It's articles like this that hurt our share price

posted on

Jan 28, 2014 07:34PM

CUU own 25% Schaft Creek: proven/probable min. reserves/940.8m tonnes = 0.27% copper, 0.19 g/t gold, 0.018% moly and 1.72 g/t silver containing: 5.6b lbs copper, 5.8m ounces gold, 363.5m lbs moly and 51.7m ounces silver; (Recoverable CuEq 0.46%)

I'm Still Not Impressed With Copper Fox Metals

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Introduction

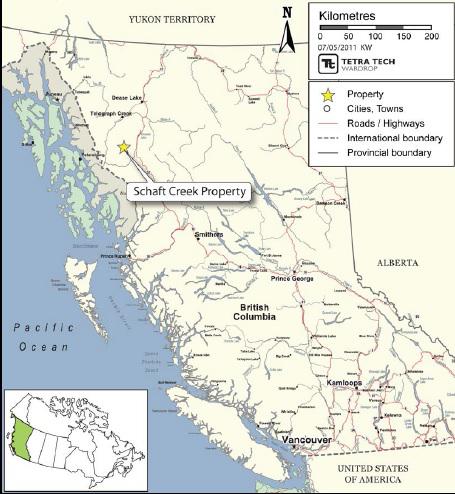

In this article, I'll have a closer look at Copper Fox Metals (OTCPK:CPFXF), a Canadian company which aims to develop the Shaft Creek Copper-Gold-Molybdenum deposit in British Columbia, Canada. I will provide a brief overview of the project where after I will play around with some numbers, as I think the feasibility study on the project paints a picture which is too optimistic given the current commodity prices.

I will also explain the deal whereby Teck has exercised the right to earn back a 75% interest in the project, and what implications this has on the valuation of Copper Fox Metals. Thereafter I'll shed some light on the risks involved with an investment in Copper Fox Metals, which will result in my investment thesis at the end of this article.

As trading in Copper Fox stock is relatively illiquid on the US exchanges, I'd highly recommend to trade in Copper Fox Metals through the facilities of the TSX Venture Exchange, where the company is listed with CUU as its ticker symbol.

Executive Summary

In this article, I'll explain why I think the share price of Copper Fox Metals is way too high based on its assets. I have recalculated the NPV of the project using an after-tax calculation and updated commodity prices, and the NPV6% attributable to Copper Fox Metals at the current commodity prices is just slightly higher than the current market capitalization.

That being said, there are also positive aspects on the project, as the joint venture agreement with Teck Resources (TCK) will be extremely important once a construction decision will be made, as Teck will source the financing for this massive project.

Copper Fox Metals could be seen as a call on the copper, gold and molybdenum price, as the price of these three commodities will be extremely important for the economics of the project. As I don't bet on higher commodity prices, I don't see any reason why anyone should be buying Copper Fox Metals right now.

The Shaft Creek Project

The Shaft Creek project is a copper-gold-molybdenum-silver project in British Columbia, Canada. The project could easily be described as one of the largest undeveloped copper-gold projects in a safe and supportive region which has had a rich history of mining and development of mining projects.

The total reserve estimate stands at 941 million tonnes at an average grade of 0.27% copper, 0.19g/t gold, 1.72g/t silver and 0.018% molybdenum. This translates into 5.6 billion pounds of copper, 5.8 million ounces of gold, 51.5 million ounces of silver and almost 364 million pounds of molybdenum. This translates into an in situ vale of approximately $30B, which is why it's one of the largest projects out there. Does this mean the project is a slam dunk? Absolutely not. The feasibility study on the project shows that the deposit is viable at a copper price of $3.25/lbs, a gold price of $1445/oz, a silver price of $27.74/oz and a molybdenum price of $14.64/lbs. However, the current gold, silver and molybdenum prices aren't anywhere near the prices which were used in the feasibility study, and in the next paragraph I will discuss the impact of a lower by-product revenue on the net present value of the project.

Playing with some numbers

Using the aforementioned commodity prices, the pre-tax NPV5% of the project is approximately $1.5B. I will now recalculate the net present value of the project by using more appropriate by-product prices of $1250 gold, $20 silver and $10 molybdenum. On top of that I will increase the discount rate to 6%, and will try to calculate the after-tax NPV of the project (compared to Copper Fox' pre-tax numbers).

This calculation should be considered as a back of the envelope calculation, as there might be some more improvements possible. On top of that, there will be some fluctuations in the annual production which averages 232 million pounds per year over the life of mine. As such, this calculation should be a starting point only, and a base thesis to build from here on. I will use a base case copper price of $3.2/lbs, but I will also calculate alternative scenarios using a copper price of $2.90/lbs which is my (optimistic) personal long-term target price for copper.

In my first calculation I will continue to use the 941 million tonnes in the reserve estimate, which I will later increase to 1.23 billion tonnes in the measured and indicated category.

The initial capital expenditures were estimated at $2.95B and the average cost per pound of copper was estimated to be $1.05. However, based on my rough calculations using the updated commodity prices for gold, silver and molybdenum, I expect the cash cost per pound of copper to increase to $1.5/lbs, as the average annual by-product revenue at the current gold, silver and moly prices would be approximately $100M per year lower. This will obviously have a huge impact on the net present value, which I will now calculate. I anticipate a construction start in 2016 (if, and that's a big IF, the financing to cover the initial capital expenditures will have been secured by then), and will inflate the capex with a very moderate 2% per year. This increases the initial capex to $3.25B (or C$3.65B). The annual production rate in the first five years of operation will be 274M lbs, decreasing to an average of 220M lbs per annum for years 6-21.

|

Cash Flow per year |

Corporate tax rate (30%) |

after tax |

Discount rate (6% per annum) |

NPV6% |

|

-3250000000 |

-3250000000 |

|||

|

0 |

0% |

0 |

1,00 |

0 |

|

411000000 |

0% |

411000000 |

1,06 |

387735849 |

|

411000000 |

0% |

411000000 |

1,12 |

365788537 |

|

411000000 |

0% |

411000000 |

1,19 |

345083525 |

|

411000000 |

0% |

411000000 |

1,26 |

325550496 |

|

411000000 |

0% |

411000000 |

1,34 |

307123109 |

|

330000000 |

0% |

330000000 |

1,42 |

232636978 |

|

330000000 |

0% |

330000000 |

1,50 |

219468847 |

|

330000000 |

0% |

330000000 |

1,59 |

207046083 |

|

330000000 |

0% |

330000000 |

1,69 |

195326493 |

|

330000000 |

30% |

231000000 |

1,79 |

128989193 |

|

330000000 |

30% |

231000000 |

1,90 |

121687918 |

|

330000000 |

30% |

231000000 |

2,01 |

114799923 |

|

330000000 |

30% |

231000000 |

2,13 |

108301814 |

|

330000000 |

30% |

231000000 |

2,26 |

102171523 |

|

330000000 |

30% |

231000000 |

2,40 |

96388229 |

|

330000000 |

30% |

231000000 |

2,54 |

90932292 |

|

330000000 |

30% |

231000000 |

2,69 |

85785181 |

|

330000000 |

30% |

231000000 |

2,85 |

80929416 |

|

330000000 |

30% |

231000000 |

3,03 |

76348505 |

|

330000000 |

30% |

231000000 |

3,21 |

72026892 |

|

330000000 |

30% |

231000000 |

3,40 |

67949898 |

|

482,070,701 |

Using these parameters, I end up with a net present value of $482M.

Let's now move over to the expanded mine life of 28 years and see how this influences the NPV of the project.

|

Cash Flow per year |

Corporate tax rate (30%) |

after tax |

Discount rate (6% per annum) |

NPV6% |

|

-3250000000 |

-3250000000 |

|||

|

0 |

0% |

0 |

1,00 |

0 |

|

411000000 |

0% |

411000000 |

1,06 |

387735849 |

|

411000000 |

0% |

411000000 |

1,12 |

365788537 |

|

411000000 |

0% |

411000000 |

1,19 |

345083525 |

|

411000000 |

0% |

411000000 |

1,26 |

325550496 |

|

411000000 |

0% |

411000000 |

1,34 |

307123109 |

|

330000000 |

0% |

330000000 |

1,42 |

232636978 |

|

330000000 |

0% |

330000000 |

1,50 |

219468847 |

|

330000000 |

0% |

330000000 |

1,59 |

207046083 |

|

330000000 |

0% |

330000000 |

1,69 |

195326493 |

|

330000000 |

30% |

231000000 |

1,79 |

128989193 |

|

330000000 |

30% |

231000000 |

1,90 |

121687918 |

|

330000000 |

30% |

231000000 |

2,01 |

114799923 |

|

330000000 |

30% |

231000000 |

2,13 |

108301814 |

|

330000000 |

30% |

231000000 |

2,26 |

102171523 |

|

330000000 |

30% |

231000000 |

2,40 |

96388229 |

|

330000000 |

30% |

231000000 |

2,54 |

90932292 |

|

330000000 |

30% |

231000000 |

2,69 |

85785181 |

|

330000000 |

30% |

231000000 |

2,85 |

80929416 |

|

330000000 |

30% |

231000000 |

3,03 |

76348505 |

|

330000000 |

30% |

231000000 |

3,21 |

72026892 |

|

330000000 |

30% |

231000000 |

3,40 |

67949898 |

|

330000000 |

30% |

231000000 |

3,60 |

64103677 |

|

330000000 |

30% |

231000000 |

3,82 |

60475167 |

|

330000000 |

30% |

231000000 |

4,05 |

57052045 |

|

330000000 |

30% |

231000000 |

4,29 |

53822684 |

|

330000000 |

30% |

231000000 |

4,55 |

50776117 |

|

330000000 |

30% |

231000000 |

4,82 |

47901997 |

|

330000000 |

30% |

231000000 |

5,11 |

45190563 |

|

861,392,951 |

As you can see, adding the measured and indicated resources to the calculation almost doubles the NPV to $862M.

In the next calculation I will use my long-term copper price expectation of $2.75/lbs combined with the extended mine life. As the additional tonnage is located in the measured and indicated categories, I feel quite comfortable using the extended mine life.

|

Cash Flow per year |

Corporate tax rate (30%) |

after tax |

Discount rate (6% per annum) |

NPV6% |

|

-3250000000 |

-3250000000 |

|||

|

0 |

0% |

0 |

1,00 |

0 |

|

350000000 |

0% |

350000000 |

1,06 |

330188679 |

|

350000000 |

0% |

350000000 |

1,12 |

311498754 |

|

350000000 |

0% |

350000000 |

1,19 |

293866749 |

|

350000000 |

0% |

350000000 |

1,26 |

277232782 |

|

350000000 |

0% |

350000000 |

1,34 |

261540361 |

|

275000000 |

0% |

275000000 |

1,42 |

193864149 |

|

275000000 |

0% |

275000000 |

1,50 |

182890706 |

|

275000000 |

0% |

275000000 |

1,59 |

172538402 |

|

275000000 |

0% |

275000000 |

1,69 |

162772077 |

|

275000000 |

0% |

275000000 |

1,79 |

153558564 |

|

275000000 |

0% |

275000000 |

1,90 |

144866569 |

|

275000000 |

30% |

192500000 |

2,01 |

95666602 |

|

275000000 |

30% |

192500000 |

2,13 |

90251512 |

|

275000000 |

30% |

192500000 |

2,26 |

85142936 |

|

275000000 |

30% |

192500000 |

2,40 |

80323524 |

|

275000000 |

30% |

192500000 |

2,54 |

75776910 |

|

275000000 |

30% |

192500000 |

2,69 |

71487651 |

|

275000000 |

30% |

192500000 |

2,85 |

67441180 |

|

275000000 |

30% |

192500000 |

3,03 |

63623755 |

|

275000000 |

30% |

192500000 |

3,21 |

60022410 |

|

275000000 |

30% |

192500000 |

3,40 |

56624915 |

|

275000000 |

30% |

192500000 |

3,60 |

53419731 |

|

275000000 |

30% |

192500000 |

3,82 |

50395973 |

|

275000000 |

30% |

192500000 |

4,05 |

47543371 |

|

275000000 |

30% |

192500000 |

4,29 |

44852236 |

|

275000000 |

30% |

192500000 |

4,55 |

42313431 |

|

275000000 |

30% |

192500000 |

4,82 |

39918331 |

|

275000000 |

30% |

192500000 |

5,11 |

37658803 |

|

297,281,061 |

The lower copper price has a huge impact, as in the extended mine life version, the NPV falls short of $300M, which is disappointing, given the high initial capital expenditures of $3.25B.

If I would give the same weight to all three calculations, the average after-tax NPV would be $547M. As Copper Fox Metals will very likely end up with a stake of just 25% in the project, its fair share would be $137M, which is just 10% lower than the current market capitalization…

So why are my calculations so different from the feasibility study?

The explanation is quite simple. First of all, I use a higher discount rate (6% versus 5% in the feasibility study). Even though British Columbia is undeniably a safe and stable region to operate in, I think a 3% markup to the risk-free interest rate is appropriate for a project of this size where so many things could go wrong.

Secondly, Copper Fox has only released a pre-tax net present value, whereas I attempted to calculate an after-tax value of the project. I think it's only normal to take taxes into consideration, and I used an average corporate tax rate of 30% in my calculations.

These two assumptions are the main reason why my calculations result in a lower fair value than the company's release.

The Teck Resources clawback-deal

Approximately six months after the feasibility study, Copper Fox Metals announced it formed a joint venture agreement with Teck Resources to jointly develop the Shaft Creek project.

Basically, Teck will pay a total of $60 million in three direct cash payments to Copper Fox: $20 million upon signing the Schaft Creek Joint Venture Agreement, $20 million upon a Production Decision, and $20 million upon the completion of the mine facility. On top of that, Teck will fund 100% of costs incurred prior to a production decision up to $60 million; Copper Fox's pro rata share of any pre-production costs in excess of $60 million will be funded by Teck and the direct cash payments payable to Copper Fox will be reduced by an equivalent amount, and Teck will fund any additional costs incurred prior to a production decision, if required, by way of loan to Copper Fox to the extent of its pro rata share, without dilution to Copper Fox's 25% joint venture interest.

Although it might seem to be good to have a partner as Teck on board, let's not forget most question marks are still in place.

First of all, it's not because Teck stepped in that there now is a guarantee the project will be built. No production decision has been made, and as such, Copper Fox Metals can't even be sure to receive the next $40M in cash payments from Teck. By signing this agreement, Copper Fox' destiny is now completely controlled by Teck Resources which might very well decide to put the project on hold until the commodity prices improve again.

The risks of investing in Copper Fox Metals

First of all, there's a huge commodity price risk. As I explained and proved in this article, the Shaft Creek project is extremely dependent on the price of copper and gold. Even a small change in those commodity prices might have a huge impact on the final value of the Shaft Creek project and ultimately the valuation of Copper Fox Metals as a whole. I have established that at the current molybdenum and gold price the project is already worse than what the feasibility study showed.

A second risk is the execution risk. As per the agreement whereby Teck Resources agreed to earn back an interest of up to 75% in the project by making cash payments totaling $60M, of which $20M has been paid, $20M will be paid when a production decision will have been made and a final $20M is due on the completion of a mine facility.

The country risk and geopolitical risk can be ignored, as the Shaft Creek project is located in British Columbia, Canada which still is one of the prime locations for mining companies in the world. Because of this, I feel perfectly comfortable using a discount rate of just 6% to calculate the net present value of the project.

Conclusion

Even though the Shaft Creek project is undoubtedly one of the largest copper-gold projects in North America, there is no guarantee the project will ever be built. The main culprit is obviously the initial capital expenditures of $3B. On top of that, approximately $60M per year will have to be spent on sustaining capital expenditures.

Even though the capex is high, the project has a lot of merit if the prices of the by-products would be lower than where they are now. As I proved in this article, the Shaft Creek project is actually just a 'marginal' project when taking the updated commodity prices into consideration.

As the gold, silver and molybdenum price have decreased since the completion of the feasibility study, Shaft Creek will have to take a $100M lower by-product revenue into consideration.

As the company is already trading at 0.9X the after-tax NPV6% of the project (this does not include its other exploration projects), I really don't see any value at this share price. Granted, Shaft Creek is a very important call option on a price increase of either gold or molybdenum, and if you think the price of these commodities will increase by at least 30%, then Shaft Creek might be a good investment.

However, at the current commodity prices I don't see any added value in buying Copper Fox Metals right now, and I'm steering clear of any investment in the company.

If you found this analysis helpful, there are exclusively available in the ![]() research library for professional investors.

research library for professional investors.

|

Loading...

Symbols:

|

- | - | |||

|

Loading...

Symbols:

|

- | - | |||

|

Loading...

Symbols:

|

- | - | |||

|

Loading...

Symbols:

|

- | - | |||

|

Loading...

Symbols:

|

- | - | |||

|

Loading...

Symbols:

|

- | - | |||

|

Loading...

Symbols:

|

- | - | |||

|

Loading...

Symbols:

|

- | - | |||

|

Loading...

Symbols:

|

- | - | |||

|

Loading...

Symbols:

|

- | - |