OT: Interactive Brokers has just opened an office in Hong Kong

posted on

Nov 11, 2016 12:56PM

NI 43-101 Update (September 2012): 11.1 Mt @ 1.68% Ni, 0.87% Cu, 0.89 gpt Pt and 3.09 gpt Pd and 0.18 gpt Au (Proven & Probable Reserves) / 8.9 Mt @ 1.10% Ni, 1.14% Cu, 1.16 gpt Pt and 3.49 gpt Pd and 0.30 gpt Au (Inferred Resource)

Interesting article , but keep in mind that as great of a CEO that many believe Keith Neumeyer might be, much of his acclaim is a direct result of his promotional efforts. We've been hearing stories like this from the Precious Metals Permabulls for years now, but their prognostications have yet to result in any significant sustained long term rise in the precious metals/mining stocks themselves ;(

Cheers,

Luker

This Why The Smash In Gold & Silver Is Happening? A Shocking Game-Changer For Gold & Silver Is Now Unfolding…

With gold down over $31 and silver plunging $1.08, is this why the smash in gold and silver is happening? Today King World News is reporting on a shocking game-changer in the gold and silver markets that is now unfolding.

Eric King: “Keith, you are a legend in the business and you have been on a long road trip that’s taken you around the world, including into Asia and Europe. You are in London currently but talk about about what you discovered in Hong Kong? I understand that a huge transformation is coming to the gold and silver sector.”

A Game-Changer For Gold & Silver Is Now Unfolding

Keith Neumeyer: “That’s correct, Eric. I have been building relationships in Hong Kong for many, many years, but up to now there has been no way for Chinese investors to invest in North American companies. But for the first time ever Chinese investors can set up an account through Interactive Brokers, which has just opened an office in Hong Kong. This is going to be a massive game-changer for the gold and silver sector…

Keith Neumeyer continues: “What this means, Eric, is that for the first time ever Chinese investors will now be able to directly buy U.S. and Canadian mining stocks.”

Eric King: “When you talk about the Chinese coming into the mining share market, even though the sector is currently experiencing the final stages of a correction, you are talking over time about a radical flow of money into the mining shares, aren’t you?”

The Tip Of The Iceberg

The Tip Of The Iceberg

Keith Neumeyer: “Yes, and it will just be the tip of the iceberg compared to what is coming. This is a new phenomenon and as more and more Chinese investors open up new accounts through brokerage firms in both China and Hong Kong, they are going to be looking to add to their exposure in the gold and silver space and they will now be able to do that by investing in mining stocks for the first time ever.

We are in the beginning stages of a new bull market in gold and silver and the mining shares, so that will translate into huge money flowing into North American, and Canadian companies specifically, from China.”

Eric King: “I know you are familiar with the mania that took place in the mining shares in the late 1970s and into 1980 time frame. Despite the pullback, like the one we are seeing today and this week, what we will eventually see is a super-charged mania in gold, silver, and the mining shares because of the ocean of money that will be part of the secular bull market in gold and silver, this time around from China and the rest of Asia. Pierre Lassonde has spoken with me in the past about this but it was in relation to physical gold and silver prices. However, what you have uncovered now opens the door for oceans of money to eventually pour into the mining shares. Meaning, this mania will see upside moves that are difficult to comprehend because the Chinese are notoriously aggressive gamblers.”

Keith Neumeyer: “The key thing you and Pierre have discussed many times is the fact that the Chinese are gamblers. They love to play the stock market now and that will add a new dynamic to the gold and silver mining share market that we have never seen in the North American marketplace.

We have experienced bull runs in the mining share market over the last 15 or so years but it has never had the Chinese buyer coming in as part of the whole equation. What that means is that over the next few years in this new bull market in the mining sector we will see these new buyers, the Chinese, coming into the market and setting the stage for a major run in the mining shares.

China has a huge population, the largest population on the planet, and they are getting wealthier by the day. The Chinese are very familiar with the gold and silver markets and they love the physical metal. For them to be able to buy mining stocks, which generally trade at 3 – 5 times the move in gold and silver, they will be all over that upside leverage in the gold and silver markets.

Chinese Buying Causes A Major Silver Stock To Skyrocket!

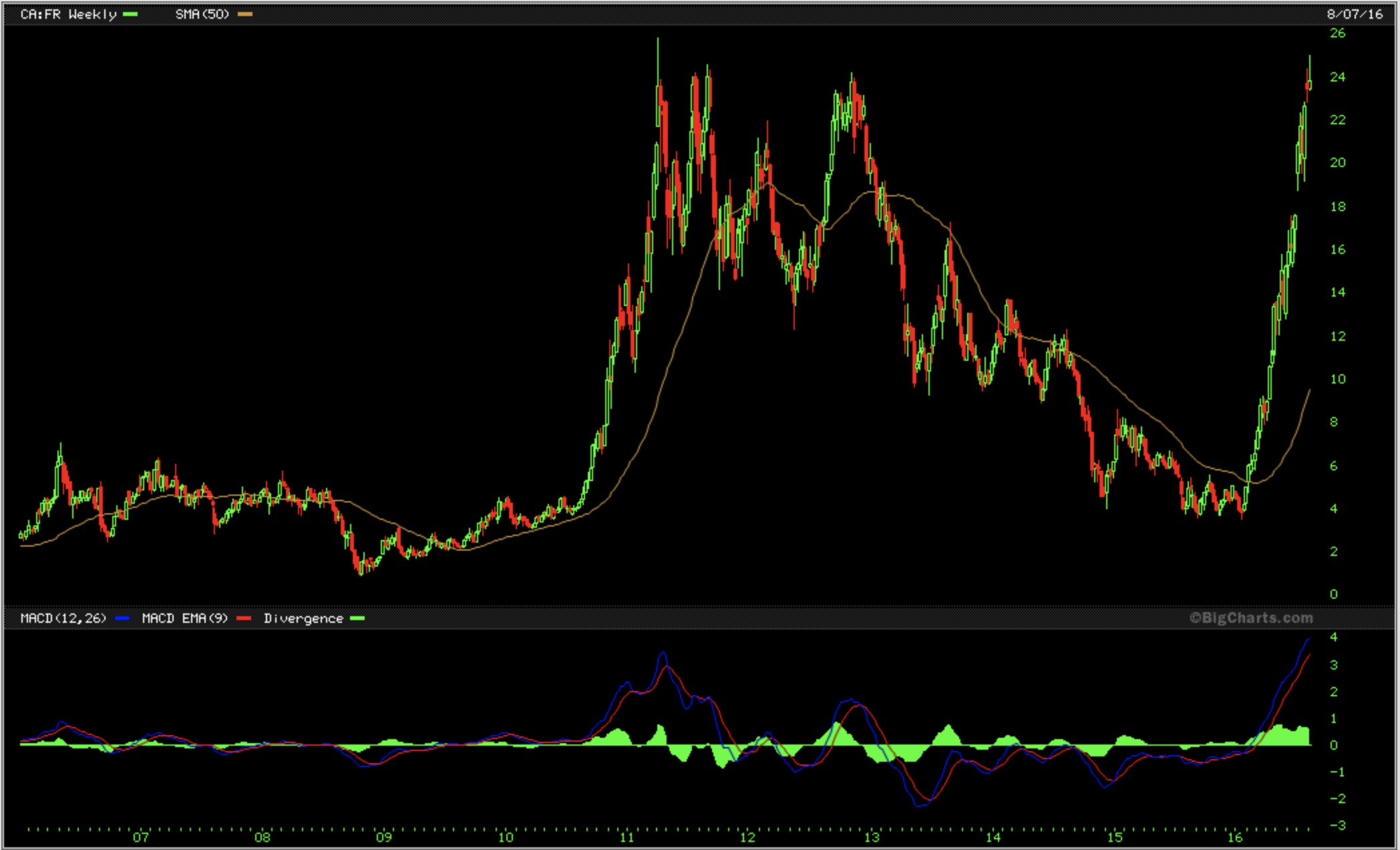

As I said earlier, Eric, this is a new phenomenon. I was just in Hong Kong with some of my staff and we met a large number of investors who are already shareholders in First Majestic Silver and First Mining Finance. This is quite interesting and it represents the beginning of what is going to be massive change in the mining share industry. We all know what happened to First Majestic Silver in the first six months of this year when it went from $4 Canadian to nearly $25 a share (see stunning 10-year chart below of First Majestic Silver).

Yes, the share price has corrected over the past couple of months but you can be assured that the massive spike to nearly $25 was due in part to Chinese buying.”

Eric King: “Keith, when I saw that move in First Majestic Silver I knew it was a short squeeze combined with new money entering the stock and I was trying to figure out where that money was coming from because the stock essentially went back to the all-time highs when the price of silver was around $50. Now I know where that new money was coming from — China. And of course this time the price of silver was only $20 and change when the Chinese money helped propel the stock back to the previous all-time high. Was that just a preview of what is to come in the mining sector and in First Majestic Silver? Because I am trying to figure out what happens to the share price of First Majestic Silver when the price of silver goes to $25 or $30 or even higher.”

Keith Neumeyer: “Eric, you mentioned an important point about short covering. First Majestic had 14 million shares short in January when the stock was $4 Canadian. The short position dropped to only 4 million shares by July. That’s when the stock peaked at nearly $25 Canadian. That was indeed a huge, huge move. And now today the short position is back to 18 million shares, which is ridiculous but it’s the highest short position in the First Majestic Silver’s history.

Interestingly, the price of silver went from $13.50 (U.S.) to around $21 in late July. But the price of First Majestic Silver went from a low of $2.40 (U.S.) to over $19 a share. You have to remember that is only with a little more than a $7 move in the price of silver. That was a pretty amazing move. So when we look forward to $25 or $30 silver, you will see some pretty interesting prices for First Majestic Silver.”

Neumeyer added: “Eric, we have also seen a very nice move in gold, even with the correction here, and I think this is a great opportunity for investors to take advantage of this down-move in gold and take a look at high-quality equities. One of those companies is First Mining Finance (symbol FF in Canada and FFMGF in the U.S.). I believe First Mining Finance has the best portfolio of development projects in the world. I don’t believe that the market fully understands what the company has achieved as a business.

The company has amassed 14 million ounces of gold in the ground with projects in great jurisdictions in the province of Ontario, Quebec, Newfoundland. If a major is looking for a portfolio of gold projects, this portfolio will make their mouth water looking at what First Mining Finance possesses. The company has about 25 projects throughout Mexico, the U.S. and Canada.

As I said earlier, it is probably the best assembly of projects in the world and the company’s share price is highly undervalued at current levels. At 68 cents a share (Canadian) we are talking about roughly $21 for every ounce of gold in the ground. And in a healthy market the price for gold in the ground should be priced at 3, 4 or 5 times that amount.”

Eric King: “Keith, where do you see the price of silver trading in 2017?”

Price Of Silver To Soar By The End Of The Year And Into 2017

Price Of Silver To Soar By The End Of The Year And Into 2017

Keith Neumeyer: “I would never have believed that the price of silver would have traded down from $50 to $13.50 an ounce and it happened for all kinds of ridiculous reasons, from manipulation and short selling to sentiment and other things your guests have pointed out on King World News.

I projected the price of silver would end at $21 an ounce by the end of 2016. The price of silver hit $21 in July of this year, which was a fantastic move, and has since pulled back. This has positively impacted First Majestic Silver with cash flows that we haven’t seen for 5 or 6 years and our treasury is building every week — at new record highs — and our balance sheet is extremely strong.

But getting back to the price of silver and the fact that it hit $21 in July of this year, I wouldn’t be surprised to see $21 to $23 by the end of this year. And we have seen about a $100 move down in the price of gold in the last couple of days, the price of silver has pulled back but it has remained much stronger and I think that bodes very well for the price going forward. So I am exphttp://kingworldnews.com/is-this-why-the-smash-in-gold-silver-is-happening/ecting $25 – $30 silver in 2017.”