Ok Again With Charts.

posted on

Jun 06, 2012 08:39PM

Sorry about Double posts.

Last Friday, brutal employment news coupled with the usual chaos out of Europe caused the price of gold to spike more than 4%.

A higher unemployment rate means the Bernank will roll out QE3, possibly as soon as the next Fed meeting on June 19-20.

Following QE1, gold went up 70%.

After QE2, it went up about 17%.

China Don't Like It

China has 60% of its $3.3 trillion foreign currency reserves in U.S. dollars. It would rather not see these reserves lose value though the printing press...

Therefore, they are trading these dollars for gold.

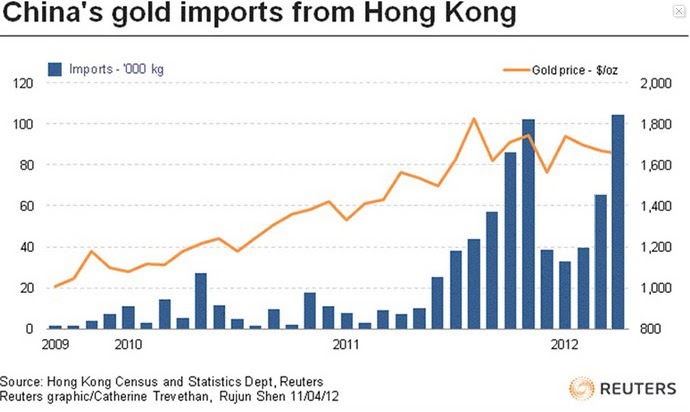

The Chinese are buying the dip in gold price and supporting the market. (It should be noted that imports from Hong Kong are estimated to be only half of all gold imported.)

Official imports were 67.4 tons in April and 104 tons in May!

In addition to unloading its dollars, China wants its currency, the RMB, to be a global currency.

This means they must have gold.

Two years ago, the Middle Kingdom said they have 1,054 tons of gold. By comparison, the United States has 8,133 tons of gold.

Chinese gold holdings would have to triple to match the U.S. vis–à–vis the ratio of gold to GDP.

Massive Revalue: Gold as a Tier-1 Asset

But the biggest possible catalyst for gold is a massive reevaluation by the Basel Committee of Bank Supervision.

BCBS sets the international rules for banks. Currently gold is rated as a tier-3 asset. This means banks can only carry 50% of its market value as capital.

Needless to say, this inhibits the desire for banks to hold gold...

The more tier-1 assets a bank has, the more money it can lend.

But the Basel Committee is looking at turning gold into a tier-1 asset so that it can be carried at 100% of its value. If this happens, it would double the value that banks place on gold overnight.

It's already happening...

According to U.S. Global Investors:

In February 2011, JPMorgan Chase & Co. said gold is at least as good an investment as triple-A rated Treasuries.

JPMorgan started allowing clients to use gold as collateral in some transactions where traditionally only Treasury bonds and stocks have been accepted.

On May 25, 2011, the European Parliament's Committee on Economic and Monetary Affairs (ECON) agreed to accept gold as collateral.

In March, Turkey passed a law allowing tier-1 status for gold held by banks. The one caveat is that gold can only represent 20% of the bank's total tier-1 holdings.

Exter's Golden Pyramid

John Exter (1910-2006) was vice president of the Federal Reserve Bank of New York. Among other things, he is credited with creating the Central Bank of Ceylon, but Exter is best known for his Golden Pyramid.

It is a simple visualization of risk.

Gold has the most reliable value at the point, while asset classes on progressively higher levels are more risky.

The chart is also representative of the size of riskier assets in the world: the higher and bigger on the chart, the more of the asset there is worldwide and the greater its total value.

During boom times, money flows from the bottom of the chart to the top; during busts, money flows from the top to the bottom.

Right now, the world is in massive debt and denial.

The G10 is estimated to be $70 trillion in debt, which is collateral for $700 trillion in derivatives. Gross world product is only $78 trillion.

A simple way to prop up the banks and reduce risk in the global economy would be for Basel III to revalue gold to tier-1.

The new rules are expected to be announced in January 2013.

Until then, look for the Chinese to support the market and the constant stream of macro catastrophes to push up the price of precious metals.

Until next time,