Why all the deception from the BC Securities Commission, I thought they were supposed to maintain the integrity of the market and ensure an ethical environment?

Why would the BCSC continue to press charges for a year that it knows are false? Fraud charges such as the charges BCSC continued to attempt to push on the U-GO Brands directors well after it knew they were innocent are very serious charges.

A Federal offence for which jail time may apply. To publicly allege that persons known to be innocent of such a crime are going to be prosecuted for such a crime also constitutes more then one serious Federal offence as well, regardless of the outcome of the trial or hearing. The prosecution attempted to have someone charged with a Federal offence they knew was innocent! How is this justifiable on behalf of the BCSC?

See evidence below that our lawyer and BCSC investigator Ms. Donders are aware that the allegations facing the U-GO Directors have no merit as early as July 4th 2014. Why then were the charges still facing the directors in Oct of 2014 when Ms. Mitchell-Banks insisted the U-GO Directors plead guilty to all allegations? Why were they still standing in July of 2015 in front of the Commission Tribunal?

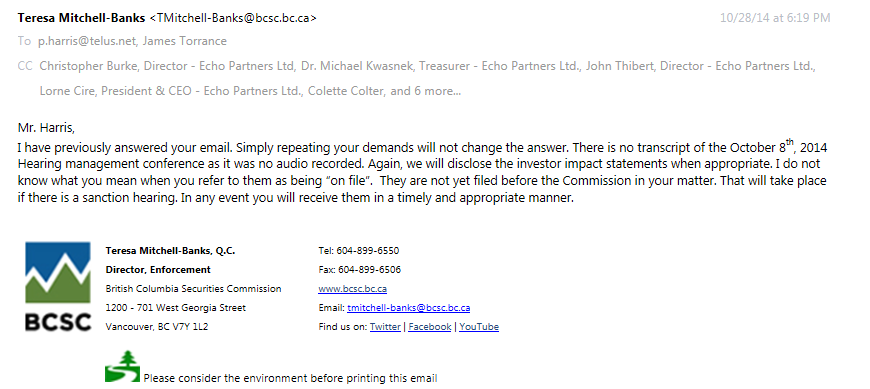

See Head of Criminal Enforcement Ms. Mitchell-Banks obstruct justice and attempt to have known innocents plead guilty to Fraud in Oct 2014;

See the BC Securities Commission Council for the Executive Director attempt to continue their lie that the U-GO Brands Directors are guilty of Fraud and attempt find them guilty of Section 57, a Section that constitutes a Federal Offence for which jail time is an applicable punishment.

The BCSC insist as always this is simply a Securities matter so the Rule of Law does not apply, we will show you how that is not true.

Not only that, once BCSC employees attempted to prosecute innocent citizens for a crime that is punishable by jail-time the BCSC crossed into the world of Federally indictable offences. Once Fraud and jail-time are involved this no longer is just a 'Securities' matter. To further the issue once BCSC employees committed the Obstruction of Justice, and False Pretence among other Federal Offences the protection of Section 170 of the Securities Act became null and void. You can not attempt to prosecute someone for Fraud charges a year after you know the allegations you put before them are not true and still claim 'Good Faith'.

See the charges still stand at the BCSC Tribunal Hearing in 2015, over a year after they were aware of the U-GO Directors innocence. Why?

Contrary to the insistence that the BCSC can take such arbitrary malicious and criminal action because 'this is a Securities matter' the BCSC still has must maintain adherence the rule of law and the Fundamentals of Justice.

The following is taken from reasons for the Courts decision in turning down an appeal based on Section 7 violations of the Charter of Rights. Notice that although the Court acknowledges the right of the ASC to suspend Section 7 rights related to the Canadian Constitution, the Court in relation to its ruling against Beaudette noted that the ASC was still bound to do so in a way that does not violate the principles of fundamental justice.

It is very important to note that the while the Court in this case sides with the ASC in terms of a Section 7 Charter violation it also outlines the expectations on an agency relying on such exemptions from the Charter.

Exert from the Courts ruling in ASC v. Beaudette “Section 7 does not promise the state will never interfere in a persons life, liberty, or security of the person – laws do this all the time – but rather that the state will not do so in a way that violates the principles of fundamental justice.”

To be clear I will provide an example so the BCSC understands how it has violated the Fundamental principles of Justice regardless of whether or not a this is a highly regulated environment. In fact because its is such a highly regulated environment these principles must by natural extension of the delicacy of the integrity of the market place be held in a high regard.

However by first violating the fundamental principles of justice the BCSC has made itself liable for the violation of multiple Charter rights as well as of course Criminal Code offences.

Further on the Court Ruling in the ASC vs. Beaudette case, the Court in siding with the ASC outlines exactly the type of responsibilities a Securities Regulation and Enforcement agency has to the rule of law in its Regulation of the Financial Markets:

As pointed out by the Alberta Securities Commission, Section 32 the Charter of Rights speaks to the rule of law as fixing boundaries on the legal authority of the state. In addition the Court speaks to the Supremacy of the Constitution as per Section 52 of the Canadian Constitution Act of 1982.

Again to reiterate we do not protest the ability of the BCSC to override SOME of our rights as to do so can be sometimes prejudicial to the public's interest in terms of maintaining the integrity of the financial markets. Our issue is in the manner it is done, we have never had a problem with the truth and as we have stated many times we have only wanted a fair and impartial proceeding against us and an opportunity to save U-GO Brands and its investors.

In plain terms to use one simple event as an analogy the we do not protest the fact that the BCSC uses Supreme Court rulings to force someone to testify against ones self contrary to our Section 11 and 7 rights of the Constitution. We protest having to be forced to testify against ourselves in front of a lying investigator and in a Court that in their own words only 'sometimes' records hearings.

Again we repeat the rulings from the Court in the ASC case.

Exert from the Courts ruling in ASC v. Beaudette “Section 7 does not promise the state will never interfere in a persons life, liberty, or security of the person – laws do this all the time – but rather that the state will not do so in a way that violates the principles of fundamental justice.”

The Principles of fundamental justice have been broken since the start when the BCSC was deceiving and misleading, why were False Pretence and Fraudulent Concealment the first actions of the BCSC when we reported Fraud?

See Mr. Ting begin the deception below,

Why would Mr. Ting tell our lawyer he is aware of our intent and will let us continue filing procedures if their was a potential issue, why did the BCSC not inform us that they had no jurisdiction over Spyru at this time? As the letter below indicates we begged for help, where were they?

What happened to policy Section 2.1, specifically the rules of 'Natural Justice'?

According to policy the BCSC states first in Part 2, Hearings 2.1 Procedures, that since there is no Legislation in the Securities Act (RSBC) 1996 that the BCSC is master of its own domain in deciding procedural matters. It follows this statement by saying that the BCSC considers the rules of natural justice as set by the courts in hearing matters fully and promptly.

First we will note that as the BCSC policy manual itself states their is little in the Securities Act (RSBC) 1996 that outlines procedure as far as procedural matters in hearings and legal processes of the Commission.

Next we will look at Section 4.1 of the Securities Act

********************************************

Application of Administrative Tribunals Act to commission

4.1 The following provisions of the

Administrative Tribunals Act apply to the commission:

(a) Part 1

[Interpretation and Application];

(b) Part 2

[Appointments], except the following:

(i) section 7 (3)

[powers after resignation or expiry of term];

(ii) section 9

[responsibilities of the chair];

(iii) section 10

[remuneration and benefits for members];

(c) section 43

[discretion to refer questions of law to court];

(d) section 46

[notice to Attorney General if constitutional question raised in application];

(e) section 46.1

[discretion to decline jurisdiction to apply the Human Rights Code];

(f) section 55

[compulsion protection];

(g) section 61

[application of Freedom of Information and Protection of Privacy Act].

******************************************

Noticeably absent in the application of power of the Administrative Tribunals Act SBC 2004 Chapter 45 to the Securities Act Section 4.1 are the following provisions, Section 11 and Section 14.

Administrative Tribunals Act SBC 2004 (AS PER SECTION 4.1 OF THE SECURITIES ACT THESE SECTIONS DO NOT APPLY)

Part 4 — Practice and Procedure

General power to make rules respecting practice and procedure

11 (1)

Subject to an enactment applicable to the tribunal, the tribunal has the power to control its own processes and may make rules respecting practice and procedure to facilitate the just and timely resolution of the matters before it.

General power to make orders

14 I

n order to facilitate the just and timely resolution of an application the tribunal, if requested by a party or an intervener, or on its own initiative, may make any order(a) for which a rule is made by the tribunal under section 11,(b) for which a rule is prescribed under section 60, or(c) in relation to any matter that the tribunal considers necessary for purposes of controlling its own proceedings. How can the BCSC operate in such blatant denial of the Fundamentals of justice, and the Rule of Law? These major breaches of the law are demonstrated by the of withholding hearings transcripts and attempting to possibly imprison someone for false charges among many other crimes.

How does the BCSC justify this?

Clearly the BCSC has an obligation to the principle of fundamental justice that it has denied us throughout the course of this investigation.

Why? See Section 362 of the Canadian Criminal code to understand that it is a crime for anyone to allege that that someone is guilty of Fraud when it is known they are innocent. Civil servants and BCSC officials are no exception.

False pretence or false statement R.S., 1985, c. C-46, s. 362;R.S

362. (1) Every one commits an offence who

(a) by a false pretence, whether directly or through the medium of a contract obtained by a false pretence, obtains anything in respect of which the offence of theft may be committed or

causes it to be delivered to another person;

(b) obtains credit by a false pretence or by fraud;

(c)

knowingly makes or causes to be made, directly or indirectly, a false statement in writing with intent that it should be relied on, with respect to the financial condition or means or ability to pay of himself or herself or any person or organization that he or she is interested in or that he or she acts for, for the purpose of procuring, in any form whatever, whether for his or her benefit or the benefit of that person or organization,

(i) the delivery of personal property,

(ii) the payment of money,

(iii) the making of a loan,

(iv) the grant or extension of credit,

(v) the discount of an account receivable, or

(vi) the making, accepting, discounting or endorsing of a bill of exchange, cheque, draft or promissory note; or

(d) knowing that a false statement in writing has been made with respect to the financial condition or means or ability to pay of himself or herself or another person or organization that he or she is interested in or that he or she acts for, procures on the faith of that statement, whether for his or her benefit or for the benefit of that person or organization, anything mentioned in subparagraphs (c)(i) to (vi).

CEO Brenda Leong, Ms Mitchell-Banks, Mila Pivnenko, James Torrance, Audrey T. Ho, and Judith T. Downes you are all guilty of False Pretence. You can not claim you acted in 'Good faith' and be immune to prosecution under Section 170 when such will full and malicious behavior has been undertaken by you all on behalf of the BCSC.

How many lies will the BCSC continue to try to tell?