This welcome rain brings predictability to the company’s business moving forward

posted on

Dec 17, 2008 07:21PM

They could be talking about EDIG in many respects here...

Asure Software (ASUR) formerly Forgent Networks, in its early years, had dealt in the business of designing, manufacturing, and selling multimedia conference systems. The VTEL brand was well established and they had a rapport with resellers and a vested interest from Intel. This rosy outlook saw a volte-face from 1996 onwards as the business experienced low margins along with low growth. Initially price competition contributed to this woe but later Internet based technologies with enhanced flexibility proved overwhelming. The company’s financials prior to 2001 shows the unraveling of that business. The following summarizes the financials of the company after fiscal 2000:

In 2001 the company divested its products and services business, their main revenue sources. They also announced the intention to drive revenue from its Intellectual Property (IP) licensing business. As the table indicates, IP licensing helped the business stay afloat as they realized more than $160M in revenue during the period from 2001 thru 2006.

In October 2003, they announced the acquisition of Network Simplicity Software. The Meeting Room Manager (MRM), Visual Asset Manager (VAM), and certain derivative products of MRM together formed the NetSimplicity suite of products. With this new software business, they are looking to develop a profitable model outside of IP licensing. This is in effect an acknowledgement that the IP business is well past the prime. The iEmployee acquisition in 2007 is another significant step in this regard.

Asure received a Notice Of Delisting from Nasdaq on 8/31/2007. This is the second time in the last two years that the company came under such scrutiny. The first of these was on 8/11/2006 and the company came into compliance when the stock stayed above $1 for an extended period of time between November 2006 and March 2007. Delisting is a risk that needs to be managed and can be achieved by:

The company has achieved compliance as of Friday October 12 as the company’s shares closed above $1 for 10 continuous days between October 1 and 12. Even though the immediate threat of delisting is at bay, the risk remains as long as the share price hovers in the $1 vicinity.

Asure has more than $6/share in tax-loss as a carry forward in its balance sheet. It has placed a valuation allowance against this and so this can potentially be viewed as a hidden asset from which value may be drawn under certain conditions. Acquiring companies with current earnings would work in its favor as that may allow Asure to tap into the tax-loss carryover. Further, this may allow the company to negotiate a better deal in an acquisition, as the company’s offer may be considered more lucrative when the tax benefit is taken into account.

The balance sheet is strong with $35M in cash and with no debt Asure has the opportunity to grow the new business organically and through acquisitions. To become a leader in the SaaS workspace management space and realize sustainable growth, it will have to gain critical mass as quickly as possible. It is evident the company will be pursuing more acquisitions. The competitive landscape is busy with prominent players like Microsoft, SalesForce.com, etc along with specialized vendors such as ClickSoftware Technologies Limited (CKSW).

Globally, Software as a Service (SaaS) in the workspace management space is a segment experiencing tremendous growth. Asure’s NetSimplicity and iEmployee product suites provide an automated, easy to use self-service unit, which showcases in-depth domain expertise in HR benefits, time tracking, scheduling, and asset management areas. The calculated focus on small to medium size businesses and divisions of large enterprises should allow the company to seed the market as it seeks to set the business up for growth.

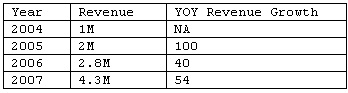

Here is a look at the Asure’s NetSimplicity business:

As of October 2006, Asure is lean with a head count of only 37 employees. The business started operating in the black and generated about 100K in cash during the last quarter. The expectation is to grow the revenue close to the $6M range in fiscal year 2008 per the 4th quarter earnings call.

The iEmployee acquisition roughly doubled the business. The purchase price of $10.7 million at slightly more than twice the revenue is reasonable considering the business has 15% bottom line net income. The 8-K filing indicates the cash consideration was roughly $6.6M and the remaining portion was funded through roughly 5M shares of Asure stock. This brings the total outstanding shares to roughly 31M and cash tapers to about $30M.

The combined business is expected to rake in recurring revenue in the 70% range. This welcome rain brings predictability to the company’s business moving forward. The initial expectation is that the combined business will generate cash in the 2nd half of next year but there the guidelines provided stops short. During the 4th quarter earnings call, it was indicated that such guidance would be forthcoming in the November timeframe.

Asure is valued very low since it is unclear how the business will perform as time progresses. Once the business track for the upcoming year is in place much of the uncertainties surrounding revenue, profitability, and growth expectation should get cleared up. If the company can turn profitable it will get valued per the projected growth expectations. Until then, investors will stay in limbo taking solace that the valuation is cheap…