Gold Myth Busting.....awesome analysis....

posted on

Jun 14, 2009 03:13PM

Golden Minerals is a junior silver producer with a strong growth profile, listed on both the NYSE Amex and TSX.

link for ease: http://www.marketoracle.co.uk/Articl...

By: Adam_Brochert Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/ Adam Brochert BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.Gold Myth Busting- U.S. Dollar, Deflation and Hyperinflation

Commodities / Gold & Silver 2009Jun 07, 2009 - 06:42 PM

There are a lot of myths and “old wives’ tales” out there about Gold and the frequently accompanying topics of inflation and deflation. In no particular order, I’d like to debunk three big ones with facts rather than universally accepted catch-phrases that prey on lazy investors and speculators.

There are a lot of myths and “old wives’ tales” out there about Gold and the frequently accompanying topics of inflation and deflation. In no particular order, I’d like to debunk three big ones with facts rather than universally accepted catch-phrases that prey on lazy investors and speculators.

1. “Dollar down, Gold up” or “Dollar up, Gold down”

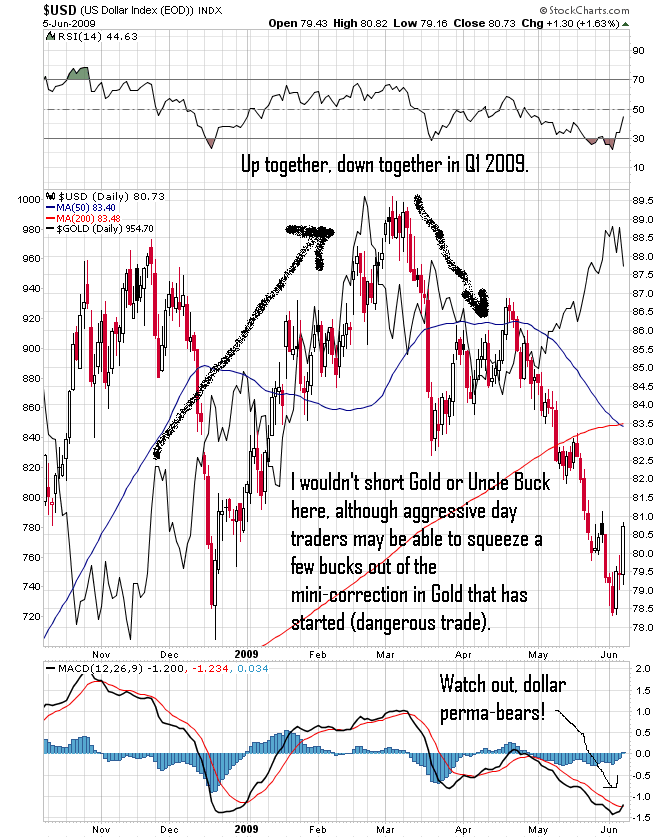

Yes, this is often true, but it’s a far from perfect correlation. The US Dollar and Gold are two different currencies traded on exchanges around the world. Because the Gold price is denominated in US Dollars, it is generally assumed that when the US Dollar goes down in price that Gold must go up in price. There is certainly a correlation here, to be sure. But even recent history shows it’s a dangerous game to play if you’re a speculator or intermediate-term investor.

Here’s a daily 8 month price chart of the US Dollar and Gold up through June 6th, 2009:

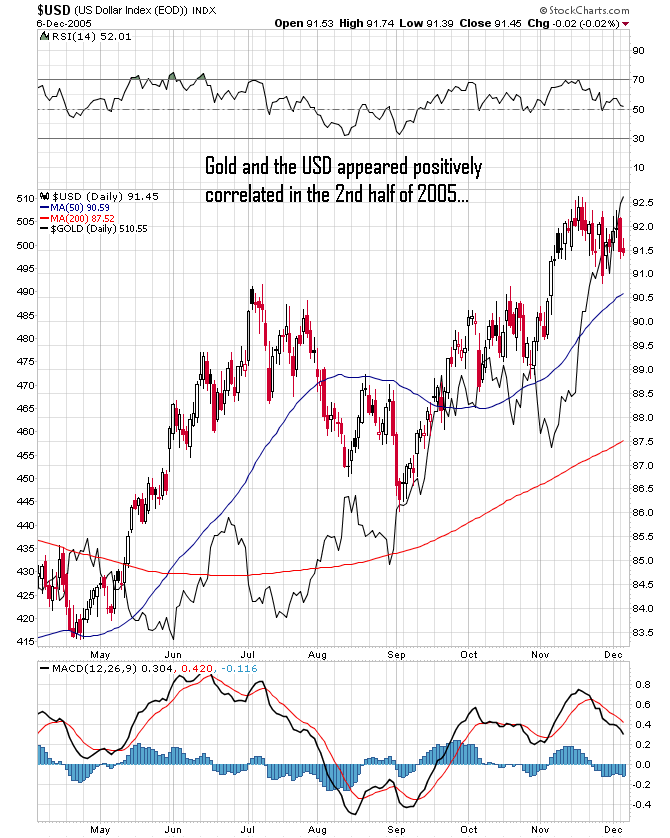

Or how about in the 2nd half of 2005:

Gold is in a secular bull market as are Gold stocks. The US Dollar is in a cyclical bull market within the secular bear market that always characterizes all fiat currencies over time. The US Dollar has been in a secular bear market since it left the Gold standard in the early 1970s! Many savers could use a little respite from the chronic devaluation of the Dollar, even if it is only a temporary deflationary blip when viewed from a longer term perspective.

When an asset class is in a strong, long-term bull market like Gold and Gold stocks are currently, that asset class goes up because it is going up! Trying to find rational explanations for even intermediate-term moves is a fool’s game. Gold is acting as a store of value at a time when other asset classes are having their value destroyed. This will keep a bid under Gold, regardless of what the US Dollar is doing.

Also remember that the US Dollar is considered “strong” or “weak” based on a comparison to other intrinsically worthless fiat currencies like the Euro (10 years old, artificially created out of thin air, backed only by promises of rotating apparatchiks and already considered a reliable, long-term, safe alternative to the US Dollar!?) or Chinese Yuan. All fiat currencies are sinking, simply at different rates. Gold is in a secular bull market relative to all currencies used in the world right now and that bull market is not over.

2. “The government is printing money and this will stop deflation and cause heavy inflation or hyperinflation”

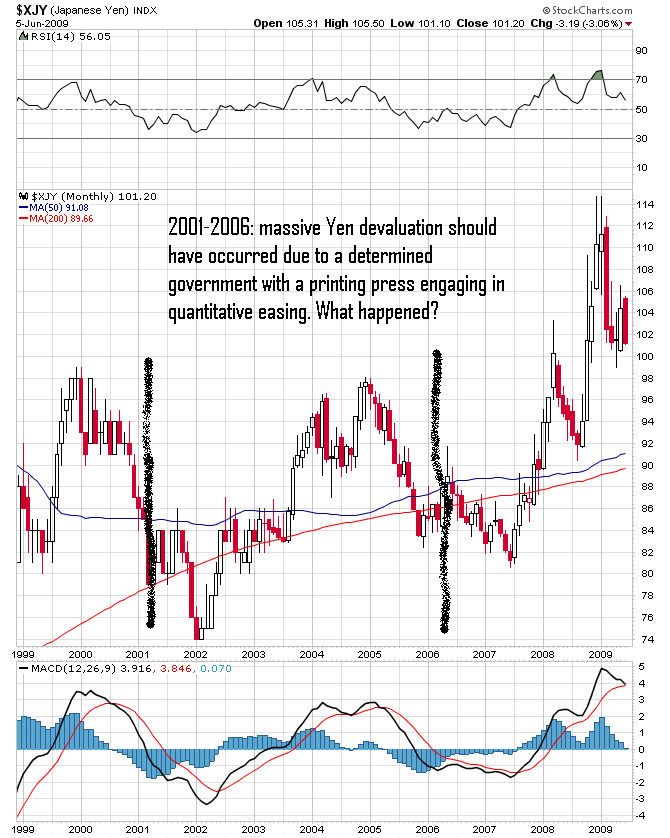

You want heavy “money printing” and heavy government debt loads? Try Japan! The table below is stolen from an article by PIMCO:

How many Gold bugs are calling for pending hyperinflation in Japan? If any are, when did they start calling for it? Quantitative easing was begun in Japan in 2001 and went on for 5 years before they took a break. Here’s the results, first using the Yen currency index:

Or how about those bond vigilantes stopping the Japanese government in its tracks and pushing government bond yields to astronomical highs (chart below from fxthoughts.com):

Instead of thinking of things like Weimar Germany or Zimbabwe, how about thinking about bonds being debt. “Printing money” might be true if you’re a shareholder in the for-profit, non-federal, private federal reserve bank corporation (and you get paid interest for creating money out of thin air!). But for the US, Japanese and other sovereign governments around the world trying to “stimulate” themselves like subway frotteurists, they are simply “printing” debt, not money.

If every time you got in trouble as an individual you simply took on more debt to meet current obligations and expand your lifestyle, what do you think would happen after a while? Well, that’s what has happened to the United States, both the government and its average citizen.

Of course the US government would like to inflate its way out of this mess, but that doesn’t mean it can every time it wants to. To do so overly aggressively would mean to truly commit to hyperinflation and that would end the federal reserve franchise instantly. Don’t assume the people who control the federal reserve are so naïve as to welcome hyperinflation. Deflation allows those in control of the money supply to buy assets cheap and expand their power by pretending to be a friend to the United States and agreeing to “help them out.”

Once debt becomes overly burdensome, the economy withers on the vine until most of the debt can be defaulted on or re-paid. This only happens once every generation or two and causes what has been termed an economic depression or secular credit contraction. We have started one and this is only the beginning. Ten years of it would be a blessing but 15-25 years is more likely.

Of course, wars and other geopolitical events could change the currency dynamics of the globe and this is why Gold is also a good hedge. It will retain its value during heavy deflation as well as if there is a currency crisis (i.e. US Dollar dethroned as the world’s reserve currency, which would cause an immediate and significant devaluation). This is the paradox of Gold that most do not understand. When Gold is looked at as a strong, independent, non debt-based, non-debasable currency this makes sense, but many erroneously think Gold is a commodity like oil. Not so, either currently or historically.

And for those who say “this time is different” because we’re doing it more aggressively, earlier, using private assets, etc. – save it. It’s all been done before and it’s never worked. This argument is for academic Keynesian economists in a classroom and the real fallacy is believing that the government has any power to change the primary trend once it has a good head of steam. Though Greenspan kept the old trend going a little longer, it was only because there was enough room to expand debt – there’s no more room in the United States to expand private debt in aggregate regardless of what the government does. The more the government “stimulates,” the deeper and longer the economic depression will be (ask Japan, currently in the 19th year of its secular bear market).

3. “Gold and Gold stocks are lousy investments during deflation”

It is hard for traditional investors to find a good investment during deflation other than cash and cash equivalents. Stocks, corporate bonds and real estate all go down in value (sound familiar?). But Gold is cash! When this deflationary bear market started in October, 2007, Gold was about $750/ounce. In other words, it has gone up roughly 25% since the day this bear market started! The Dollar Index was at around 78 when this bear market started and thus it is up about 3% (we’ll add in some interest and say it’s up 10%).

If you want to invest in firms in the money business who produce cash (since "cash is king" during deflation), many erroneously look for corporate bonds or stocks of firms who deal in fiat money. If you think putting your money in banking stocks or Wall Street firms like JP Morgan is a good long-term investment, I wish you well but know you won’t do well. These firms are insolvent, which is what happens in economic depressions. These money changers are overleveraged and made too many bad loans, so they will bear the brunt of the turn in sentiment even with all the free money the government has given them. These stocks will be making significant new lows well before 2009 is over and some will go bankrupt and be de-listed from the stock exchanges.

Gold miners, on the other hand, are digging real money out of the ground at a time when money is becoming more valuable and costs are declining. Profit margins for producing Gold miners are set to explode to the upside. Their hard work will help to re-liquefy the global banking system and they will be rewarded with heavy profits and appreciating stock prices.

People think this time is different from the 1930s since we aren’t on a Gold standard anymore so I bring you the inflation-adjusted price of Gold from the 1873 thru 1895 “Great Depression” (chart stolen from thechartstore.com):

When the inflation-adjusted or “real” price of Gold is rising, so is Gold miner profitability. This will translate into higher Gold stock mining prices even under a fiat system. Once everyone sees Gold stocks outperforming by the end of this year, they will jump aboard the only sustainable equity sector bull market out there.

Gold fever is dead ahead and Gold bulls don't even have to pray for the destruction of their currency to profit from it.

abrochert@yahoo.com

http://goldversuspaper.blogspot.com