Now this is more like-it -

posted on

Jan 15, 2013 07:36PM

2013 is expected to see NFC commercial launches on five continents, as the 10-plus year technology finally enters its commercialization phase. But mobile operators and others rolling out NFC will have to prove that consumers will use the technology.

2013 is expected to see NFC commercial launches on five continents, as the 10-plus year technology finally enters its commercialization phase. But mobile operators and others rolling out NFC will have to prove that consumers will use the technology.The 10-year anniversary of the official birth of NFC came and went quietly on Sept. 5, 2012.

It was on that day ten years ago that co-creators of the technology, NXP Semiconductors, then called Philips; and Sony; first announced their development of NFC. But the companies last September issued no press releases commemorating the anniversary and made no mentions on their blogs or on Twitter. While they continue to promote NFC, apparently they did not want to draw attention to the fact that it has taken NFC technology so long to take off.

But as 2012 came to an end, there was a palpable sense that NFC technology was finally beginning to roll out–with commercial launches underway or planned for 2013 in just about every major industrialized country.

That includes new commercial services planned for 2013 in Germany, Italy, Australia and Spain. And there are expansions of NFC commercial services expected in the U.S., Canada, France, the UK, Poland and others.

Moreover, major developing countries China, Brazil and Russia all plan to commercialize NFC in 2013.

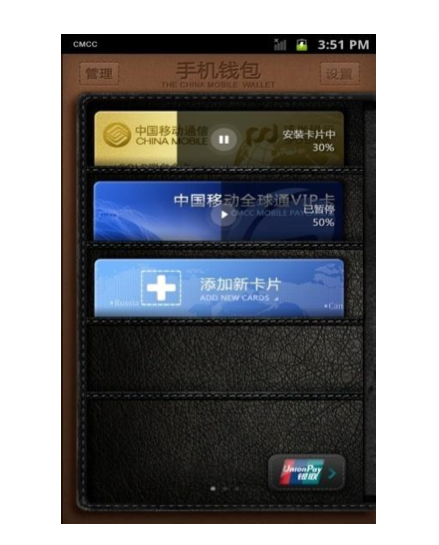

That includes a launch by the world’s largest operator in terms of subscriptions, China Mobile, which has set a goal of distributing 10 million NFC-enabled phones and signing up 3 million customers for NFC payment and other services by the end of this year.

The prospects for rollouts were much further from reality a year ago, as this annual New Year’s feature described, noting that significant rollouts would have to wait for another year–until 2013. The planned commercial services are expected to remain relatively small in most countries this year. But a year ago, most NFC projects were still in the precommercial or pilot stage.

Still, mobile operators and other companies leading the NFC rollouts in 2013 will have much to prove.

While numerous NFC trials over the years returned high satisfaction rates among consumers, most were conducted under controlled conditions. Commercial NFC services launched to date have met with relatively poor interest from consumers, including those in South Korea, Turkey, Singapore, the UK and the U.S., the latter with the Google Wallet.

Project organizers in these and other countries face significant challenges, including the need to increase awareness and overcome security worries among consumers and to offer them more compelling nonpayment services.

But the planned launches across several countries on five continents in 2013 means NFC is beginning to enter its commercialization phase. Most, though not all, of the projects are led by mobile operators, which see NFC as a way to boost struggling average revenue per user results and to open up a new category of services to keep their subscribers loyal.

“The first chicken-and-egg cycle has been broken,” Pierre Combelles, business lead for the NFC program at the GSMA, the large mobile operator trade group, told NFC Times. “Operators have decided to seed the market by deploying (NFC) phones and SIMs.

There is much work to be done to make the commercial launches successful, he agrees, and the GSMA’s NFC team, for example, has an initiative to bring more merchant applications into NFC-enabled wallets, including those that use “complementary” technologies, such as 2-D bar codes.

Critical Year for U.S.

In particular, 2013 will be a critical year for the future of NFC in the highly competitive U.S. market, where NFC is technically already in commercial mode, following the launch by Google of the first version of its Google Wallet in September 2011.

But Google Wallet continues to struggle with low usage and a delayed version 2.0. The program might be up for an overhaul, and there is credible talk that says wallet chief Osama Bedier might be departing the program.

Meanwhile, major mobile operators that make up Isis, Verizon Wireless, AT&T Mobility and T-Mobile USA, plan to expand their two-city pilot to more cities and to offer applications from more banks in 2013. That might not happen until mid-2013 or later. And any decision by the telcos and their joint venture for a national rollout will have to wait until the results of these projects are in, including the two-city trial, launched in October in Salt Lake City, Utah, and Austin, Texas. Transactions were off to a slow start in the cities, but the joint venture has undertaken a considerable advertising and promotional campaign there.

Meanwhile, major mobile operators that make up Isis, Verizon Wireless, AT&T Mobility and T-Mobile USA, plan to expand their two-city pilot to more cities and to offer applications from more banks in 2013. That might not happen until mid-2013 or later. And any decision by the telcos and their joint venture for a national rollout will have to wait until the results of these projects are in, including the two-city trial, launched in October in Salt Lake City, Utah, and Austin, Texas. Transactions were off to a slow start in the cities, but the joint venture has undertaken a considerable advertising and promotional campaign there.

Isis appears to face a greater threat from the MCX consortium, made up of such major U.S. merchants as Wal-Mart, Target and Best Buy, than from Google. The merchant group, which is seeking to reduce transaction fees for mobile payments compared to what they pay now for accepting cards, is developing their own mobile-wallet platform.

It’s unclear when they will launch their first trial and what technologies they will use, but they could keep merchants away from both Isis and Google through exclusivity clauses with MCX.

Like Google, MCX is later expected to combine cloud-based technologies with NFC, though not in the same way.

And Sprint, the No. 3 telco, plans to launch its own NFC-enabled wallet and to open up the embedded secure elements in its phones to other wallet providers, sources have told NFC Times. The launch of Sprint’s Touch wallet is also delayed, having been originally targeted for unveiling before the end of 2012.

At the same time, NFC is making its way into more types of devices, boosted by support for the technology by Microsoft in its Windows 8 operating system for PCs and by a range of chip makers planning to integrate NFC into their offerings. Among the major NFC-enabled devices that hit the market in late 2012 that are not smartphones or tablets was the Nintendo Wii U game console.

At the same time, NFC is making its way into more types of devices, boosted by support for the technology by Microsoft in its Windows 8 operating system for PCs and by a range of chip makers planning to integrate NFC into their offerings. Among the major NFC-enabled devices that hit the market in late 2012 that are not smartphones or tablets was the Nintendo Wii U game console.

Tag-reading applications are also expected to fuel growth of NFC, ranging from tag-based promotional campaigns using smart posters and other signage to health-monitoring devices and equipment embedded with NFC chips.

But the premier use for NFC is in smartphones, and it’s becoming one less headache for backers of NFC, as the availability of NFC-enabled phones continues to grow.

Project backers increasingly will not have to worry about availability of NFC-enabled devices, even if they still have to certify or validate them for payment and other secure applications before pressing the phones into service.

More than 100 NFC phone and tablet models had been released as of the end of 2012, with many more planned in 2013.

Shipments of NFC-enabled handsets will reach 285 million in 2013, up from just over 100 million units in 2012, according to ABI Research. Other analysts put the 2013 NFC device figure higher.

Nine out of the top 10 handset makers support NFC, with, of course, the notable exception of Apple.

That includes Samsung Electronics, which shipped more than 30 million units of its flagship Galaxy S III in 2012, all packing NFC technology. The South Korean device maker sees NFC as a possible money maker on its own and will enable applications in certain markets with the embedded secure chip it puts in each of the Galaxy S III units and in many other models.

That includes Samsung Electronics, which shipped more than 30 million units of its flagship Galaxy S III in 2012, all packing NFC technology. The South Korean device maker sees NFC as a possible money maker on its own and will enable applications in certain markets with the embedded secure chip it puts in each of the Galaxy S III units and in many other models.

Meanwhile, just about all major chip makers have adopted NFC, offering the technology to smartphone manufacturers and a range of other devices, from PCs to gaming consoles to printers.

2012 saw major announcements or the beginning of shipments by such large chip makers as Broadcom, Qualcomm and MediaTek, promising to make NFC more accessible to smartphone and tablet makers across the range of tiers, from low end to high end.

U.S.-based Broadcom began shipping its standalone chip for the Google Nexus 4 smartphone and Nexus 10 tablet, released in the fall. That and a new working relationship with Google for the latter’s Android platform makes Broadcom the chief rival to NXP, which had supplied NFC technology to all other Android devices up until that point, including the Samsung Galaxy S III.

Then in December, Broadcom announced it would incorporate NFC in its premier combo wireless chip family, combining NFC with Wi-Fi, Bluetooth and FM radio. The previous version of this combo chip is being used by Apple and Samsung for their flagship devices.

The vast majority of smartphones with Wi-Fi and Bluetooth use combo chips, and Broadcom owns more than 70% of that market, noted Mark Hung, wireless research director for U.S.-based research and consulting firm Gartner, who has predicted Broadcom's inclusion of NFC in its well-used wireless combo chip series will accelerate the adoption of NFC in mobile handsets.

Also in December, U.S.-based Qualcomm, the world’s largest supplier of processor chips to smartphone makers announced it would enter the NFC market–integrating a standalone NFC chip with its Snapdragon processors–a move sure to expand the availability of NFC-enabled smartphones.

MediaTek, Texas instruments, Intel and Marvell Technology also have active NFC programs, which could help usher in the technology to a range of devices. That’s in addition to all major smart card chip makers supporting NFC, most supplying both NFC modem chips and secure elements.

It’s debatable the impact of Apple’s snub of NFC in the iPhone 5, however, since all major device makers for the growing Android platform support the technology. Other mobile platforms, Windows Phone 8 and Research In Motion’s long-awaited BlackBerry 10 operating system, due for release later this month, also support NFC. Most Windows smartphone makers are expected to include the NFC chip and RIM has been an early backer of NFC.

Of course, while Apple’s mystic may be fading with the death of Steve Jobs and the recent debacle over its iOS maps application, it remains a trend setter for many developers and service providers, along with attracting more interest from consumers. So Apple’s introduction of the iPhone without NFC definitely cost the technology considerable buzz in 2012.

Apple senior vice president of worldwide marketing, Philip Schiller, reportedly told AllThingsD following the iPhone 5 unveiling in September that Apple's planned Passbook digital wallet “does the kinds of things customers need today.” The wallet uses 2-D bar codes to communicate with acceptance devices, when needed. The publication, apparently paraphrasing Schiller, added that he said it’s not clear NFC is the solution to any current problem.

After Apple announced the iPhone 5 without NFC, observers repeated earlier assessments that Apple would wait until NFC technology matures further, especially in terms of infrastructure that would make it easier for users to find places to tap their NFC-enabled iPhones.

After Apple announced the iPhone 5 without NFC, observers repeated earlier assessments that Apple would wait until NFC technology matures further, especially in terms of infrastructure that would make it easier for users to find places to tap their NFC-enabled iPhones.

Despite frequent speculation over the years, Apple has never given off any real signals that it wanted to become a payments services provider with NFC or any other technology at the physical point of sale. If it supports NFC in 2013, it could enable payments using a secure chip.

Apple has also expressed lots of interest through its patent requests for enabling users to more easily pair its devices and share content, and it could do that more simply than enabling payment, using NFC’s tag reading and peer-to-peer modes.

Apple has used Broadcom’s combo wireless chips in its last four iPhones, starting with the 3GS, according to tech site AnandTech, and including the iPhone 5. Broadcom said this month that its new combo wireless chip incorporating NFC, the BCM43341, would be available for volume production in the first quarter of 2013.

That doesn’t mean Apple will necessarily support NFC in its next iPhone, Gartner’s Hung told NFC Times earlier this month. If the next iPhone is launched in the third or fourth quarters of next year, Apple probably wouldn’t use the new Broadcom combo chip with NFC, he predicted.

By then, Apple will want super-fast Wi-Fi technology, available with the new 802.11ac Wi-Fi standard, he said. And Broadcom is not including 802.11ac–or fifth-generation Wi-Fi as Broadcom calls it–in the new combo chip containing NFC.

But Broadcom has included the high-speed Wi-Fi technology in a separate combo chip, the BCM4335. And it also announced it is “integrating” that second combo chip with its standalone NFC controller, the BCM20793.

Apple, however, could decide to adopt the Broadcom combo chip with high-speed Wi-Fi but without the extra standalone NFC chip.

China Mobile in early December officially announced plans for an ambitious launch of NFC technology, starting in February, with a large trial that will expand to as many as 12 provinces, then a general rollout later in the year.

Shen Hongqun, deputy general manager of China Mobile's data department, speaking at the telco’s Global Developers Conference in Guangzhou in December, repeated earlier goals set by the telco that it intended to sell 10 million NFC-enabled phones supporting China’s domestic 3G standard this year from such phone makers as Samsung, HTC and Huawei, and to sign up 3 million users by the end of the year.

The telco said it plans to issue NFC SIMs offering 500-kilobytes of space, which could support more than 10 applications. That likely would include multiple payment applications, as well as transit ticketing, coupons and city card services.

China Mobile also revealed recently that it would work with such large banks as China Construction Bank and China Merchants Bank, in addition to Shanghai Pudong Development Bank, or SPD Bank, which it had disclosed earlier. The telco owns a substantial stake in SPD Bank.

China Mobile also revealed recently that it would work with such large banks as China Construction Bank and China Merchants Bank, in addition to Shanghai Pudong Development Bank, or SPD Bank, which it had disclosed earlier. The telco owns a substantial stake in SPD Bank.

The telco in June signed a deal with the large domestic payment network, China UnionPay, and a representative of the telco said it would offer space on its NFC SIMs for UnionPay and its affiliated banks to download payment applications, using the payment network’s trusted service manager. UnionPay will have rolled out more than 1 million contactless point-of-sale terminals in China by the end of 2012, according to the mobile operator.

China Mobile was reported to have begun issuing NFC SIMs, and No. 2 telco, China Unicom in December already launched NFC service in Shanghai with China Merchants Bank, using such high-profile phones as the Galaxy S III, Galaxy Note II and Sony Xperia models.

Still, even if China Mobile hits its goal of 10 million NFC phones in 2013, it will take some time to make consumers aware of the new services.

Seeking Awareness in Korea

In South Korea, for example, by the end of 2012, operators KT, SK Telecom and LGU+ together had sold more than 10 million NFC smartphones supporting the single wire protocol-SIM standard–the largest rollout of standard NFC phones to date. Yet, few consumers are using it for retail payment.

Finding contactless terminals is a problem, though SK Telecom told the GSMA for a recent case study on the Korean NFC market that there are more than 200,000 terminals in the country supporting Visa payWave and MasterCard PayPass.

The most popular service is transit ticketing, and SK Telecom said that more than two million people have used their phones to pay transit fares, though that no doubt includes SK Telecom’s previous proprietary contactless-mobile technology.

No. 2 Korean telco KT, which led the rollout of standard NFC phones in the country starting in late 2010, said it has 80,000 “active” users for transit ticketing with NFC phones, and they pay fares regularly on buses, subway trains and taxis. The telco also has reportedly rolled out more than 20,000 tags at bus stops.

Still, the slow take-up of NFC services so far by Korean consumers caused Hankil Yoon, senior vice president of product strategy for Samsung’s mobile communication business and a key backer of NFC at the company, to complain that awareness was still low among consumers.

“Use of NFC services is very low,” said Yoon, speaking at a conference in late September. “One example, in Korea, as you know, we started launching NFC services on Galaxy S II, Galaxy Note and Galaxy S III, so in Korea I think there are tens of millions of NFC devices already in the market. (But) consumers, they don’t know how to use it. They don’t even know they have something called NFC that they can use for transportation and mobile payment.”

Japan to Expand Move to Standard NFC

Japanese telcos, which have sold at least 70 million contactless-mobile phones with proprietary FeliCa technology, have found that a large base of phones and acceptance points for payment and transit ticketing does not necessarily lead to mass adoption by consumers.

Past surveys have identified security concerns among consumers as one reason. But Japanese Osaifu-Keitai or wallet phone backers have also indicated the need for more incentives and services to promote use of the wallet–which to date has focused on payment.

The much-anticipated move by Japanese telcos during the latter part of 2012 to standard NFC technology could eventually help in that effort–perhaps bringing in NFC-enabled apps used elsewhere for Android phones. But it appears FeliCa-based services will dominate for some years to come.

The massive base of FeliCa point-of-sale terminals in Japan, estimated at more than 1 million, has required telcos to order phones with hybrid FeliCa and NFC chip technology so that consumers can continue to use them on the FeliCa terminals.

NTT DoCoMo, the country's largest telco, in October announced its first lineup of devices that include support for the hybrid FeliCa and NFC chips. Its winter lineup included four of the Android-based smartphones and a tablet.

No. 2 Japanese operator KDDI announced seven devices supporting hybrid FeliCa and NFC technology in its winter collection. Like the DoCoMo phones, they support Android and most are made by Japanese device manufacturers, such as Sharp, Sony and Fujitsu. But the KDDI release includes models from LG Electronics, HTC and Pantech.

KDDI along with No. 3 telco, Softbank Mobile, is much less invested in proprietary FeliCa technology than DoCoMo. The problem for the two DoCoMo rivals is that there are few places to use standard NFC applications, supporting types A or B of the international contactless standard.

KDDI along with No. 3 telco, Softbank Mobile, is much less invested in proprietary FeliCa technology than DoCoMo. The problem for the two DoCoMo rivals is that there are few places to use standard NFC applications, supporting types A or B of the international contactless standard.

KDDI and Japan Airlines introduced an NFC-enabled boarding pass in October and the telco has launched other token services, as well, including payment with MasterCard PayPass. It earlier introduced an NFC-enabled Samsung Galaxy S II with NFC but not with the FeliCa technology inside.

It’s possible to adapt at least some of the FeliCa POS terminals to support the type A and B interface, and perhaps one or more of Japan’s closed-loop payments service providers and bank or credit card companies will issue applications and contactless cards supporting the international standard in the future.

Until then, Japanese telcos rolling out hybrid NFC-FeliCa phones will have to make due with token NFC services in Japan and enabling their subscribers to use NFC services when they roam.

Korean and Japanese telcos have announced planned roaming service agreements over the past 12 to 18 months, including one between DoCoMo and KT, Korea’s second-largest operator. Among the services the deal would enable for DoCoMo subscribers who visit South Korea is the prepaid e-money service known as Cashbee.

Korean retail and food group Lotte has expanded to Cashbee from fare collection to retail payment. It is accepted at 52,000 locations at department stores, convenience stores and at subway and bus fare readers in South Korea, DoCoMo said in October. The roaming service is scheduled to launch in September of 2013.

DoCoMo in October also announced plans to enable subscribers of its iD payments service in Japan to pay with a MasterCard PayPass contactless application anywhere the application is accepted outside of Japan, which MasterCard says is in more than 41 countries and on more than 500,000 terminals.

Launches Expected in Australia, Taiwan, Hong Kong

Elsewhere in Asia-Pacific, Australian telcos Vodafone-Hutchison and Optus have said they would launch NFC in 2013, and Australia’s big four banks are also interested in rolling out mobile payment. With more than 100,000 contactless terminals deployed, the country has a high penetration of contactless acceptance at the point of sale.

In Taiwan, the country’s three major operators and two smaller telcos, along with contactless payments service provider EasyCard Corp. are still waiting for approval from the country’s Fair Trade Commission for their planned joint venture.

The venture would build a uniform mobile-commerce platform and possibly hire or develop a single trusted service manager. Before the JV gets up and running, however, No. 1 telco Chunghwa Telecom could launch NFC services.

New Zealand’s three mobile operators and its bank-owned payments processor have already formed a joint venture to launch a centralized trusted service manager for the rollout of NFC services.

Vodafone New Zealand, Telecom New Zealand and 2degrees, along with processor Paymark, have chosen a TSM, with one or more of the telcos likely planning to launch service in 2013.

Hong Kong will also see NFC commercial activity in 2013. That includes at least one launch by one of Hong Kong’s major financial institutions Hang Seng Bank, and a major telco PCCW mobile. They are planning to put a MasterCard PayPass credit application onto SIM cards issued by the operator. The parties announced the project in November, targeting a launch date during the first half of 2013.

Meanwhile, Singapore’s government- driven NFC launch last summer will seek to expand this year, including enabling transit fare-collection with the ez-link e-purse. At present, users cannot use their NFC phones to pay transit fares, only retail payment, with MasterCard PayPass applications issued by EZ-Link and DBS bank.

Europe’s major telco groups are gearing up for commercial launches of NFC-enabled mobile wallets and almost all have done deals with either MasterCard Worldwide or Visa Europe to include the telcos’ own mobile-payment application in the wallets.

The telcos see payment as a new revenue source and also as a way to reduce churn and to deliver related services, including merchant promotions.

Key among these telcos is Germany’s Deutsche Telekom, which plans to launch its NFC wallet in 2013, featuring its own prepaid payment application supporting PayPass.

Key among these telcos is Germany’s Deutsche Telekom, which plans to launch its NFC wallet in 2013, featuring its own prepaid payment application supporting PayPass.

The telco is issuing the application itself, through its ClickandBuy subsidiary, which has a European e-money license. The telco also will help fund the deployment of 100,000 contactless point-of-sale terminals in Germany, according to MasterCard.

Deutsche Telekom group has an agreement with MasterCard for the payment brand to help it roll out payment in other markets, such as Poland. There, Deutsche Telekom’s T-Mobile branch launched NFC in the fall, with plans for at least five banks to issue applications for the wallet.

Other groups, UK-based Vodafone and Spain-based Telefónica, have done deals with Visa Europe for their own co-branded payment applications, though except for Telefónica’s O2 UK branch, the telcos will have issuing partners.

Growing Acceptance Infrastructure

The European operators, as with most telcos elsewhere launching NFC, plan to also open up their NFC SIM cards to banks and other payment issuers in exchange for rental fees.

European mobile-commerce players see payment as a key opportunity, with the expansion of contactless point-of-sale terminals across the continent.

MasterCard recently announced that retail locations accepting PayPass in Europe reached 255,000 in December of 2012, doubling from a year earlier. In Poland, where Orange also launched commercial service last fall, in addition to T-Mobile, PayPass was accepted at about 90,000 point-of-sale terminals in the country, as of last fall. This amounts to about a third of Poland’s bank card terminals.

Most of the contactless POS terminals in Europe likely accept Visa payWave, as well. The growing infrastructure gives European banks more of a reason to issue contactless EMV debit and credit cards and mobile operators to distribute NFC-based SIM cards and phones.

The UK has the largest infrastructure of contactless terminals in Europe, with more than 150,000 according to estimates. But NFC rollouts remain stunted there.

O2 UK in April launched its long-awaited O2 Wallet, with online and text-based payment, with a promise to launch its NFC-enabled O2 Money payment application by the end of 2012. The telco had earlier planned to launch NFC in 2011.

But O2 again missed its deadline to launch the NFC part of its O2 Wallet in 2012. Its e-money license from the UK Financial Services Authority, however, only became effective Nov. 20. The application, which O2 would issue itself, would support Visa payWave.

O2 UK is part of a joint venture with two other major UK telcos, Everything Everywhere and Vodafone UK, which is building a uniform mobile payments and advertising, couponing and loyalty platform.

The venture, formerly codenamed Project Oscar and renamed “Weve,” received regulatory approval from the European Commission in September, clearing the way for probable launches in late 2013.

It follows what appears to have been a token commercial launch by Orange UK, part of Everything Everywhere, along with issuer Barclaycard. The parties launched the Quick Tap service in May of 2011. While they pledge to expand the service, at the end of 2012, there were still very few phones available for British consumers to tap to pay. And Barclaycard had issued passive contactless stickers for its customers to affix to the back of phones.

To JV or Not to JV?

While telcos in Sweden and Denmark, along with Hungary, have also formed joint ventures–in some cases with other financial services companies–operators in Italy, France and Spain have opted against this in favor of less formal cooperation agreements. Telcos in the Netherlands dropped a planned joint venture with major Dutch banks, also with plans for a less formal arrangement.

By either forming a joint venture or cooperation agreement, the telcos say they want to ensure their NFC wallets and platforms are interoperable for service providers and consumers.

But the telcos also see the agreements as a way to make their SIM cards the de facto secure element in their NFC phones and also to help them gird against new players coming into the market, such as Google.

Among the latest telcos to agree to collaborate are major Italian telcos, which in October signed a memo of understanding to standardize their NFC platform.

Telecom Italia and Vodafone Italia, the two largest telcos in the country, have already said they would launch NFC in 2013. PosteMobile, a mobile virtual network operator, has already reportedly launched a small commercial NFC service. 3 Italia and Wind are also working on NFC.

French operators were the first to set up coordination committees for NFC and have been seeding the market with NFC-enabled phones. Market leader France Telecom-Orange also started to issue NFC SIMs to all new postpaid customers during the second half of 2012. Other French telcos are expected to follow this year.

What is missing are the services, outside small implementations in a few cities. French NFC backers, however, say some major French banks and merchants–and possibly the transit authority for the Paris region–are planning rollouts in 2013.

Elsewhere in Europe, more launches are planned in Eastern Europe, including Russia.

Turkcell Taps Cloud Services, Though Continues to Back NFC

And in Turkey, Turkcell, one of the first telcos to commercially launch NFC, said in October it was planning to introduce a new mobile wallet that includes a PayPal-like service enabling consumers to pay for purchases by entering their phone numbers on point-of-sale terminals.

That follows a slow adoption of NFC services since Turkcell, Turkey’s No. 1 telco, launched them in 2011. A Turkcell representative blamed that on poor awareness among consumers. But he added that Turkcell was not backing off of NFC, and would invest in higher-memory NFC SIMs.

That follows a slow adoption of NFC services since Turkcell, Turkey’s No. 1 telco, launched them in 2011. A Turkcell representative blamed that on poor awareness among consumers. But he added that Turkcell was not backing off of NFC, and would invest in higher-memory NFC SIMs.

The new Turkcell Wallet will continue to enable users to tap to pay if they have an NFC-enabled phone and SIM, as with the telco’s previous wallet. And the new wallet also will offer separate e-commerce payments with just a phone number, along with person-to-person funds transfers, airtime top-ups and coupons and offers.

The U.S. remains a wide open market for mobile-payment technologies.

The strong influence of Internet players along with Apple’s snub of NFC technology in 2012 has meant cloud-based “solutions” have drawn increasing attention stateside.

But major mobile operators and, to a large extent, the large incumbent payments players, such as payment schemes and banks, appear to be backing NFC–though they are equipping themselves to support a range of technologies, from QR codes to geo-location.

With the move to more secure EMV payment cards, merchants will have little choice but to upgrade their POS terminals over the next few years and when they do, the terminals are also expected to get a contactless interface.

Although they are keeping their options open for mobile-payment technologies, such large issuers as JPMorgan Chase, American Express, Citigroup and Capital One have active NFC programs, and Bank of America is believed to be working with NFC technology for a possible mobile-wallet launch.

Visa and especially MasterCard continue to push NFC, seeing it as a way to help them to protect their broad infrastructure of acceptance points at the physical point of sale as mobile payment emerges. The schemes, like other payment networks AmEx and Discover Financial Services, also are working on enabling online payments in their mobile offers.

Telcos, which control distribution channels of mobile phones, believe they can secure a significant share of m-commerce revenue through the secure element in NFC phones.

Overall, there will be 50 million to 80 million NFC phones sold in the U.S. in 2013, one quarter to one third of the total for the market, predicted Einar Rosenberg, head of U.S.-based NFC application company Narian Technologies.

Isis Expected to Add Cities

The Isis telcos are using SIM cards as their secure element of choice, and launched their large two-city trial in Salt Lake City and Austin in October.

Transaction activity was slow during the first month, according to merchants surveyed by NFC Times, but Isis appears to be committed to building awareness of the NFC services, and has undertaken a considerable advertising and promotional campaign in the two cities.

The consortium is expected to expand Isis to several more cities in 2013 and to add a number of other issuers. American Express, Capital One, JPMorgan Chase and a prepaid Isis Cash card supporting Visa payWave.

The Isis telcos also are expected to add a number of new handsets this year. The group predicted there would be 20 Isis-ready phones on sale in various Verizon, AT&T and T-Mobile USA shops in the cities by the end of 2012.

Still, Isis has not been very successful in signing up high-profile merchants for its SmartTap mobile-commerce feature, which enables users to redeem coupons and offers or use store loyalty cards along with payment in a single tap. And if the MCX merchants are barred from supporting other wallets, such as Isis, it could make merchant recruitment more difficult.

Continued Challenges for Google

Meanwhile, Google continues to face its own challenges with its Google Wallet. The search giant planned to launch a new version of the wallet, 2.0, which would be the wallet’s third iteration. But the new version is late, and there likely have been a number of meetings in Mountain View to chart the future of the troubled wallet.

As originally proposed but not yet released. Google Wallet 2.0, like the current version, 1.5, would enable users to load their favorite credit and debit cards into the cloud on Google’s servers. The cards would fund transactions at the physical point of sale.

With 1.5, the cards fund an NFC transaction conducted by way of a prepaid payment application supporting PayPass and stored on the embedded chip in the Google Wallet phones. That was proposed to continue with 2.0, Google sources told NFC Times in November.

With 1.5, the cards fund an NFC transaction conducted by way of a prepaid payment application supporting PayPass and stored on the embedded chip in the Google Wallet phones. That was proposed to continue with 2.0, Google sources told NFC Times in November.

The new wallet version would add a physical card, which users could swipe at merchant locations on the Discover Network to conduct the POS transaction, which would be funded by the cloud-based cards, other sources have said. Neither Google nor Discover ever confirmed this arrangement, but wallet screen shots later leaked offering more details.

It's not clear yet whether the deal has broken down between Google and Discover, possibly causing or at least contributing to the delay of the release of 2.0.

Google, which seeks to make its money from the wallet by collecting consumer data from the transactions and using it to deliver targeted promotions, has been struggling to increase use of the wallet services.

It also faces headaches in accessing the embedded chip in NFC phones. Its lone partner among major telcos is Sprint, and Sprint plans to introduce its own wallet, NFC Times has reported. Under Sprint’s open concept, Google could continue to use the embedded chip on Sprint phones, however, said sources.

Google has talked to operators and banks in Europe and Asia but apparently has had little luck trying to expand the wallet overseas.

Merchant Initiative Roils Wallet Market

Credible sources have told NFC Times that Google Wallet chief Osama Bedier is up for the job of CEO of the MCX consortium.

MCX, which besides Wal-Mart, Target and Best Buy, includes 7-Eleven, CVS/pharmacy and the Gap, plans its own mobile wallet, which sources told NFC Times would support a range of technologies, including NFC and QR codes.

The main goal of the merchants is to reduce payment transaction fees, and they believe the emerging era of mobile payment gives them an opportunity to change the prevailing payment rules. The merchants also want to keep a tighter hold on consumers’ purchase transaction data.

Original MCX planners had hoped to launch a trial of the wallet before the end of 2012. But launch preparations appear to have moved slowly in 2012. It is said to have conducted an internal trial or two using a prototype wallet from U.S.-based C-SAM, but has not hired a wallet vendor yet. It remains to be seen what the group will launch in 2013.

Besides hoping to set payment rules, the merchants could try to gain more leverage with certain open-loop card issuers and smaller payment networks willing to negotiate lower fees. MCX members are also expected to accept more private-label cards and ACH-based payments from the mobile wallet.

But one payments player that is not expected to support NFC in 2013 at the physical checkout counter is PayPal, which is using other technologies to try to make its move from the online to the offline worlds. PayPal has experimented with NFC for peer-to-peer payments, in the past.

Unlike Visa and MasterCard, PayPal has no existing infrastructure at the physical point of sale to try to protect with NFC. PayPal president David Marcus predicted a slow death for NFC payments in 2013.

Contactless Payment Hotspot in Canada

Elsewhere on the continent, Canada’s largest mobile operator, Rogers Communications, and one of the country’s largest card issuers, Canadian Imperial Bank of Commerce, launched an NFC-based mobile-payment in November with a MasterCard PayPass application on Rogers’ SIM cards. The parties plan to expand the service early in 2013.

Rogers and CIBC launched with two NFC phone models, both older BlackBerry models from Canada-based RIM. They said Rogers would add NFC-enabled Android and Windows Phone 8 models for its “suretap” NFC mobile-wallet service in early 2013.

Rogers and CIBC launched with two NFC phone models, both older BlackBerry models from Canada-based RIM. They said Rogers would add NFC-enabled Android and Windows Phone 8 models for its “suretap” NFC mobile-wallet service in early 2013.

At least one other of Canada’s major banks, The Royal Bank of Canada, is working on an NFC launch. And Rogers has applied for a banking license and is expected to issue its own payment applications for its NFC phones in the future.

As in such countries as Poland, Australia and the UK, Canada is seen as prime territory for an NFC payments launch with its high penetration of contactless terminals. Canadians appear to be taking to contactless card payment more than in most countries. MasterCard has said 10% of transactions with MasterCard-branded cards are contactless in Canada.

Seeing the Value in NFC

Perhaps one of the signs that NFC has finally arrived after 10 years is how dissident investors in Israel-based contactless and NFC vendor On Track Innovations view prospects for growth for the company, which has lost money every year since it was founded, nearly 23 years ago.

As expected, the dissident shareholders group successfully took control of OTI’s board of directors during a special meeting Dec. 30, at which they pushed through the election of a slate of new board directors. Most of the new directors are veterans of proxy battles in other industries, swooping in to take over companies whose share prices they believe are grossly undervalued.

Among the untapped value they saw in OTI is engineering talent and what they believe to be key NFC patents.

But instead of planning to dismantle OTI and selling it off in pieces to get a quick return, new board member Chuck Gillman, a U.S.-based portfolio investment manager, said the group plans to keep OTI intact. Of course, he’s eager to talk up the prospects of the company, whose long-time chairman and CEO Oded Bashan quit amid the proxy fight.

“More than 30 times, I have been involved in changing boards of directors,” he told NFC Times. “Anyone who reads the annual reports realizes most of those companies were not growth companies; the end market was not growing. There wasn’t a good reason to hold onto those companies forever. In the case of On Track Innovations, this is an industry that will grow massively.” NT