Seeking Alpha

posted on

Jun 03, 2015 02:58PM

Hydrothermal Graphite Deposit Ammenable for Commercial Graphene Applications

Disclosure: The author is long SYAAF. (More...)

In an article published May 19th, I looked at potential graphite mining companies that have produced economic evaluations (either Preliminary Economic Assessments (PEA) or Feasibility Studies). Since that article was published two junior graphite mining companies have issued updates for their flagship projects.

Canadian based Zenyatta Ventures (OTCQX:ZENYF) issued their long awaited Preliminary Economic Assessment (PEA) of the Albany deposit in Northern Ontario, and Australian based Syrah Resources (OTCPK:SYAAF) issued the results of their feasibility study for the Balama project in Mozambique.

This article evaluates those companies, based on the recently issued information.

I have reviewed Zenyatta in an earlier article, and the PEA results have confirmed what I suspected. Zenyatta's Albany mine will be extremely expensive to develop, and will have the highest operating costs in the business.

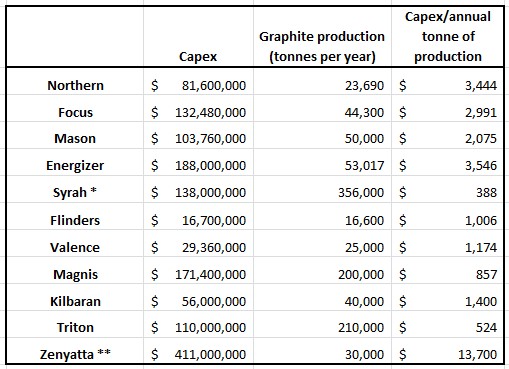

Here is a CAPEX comparison, based on data from mining companies that have so far issued economic evaluations for graphite mines:

The table is from the article that I published in May, comparing potential graphite mining companies.

Information for Zenyatta has been added, and the information for Syrah has been updated based on the newly published studies. Zenyatta's cost estimate includes a purification step after the flotation process, whereas the other companies are proposing to sell a flotation concentrate.

When the Zenyatta PEA is filed on SEDAR, we will probably be able to see how much this purification step has added to the costs. However, it is not the reason why Zenyatta's capital intensity (cost/unit of production) is so high. The reason for the high capital cost is the location and orientation of the deposit, below 30 meters of overburden and under a 10 meter thick limestone cap. The cost of removing hundreds of tonnes of overburden for mine development is the primary reason why Zenyatta's capital cost estimate is so high.

On the operating cost side, Zenyatta is forecasting a cash cost of $2,045 per tonne of 99.9% Cg graphite, FOB mine site. Operating cost estimates from other projects are significantly lower, ranging between $161 and $730/tonne. Again, the Zenyatta estimate includes the cost of purification of the flotation concentrates by caustic bake, but the information issued to date does not provide separate costs for the purification. Zenyatta's operating costs, even without the purification step, will be much higher than its competitors because of the low ore grade and very high strip ratio at the Albany mine.

In spite of the high costs, Zenyatta has estimated a positive Net Present Value (NPV10) of $438 million (after tax) based on an open pit mine, with a 22 year mine life. IRR is 24%. They are able to achieve those figures by assuming an average selling price of $7,500/tonne for the purified graphite.

There is no commodity exchange for graphite, and there are hundreds of different products, each with its own specification. Trading is mostly done directly between mines and processors or end-users on a contract basis and prices are usually confidential. It is difficult therefore to find definitive data to verify these price assumptions. However, I have reason to believe the company has taken an overly optimistic view of market prices for their product. As an example, I look at the battery grade pricing quoted in the study ($4,000 to $20,000/tonne, average $12,000/tonne). Current prices are around $4,000/tonne for uncoated spheroidized natural graphite for li-ion batteries. Zenyatta's natural graphite would need to be upgraded to 99.5%, and spheroidized to meet the specification for the $4,000/tonne material, so it is unlikely that it could be sold into the li-ion battery market at anywhere close to the assumed price.

Because of the high cost relative to competing mines, and high degree of uncertainty surrounding pricing assumptions, financing the Albany project will be very difficult in today's market.

If Zenyatta had binding take-off agreements from major partners, with guaranteed prices, then there might be an outside chance of the project attracting financing, but so far Zenyatta has come up with nothing to indicate that such an agreement is close to fruition. As it stands now, no financial institution will even consider lending money to this high risk project.

Equity financing, also very unlikely, would result in share dilution of about 500%, severely limiting the upside value for existing shareholders

Zenyatta's share price has fallen by about 25% since the PEA was issued, but there is plenty of downside left. Without financing, the mine cannot go ahead, and the shares will be worthless.