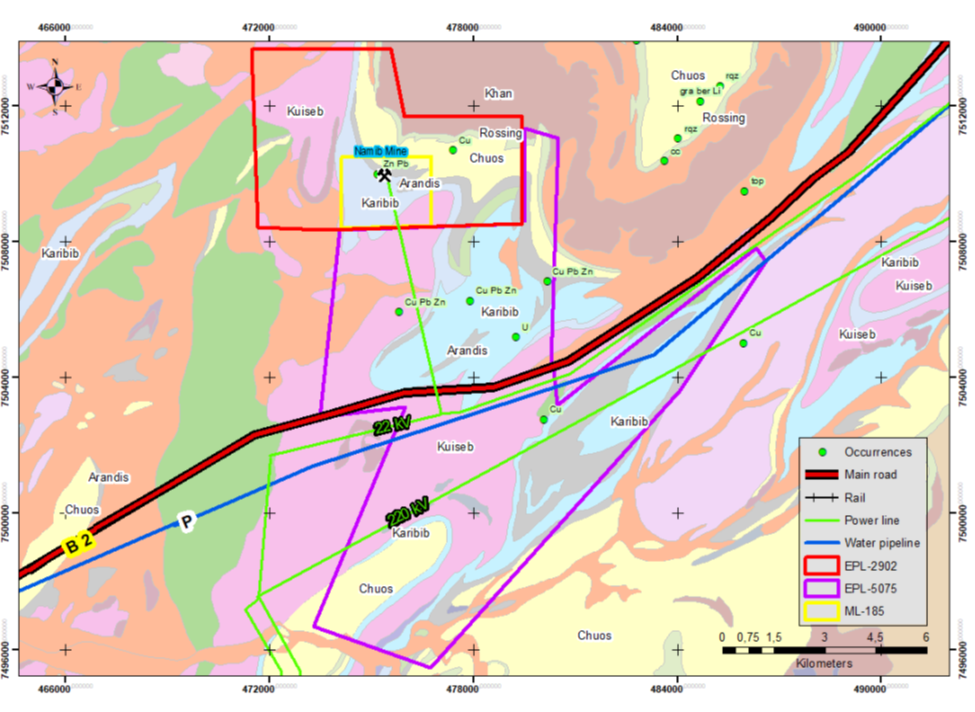

NLZM is the holder of mining license ML185 and two exclusive prospective licenses EPL 2902 and EPL 5075 that surround the Project's mine site. The Project's mine and processing facilities consist of an underground mine developed by trackless decline and sub-level stoping to yield 500 tonnes per day of ore. The ore is fed through a conventional crushing, grinding, and floatation plant to produce zinc and lead/silver concentrates which are filtered and dried on site before trucking the concentrate 70 kms to a deep water port with container handling facilities at Walvis Bay, from where the concentrate is shipped to international custom smelters. Fresh water supply is available from the desalination facility serving all mines and communities in the region and electricity is by connection to the national power grid.

Prior to 1968, the South Zone was discovered and developed. Mining and processing operations were conducted from that year until 1992. The old processing plant was eventually removed. The South Zone is comprised of steeply dipping lenses containing lead and zinc minerals (with contained silver) in a dolomite/marble host rock. Previous mining of the South Zone extended to a depth of approximately 200 meters. Subsequent exploration defined the North Zone which has similar geometry and mineralization as the South Zone, however, recent mining (2019-2020) has shown that the lodes in the North Zone are broader and more continuous. Prior to placing the Project under care and maintenance, the North Zone had only been developed to approximately 50 meters vertically. The estimated North Zone Resource from diamond drilling extends to approximately 200 meters vertically. Limited drill information coupled with geostatistical data indicate that North Zone mineralization extends to at least 300 meters vertically. In the South Zone, a similar vertical extension is supported by exploration data. The recent production has been focused on the North Zone, where multiple lodes have been extracted and processed successfully.

A Mineral Resources statement in 2012 and then updated after additional diamond drilling in August 2017, estimated resources as:

Indicated 710,300 tonnes grading 7.02% zinc, 2.40% lead and 50 g/t silver plus

Inferred 408,700 tonnes grading 5.96% zinc, 2.16% lead and 38 g/t silver.

A mining inventory in the Indicated category was:

610,859 tonnes grading 6.66% zinc, 2.35% lead and 49.1 g/t silver.

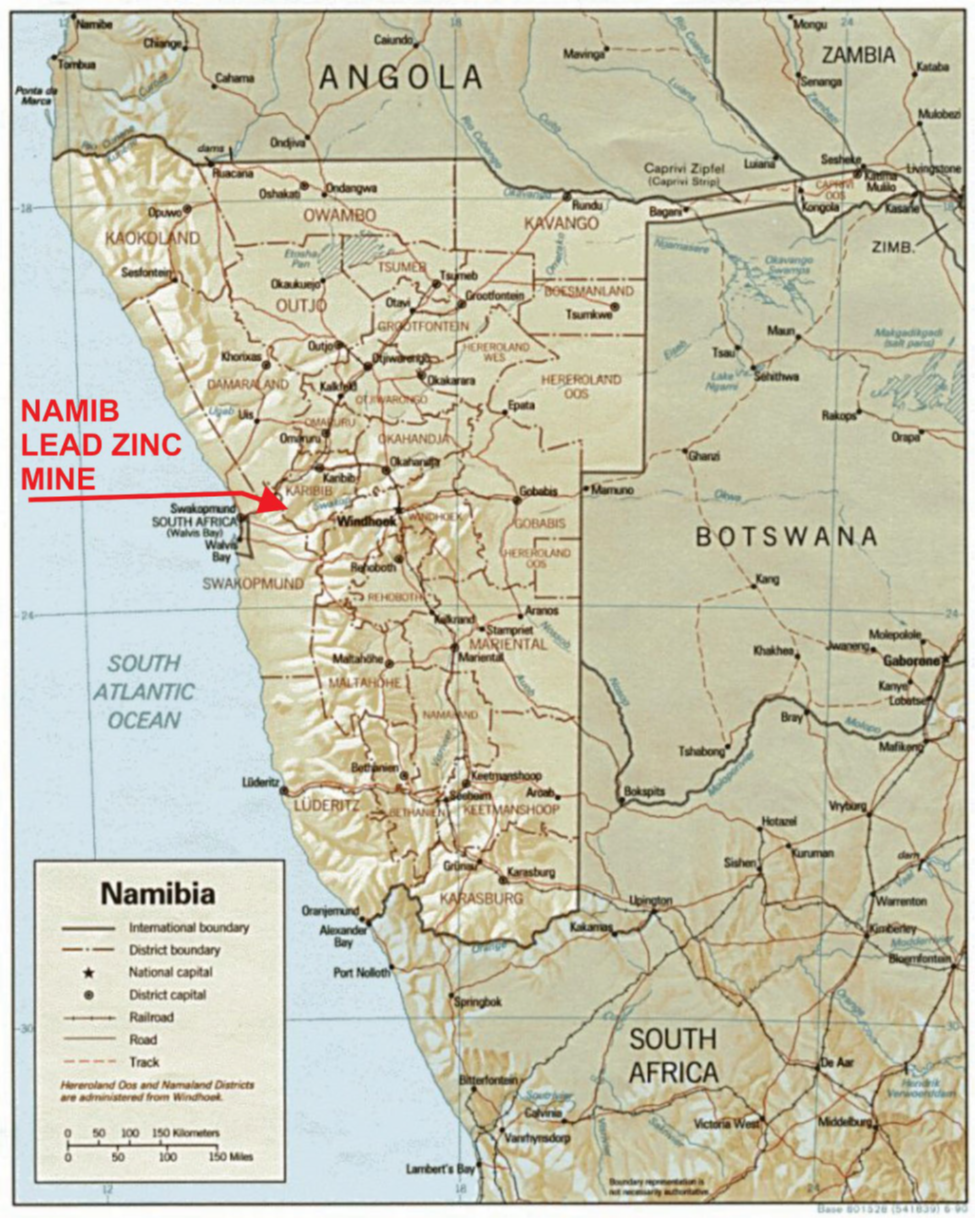

Location Namibia.

Picture 1. https://maps.lib.utexas.edu/maps/africa/namibia.gif

Picture 2 More detailed map

Picture 2 More detailed map

The mine and adjacent processing plant are located approximately 30 km east of Swakopmund by the paved National Highway. From there, access to the Project is on a dirt road, 5 km to the north. The whole area from Swakopmund to the mine site and beyond is sparse desert with a resemblance to basin and range topography, shallow soil and sand cover. Swakopmund is the nearest city and, with a population of approximately 100,000, supports a vibrant economy and community. Walvis Bay, which has an all-purpose port capable of handling large container ships and doing ship repairs, is 35 km south from Swakopmund via a paved road . Walvis Bay was used by NLZM to export concentrate in containers.

Images from the mining site

About Namibia

The Republic of Namibia, is a country in Southern Africa. Its western border is the Atlantic Ocean. It shares land borders with Zambia and Angola to the north, Botswana to the east and South Africa to the south and east. Although it does not border Zimbabwe, less than 200 meters (660 feet) of the Botswanan right bank of the Zambezi River separates the two countries. Namibia gained independence from South Africa on 21 March 1990, following the Namibian War of Independence. Its capital and largest city is Windhoek.

Namibia has a considerable mining industry, producing a diverse range of metallic and industrial minerals, including uranium, copper, zinc, and gold as well as diamonds and high-quality building stones for sawing and polishing. It has recently been ranked very highly by the Fraser Institute in their global ranking of the ease of doing business for mining companies.

On behalf of the board of directors,

Vilhjalmur Thor Vilhjalmsson

CEO and Director

About Ubique Minerals Limited

Ubique Minerals Limited is an exploration company listed on the CSE (CSE:UBQ) focused on exploration of its Daniel's Harbour zinc property in Newfoundland and is actively looking at other projects around the world. Ubique became a publicly listed company in September 2018. Ubique has an experienced management group with a record of multiple discoveries of deposits worldwide and owns an extensive and exclusive database of historic exploration results from the Daniel's Harbour area.

For more information on Ubique please contact see www.ubiqueminerals.com or contact vilhjalmur@jvcapital.co.uk

Dr. Gerald Harper, P.Geo.(NL), director of Ubique, is the qualified person as defined by NI 43-101 responsible for the technical data presented herein and has reviewed and approved this release.