Re: Soly's message

in response to

by

posted on

Sep 16, 2015 12:11AM

Developing large acreage positions of unconventional and conventional oil and gas resources

“Shareholders don’t want to wait 20 years for a payback. We’re setting ourselves up to sell. Ultimately, that’s what we want to do. Shareholders want a big return and they want a quick return.”

-Philip O’Quigley, chief executive, Falcon Oil & Gas –

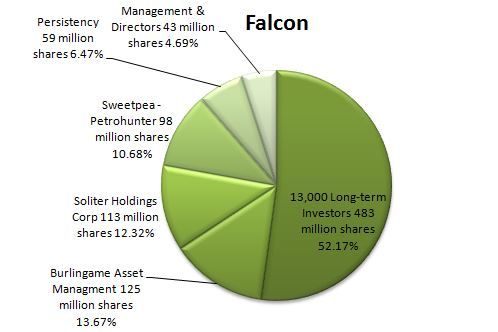

Just who are these shareholders?

Well, all of us, the 13,445 long-term investors.

But, Philip O’Quigley really talking about his bosses. You know, the guys who hired him in the first place. Burlingame, Soliter, Persistency, Sweetpea, the folks on left side on this chart.

Of course they'll wait for the conclusion of the 9 well program. And so are we, on the right side of the chart.

News item:

December 14 2009

Mega-Merger: Exxon Makes Huge Natural Gas Bet With Acquisition Of XTO Energy For $41 Billion

IRVING, Texas--(BUSINESS WIRE)--Exxon Mobil Corporation and XTO Energy Inc. announced today an all-stock transaction valued at $41 billion. The agreement, which is subject to XTO stockholder approval and regulatory clearance, will enhance ExxonMobil’s position in the development of unconventional natural gas and oil resources.

Under the terms of the agreement, approved by the boards of directors of both companies, ExxonMobil has agreed to issue 0.7098 common shares for each common share of XTO. This represents a 25 percent premium to XTO stockholders. The transaction value includes $10 billion of existing XTO debt and is based on the closing share prices of ExxonMobil and XTO on December 11, 2009.

“We are pleased that ExxonMobil and XTO have reached this agreement,” said Rex W. Tillerson, chairman and chief executive officer of Exxon Mobil Corporation.

“XTO is a leading U.S. unconventional natural gas producer, with an outstanding resource base, strong technical expertise and highly skilled employees. XTO’s strengths, together with ExxonMobil’s advanced R&D and operational capabilities, global scale and financial capacity, should enable development of additional supplies of unconventional oil and gas resources, benefiting consumers both here in the United States and around the world.”

Tillerson said the agreement is good news for the United States economy and energy security, as it will enhance opportunities for job creation and investment in the production of America’s own clean-burning natural gas resources.

XTO’s resource base is the equivalent of 45 trillion cubic feet of gas and includes shale gas, tight gas, coal bed methane and shale oil.

Soly’s note:

Price of 1 TCF of gas is about $1 billion

Price of 1 barrel of crude is $53 in 2009