http://www.zerohedge.com/article/birthdeath-adjustment-206000Of course, in the end, this is exactly what is going to happen. In fact, QE isn't even about economic growth anyway, its about funding the federal government while at the same time floating free money to insolvent TBTF primary dealer banks. The lousy U.S. economy just gives political cover and distraction for the Fed to keep the presses humming.

Remember Econ 101...Increasing the supply of an item decreases its value. More dollars equals a less valuable dollar. A declining dollar causes all things denominated in dollars (gold, oil, corn) to rise. The dollar is going to be declining farther with the advent of QE3 so the way must be prepared by smashing commodities first so that they start their next UPleg from a lower point. Thus, the fundamentals are overridden today. The prop desks of the primary dealers are the ones responsible, at the behest of their Fed masters.

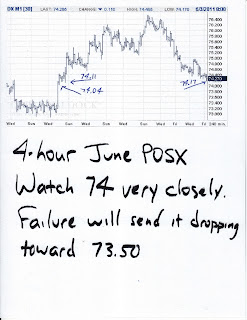

Eventually, good defeats evil and truth defeats lies. I see that just in the time it has taken me to type this note, gold has rallied $10. Maybe truth will even win the day today. We'll see. The key may be in watching the POSX. It has now made a complete roundtrip from its "Calvin" bounce last month. The bounce took it to 74. It then rallied to 76+ and now it's back to 74. A move back down through 74 and it will move quickly back toward 73.

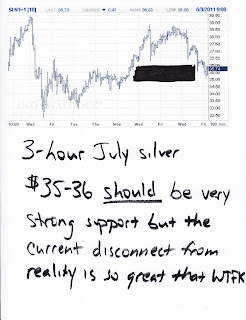

Lastly, here's a silver chart for all the other sick, pathetic gamblers such as myself. Frankly, I'm about to give up on silver for a while, even though I did get filled on another July $40 call overnight. The fiat price obtained through action on the Comex is now so disconnected from physical reality that it seems ludicrous to even participate in the nonsense. As we've often discussed here, physical silver is your insurance protection as you seek to preserve your ability to purchase everyday items. Physical gold is your insurance as you seek to preserve your wealth. As the Comex edges closer to default, the price of paper silver set by the Comex will increasingly separate from reality. The simplest strategy is to avoid the Comex, altogether. Do not play their games. Leave the "speculation" up to us lobotomized fools. Just keep stacking your physical and look the other way,

OK, I have lasts of 1542.60 and 35.60. I don't know about you but I'm ready for the weekend to start right now. More later...maybe. It depends on whether or not I go make myself a Bloody Mary. TF