Chrome - really worth a read

posted on

Sep 18, 2008 09:24AM

NI 43-101 Update (September 2012): 11.1 Mt @ 1.68% Ni, 0.87% Cu, 0.89 gpt Pt and 3.09 gpt Pd and 0.18 gpt Au (Proven & Probable Reserves) / 8.9 Mt @ 1.10% Ni, 1.14% Cu, 1.16 gpt Pt and 3.49 gpt Pd and 0.30 gpt Au (Inferred Resource)

By Tom Vulcan

Some things have not changed over the last couple of hundred years.

If you've got a classic motorbike, say, a Harley-Davidson, you can be sure it'll have some pretty spiffy chrome plating on it, whether it's on the pipes, front forks or handlebars. And then there are the myriad different wheels you can get for your motor. They'll very likely have chrome on them somewhere.

Well, back in the late 18th century, if you really loved your landau, brougham or personal fly (all horse-drawn carriages) and wanted to cut a dashing figure, you too would have used plenty of chrome. Not in the form of plating, but in the form of a bright yellow paint with which to adorn your conveyance. Hence the paint pigment's name - chrome yellow. (And the horrid pun in the title of Aldous Huxley's first novel - "Crome Yellow"!)

If, on the other hand, you like your little sparklers, it is just the tiniest trace of the metal that makes rubies red and emeralds a serpentine green.

A Bit Of Background

While chromium may not be as newly discovered an element as rhenium, it was only formally "discovered" and named in 1797 by one Nicolas-Louis Vauquelin, a professor of chemistry and assaying at the renowned School of Mines in Paris. Appropriately, he named it chromium after the Greek work for color - χρώμα (chrōma).

First dug out of mines on the eastern slopes of the Ural Mountains in Siberia, deposits of chromite (from which chromium is extracted) were also discovered on the Maryland/Pennsylvania border in 1827, and for some years the U.S. became a monopoly supplier.

Following the exhaustion of these deposits in 1860, Turkey became the world's main supplier of chromite for many years, until chromium ore started to be mined seriously in India and southern Africa. South Africa remains the world's largest producer of chromite ore and concentrates, followed by Kazakhstan and India. Together they account for around 80% of the world's production of chromite ore.

Not Just Fancy Trim

In the mid-19th century, in addition to being used for paint pigment, chromium compounds started to be used in the dyeing industry. Later in the century, this was followed by use both in the leather tanning industry and as a refractory (a substance resistant to both heat and corrosion).

Although the first patent for its use in steel was granted as early as 1865, only after there had been some major advances in furnace and smelting technology in the early 20th century did the use of chromium in steel really take off. With the invention of various stainless steels (steels containing more than 10% chromium, with or without other alloying elements) in the second decade of the 20th century, chromium can truly be said to have come of age.

As an alloying compound, adding chromium can endow the resulting new compound with:

Decay

Temperature

Wear

The vast majority of its current uses are metallurgical, predominantly in steels and superalloys.

Source: ICDA

Its industrial uses and intermediate products include:

| Refractory |

Chemical |

Metallurgical |

Foundry Sands |

|

Cement kiln |

Chromium plating |

Ferrous alloys |

|

|

Fiberglass furnace |

Corrosion control |

- Cast iron |

|

|

Glass-tank regenerator |

Metal finishing |

- Steel |

|

|

Steel industry |

Pigments |

|

|

|

Other |

Tanning compounds |

|

|

|

Other |

Non-ferrous alloys |

||

|

- Aluminum |

|||

|

- Copper |

|||

|

- Nickel |

|||

|

- Other |

Source: USGS

|

Used in the following industries... |

...chromium is commonly to be found in: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: USGS

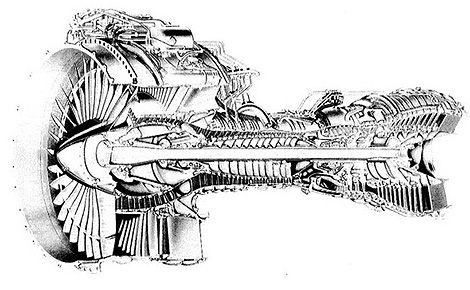

In addition, two of its strategic military uses are as an essential alloy both in gas turbine (i.e., jet engine) blades and armor plating - Krupp, the German armaments manufacturer, started using chromium in its proprietary armor plating as early as 1893.

A Typical Jet Engine

Source: The National Academies Press

A brief glance at the chromium content of just some of the major gas turbine superalloys demonstrates how important it is in the manufacture of jet engines.

|

Superalloy |

Chromium (% of weight) |

|

Hastelloy-X® |

22 |

|

WI-52® |

21 |

|

Waspaloy® |

20 |

|

IN-718® |

19 |

|

Stainless Steels |

17-25 |

|

Udimet-700® |

15 |

Source: The National Academies Press

Chromium Supply

Chromium metal is extracted from chromite ore, deposits of which were created when magma (molten rock) broke through the earth's crust. While the world's major chromite deposits - all in the Eastern Hemisphere - are in India, Kazakhstan and South Africa, there are significant deposits in the Western hemisphere, in, namely, Brazil and Cuba. All these countries (except Cuba) also mine the ore.

The World's Chromite-Producing Regions

Source: ICDA

Source: ICDA

The U.S. Geological Survey [USGS] estimates that world resources exceed 12 billion metric tonnes of shipping-grade chromite, with 95% of these concentrated in Kazakhstan and southern Africa.

According to the USGS, however, there is, at present, but a single company mining chromite ore in the U.S. (from an ore deposit near Coos Bay in Oregon).

In recent press reports, Oregon Resources Corporation (a wholly owned subsidiary of Australian company Industrial Minerals Corporation Ltd (Bloomberg Ticker - IDM:AU), hopes to mine some 700,000 tons of mineral a year. And, on June 20 this year, the Australian parent announced not only that some "probable" reserves were now "proved," but also that some previous reserve figures had been revised upward. A close look at IDM:AU could be rewarding.

Chromium Demand

Over 90% of mined chromite ore is converted to ferrochromium - an alloy produced in an electric furnace using chromite, iron or iron ore and carbon - which is then used either to make chromium metal or to introduce the metal into alloys, particularly stainless steel, with stainless steel probably using around 80% of the chromite so converted.

The world's major pure chromium metal producers include China, France, Russia, the U.K. and the U.S.

Japan remains by far the world's largest average annual producer of stainless steel, followed by the U.S., China, Korea, Germany, Italy, Taiwan and India. Preliminary figures for global stainless steel production in 2007 stood at some 27.84 million metric tonnes.

Source: International Stainless Steel Forum (ISSF)

Historically the ferrochromium market has been quite cyclical. Over the past several years, this has led to the increased production of chromite by vertically integrated producers, i.e., chromite mines that also own and operate chromium chemical, ferrochromium and chromite refractory producers. With the exception of China, now both a major ferrochromium and stainless steel producer, ferrochromium production has tended to move from the stainless-steel-producing countries to the chromite-ore-producing countries.

With both its rapid economic growth and the expansion of its stainless steel industry, China is now the world's largest annual average consumer of chromium. Indeed, the USGS noted in its 2008 mineral commodity summary for chromium: "Chinese stainless steel production exceeded that of the United States beginning in 2004 and by 2007 was 142% greater than that of the United States."

The Current Market Situation

The price of ferrochromium reached historical levels in 2007, not least because of China's growing demand as a consumer.

According to Xstrata, the world's largest ferrochromium producer, increased stainless steel production in the first half of 2008, compared with the second half of 2007, together with reduced South African ferrochromium production because of the country's well-publicized power constraints, have forced ferrochromium prices even higher. During the first six months of 2008, the average price (Metal Bulletin) of ferrochromium was 156.5¢/lb, up some 97% from 79.4¢/lb for the same period last year.

Despite continuing weak stainless steel production in the U.S. and a slowing in rate of growth of stainless steel production in China, an estimated global production for stainless steel of 15.3 million metric tonnes during the first half of this year (down 1% in the comparable period last year) is still up 16% on the second half of 2007.

While third-quarter stainless steel production is expected to slow, the market is expected to strengthen in the fourth quarter. Forecasts indicate a figure of over 29 million metric tonnes for stainless steel production for the whole of 2008, and production increases possibly up 6% on 2007. The ISSF forecasts demand for all stainless steel products rising through 2009.

All Stainless Products - Global Stainless Steel Demand Index

Source: ISSF

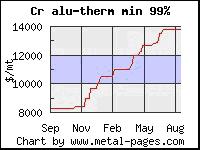

The price of pure chromium metal, too, has soared, not least because of continuing strong demand for fuel-efficient engines and its continuing heavy use in the manufacture of pumps and corrosion-resistant pipes for the oil industry (see Rhenium: Son Of Moly).

In June this year, the Financial Times ran a story noting that the price of the metal that month had already hit "a record of US$11,000 per tonne, up from about US$6,800 last year and less than US$4,000 in 2000." Currently (end-August), the pure metal is trading in the US$13,500-13,800 per metric tonne price range.

Chromium, and chromium compounds, are not traded on any public exchange and, consequently, prices are not that easy to find. Indicative prices are obtained by trade journals (Metal Bulletin, Platts, etc.) that report composite prices based on interviews with buyers and sellers.

Riding the Chromium Wave

Are there any realistic opportunities to ride the chromium wave? Perhaps.

While some chromium compounds (particularly hexavalent compounds of the metal) are unpleasantly toxic, chromium metal itself is relatively nontoxic. (In fact, we need chromium as a trace mineral, amongst other things, to prevent glucose intolerance. So, carry on eating those mushrooms, broccoli and wheat germ!)

For the more intrepid investor, owning the physical metal could, therefore, be a possibility. But, as with many of the minor/strategic metals, there will always be the issues associated with the metal not being traded on a public exchange, the liquidity of your holding, storage, how and where you sell it, etc.

On the other hand, two of the largest ferrochromium producers in the world are publicly quoted. For both, however, ferrochromium production is just one of many business activities. This is certainly the case for Xstrata (Bloomberg Ticker - XSRAF:US), not only the world's largest ferrochromium producer, but also one of the world's largest mining companies.

While Xstrata's ferrochromium production is based in South Africa, should continuing power supply problems in the country constitute too much of an issue for you, Eurasian Natural Resources Corp [ENRC] (Bloomberg Ticker - ENRC:LN), out of Kazakhstan, provides not only exposure to ferrochromium as the world's second-largest producer, but also exposure to both traded alumina and iron ore as, respectively, the world's fifth-largest producer and sixth-largest exporter. The company recently reported a 170% rise in profits for first-half 2008, with 65.5% of profits being accounted for by strong ferro-alloy prices.

Back in South Africa, Samancor and Hernic Ferrochrome (the world's third- and fourth-largest ferrochromium producers), while being pure-plays, are privately owned. And Assmang, unfortunately, the world's fifth-largest ferrochrome producer, delisted itself from the Johannesburg Stock Exchange in February 2006.

If a Chinese angle looks interesting, then just under a year ago, China's Minmetals Development Co (Bloomberg Ticker - 600058:CH), state-owned China Minmetals Group's Shanghai listed arm, bought in SA Chrome. And Tata Steel (Bloomberg Ticker - TATA:IN) now has a ferrochrome production facility in Richards Bay, South Africa.

When looking at ferrochromium production, it is, however, worth bearing in mind the very diplomatic words of the USGS: "The major producers of chromite and ferrochromium are politically and economically dynamic nations." Country risk is a significant issue. (In this regard, en passant, Zimbabwe is also a large ferrochromium producer.)

Since chromium is, though, primarily a stainless steel play, thinking laterally reveals, once again, that interesting investment possibility: scrap.

The U.S. currently produces only a small amount of ferrochromium. Indeed, as a percentage of apparent consumption, in 2007, the country had a 62% net reliance on imports: predominantly from South Africa and Kazakhstan. On the other hand, according to the USGS, some 38% of apparent consumption last year was accounted for by recycled chromium. As the price of chromium and ferrochromium, and the cost of importing ferrochromium continue to rise, so, too, will recycling stainless steel scrap become ever more attractive (see Thank Scrap: The Market For Recycled Metals).

While I am not currently aware of any publicly quoted companies in the U.S. involved uniquely in recycling stainless steel, there are a number of such companies involved in recycling stainless steel amongst other metals. Each week the ISRI publishes its Friday Report, with a section at the back titled "ISRI's Eye on Equities" covering companies involved in recycling.

Publicly quoted U.S. companies involved in metal recycling include Commercial Metals Company (Bloomberg Ticker - CMC:US); Gerdau Ameristeel (Bloomberg Ticker - GNA:US); Industrial Services of America (Bloomberg Ticker - IDSA:US) - quite a pure recycling play; Metalico - a major recycler as well as fabricator (Bloomberg Ticker - MEA:US); and Schnitzler Steel Industries - another major recycler (Bloomberg Ticker - SCHN:US).

And, recently, the Australian company Sims Metal Management Group (Bloomberg Ticker - SMC:US) - the world's and North America's largest metal and electronics recycler - bought Metal Management, previously itself one of the largest publicly quoted U.S. metal recycling companies.

Conclusion

As long as we have stainless steel, we will need chromium. There is no substitute. The same is currently true for super-alloys. But, while there may be no substitute for chromium, stainless steel scrap can be substituted for ferrochromium. Once again, scrap looks like the way to go!