With the Trudeau government signalling that their first (and following budgets) are likely to run deficits, I thought that it was time to take yet another look at Canada's debt and deficit history as I have done for several years running. This year, thanks to Royal Bank's research department, I have additional metrics that may be of some interest to my readers. It is important to note that statistics prior to fiscal 1983 - 1984 are not directly comparable to later data since the method of accounting used by the federal government changed to the full accrual method.

Let's open with a summary of which prime ministers and political parties were in control of Canada's federal coffers/Canadians' tax dollars by year:

1980 to 1984 - Pierre Trudeau (Liberal)

1984 to 1984 - John Turner (Liberal)

1984 to 1993 - Brian Mulroney (Progressive Conservative)

1993 to 2003 - Jean Chretien (Liberal)

2003 to 2006 - Paul Martin (Liberal)

2006 to 2011 - Stephen Harper (Conservative - minority)

2011 to 2015 - Stephen Harper (Conservative - majority)

2015 to present - Justin Trudeau (Liberal - majority)

As well, since there has been substantial inflation over the 35 year period, here are some values to help you ascertain how the real value of the Canadian dollar has declined at several points in time from the Bank of Canada Inflation Calculator:

- by 168.14 percent between 1981 and 2016

- by 55 percent between 1991 and 2016

- by 31.3 percent between 2001 and 2016

- by 7.62 percent between 2011 and 2016

Now, let's look at how Canada's deficit picture has evolved over three and a half decades:

Of the 35 fiscal years, only 12 or 34 percent have seen the federal government spend less than they brought in as revenue. Other than the possible small surplus in fiscal 2014 - 2015, all of the surpluses occurred between fiscal 1997 - 1998 and fiscal 2007 - 2008.

Now, let's look at what has happened to the net federal debt over the same timeframe:

Over 35 fiscal years, the net federal debt has grown from $109.6 billion in fiscal 1981 - 1982 to $612.3 billion in fiscal 2014 - 2015, growth of $502.7 billion or 459 percent. If you use the Bank of Canada's Inflation Calculator which shows that there was 168.14 percent inflation between 1981 and 2016, you can see that the growth in the federal debt outstripped inflation by 2.7 times.

Now that we have the debt and deficit data in mind, here are three additional government metrics that we rarely hear about starting with the per capita net debt:

At $17,228, per capita net debt is still below its peak of $19,010 seen back in fiscal 1996 - 1997, however, up to fiscal 2014 - 2015, it has grown by 297 percent over the thirty-five year period, 1.77 times the rate of inflation.

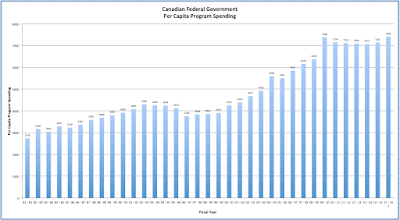

Let's now look at how much the federal government spends on programs on a per capita basis:

Program spending has risen from $2734 per capita in fiscal 1981 - 1982 to its current level of $7141, an increase of $4407 or 161 percent. This is very close to the rate of inflation over the thirty-five year period, however, given Canada's aging population, unless the federal government is willing to cut back spending on health care for seniors and other senior-related programs, per capita program spending is likely to rise significantly (and likely more than the rate of inflation) over the next two decades.

Let's close with a look at how government revenues have changed as a percentage of GDP:

It's interesting to observe that government revenues as a percentage of GDP fell right at the beginning of the Great Recession in fiscal 2008 - 2009 from roughly 16 percent of GDP to roughly 14 percent of GDP and how the revenue situation has not improved despite significant improvements in the economy after the end of the Great Recession.

The saving grace for the federal government over the past eight years has been the drop in interest rates on new and outstanding debt. Here is a chart showing the yield on Government of Canada ten year bonds since 1985:

If interest rates should rise to average historical levels of around 6 percent, the federal government would find its deficits growing at a far faster rate than they are currently.

As we can see from this data, Canada's fiscal health has been negatively impacted by a series of governments of both Liberal and Conservative persuasion. While Canada's fiscal picture is better than some of its G-20 peers, there is no doubt that if and when the next recession hits, the federal government will find it very difficult to stimulus spend its way out of trouble.