article from "The Motley Fool" on Pyrogenesis

posted on

Apr 08, 2021 02:09PM

Being commercialized in multiple applications around the world including plasma torches, Industrial 3D printing powders, aluminum & zinc dross recovery, waste management and defence - 4 US aircraft carriers

Brian Paradza, CFA | April 6, 2021 | More on: PYR PYR

Image source: Getty Images

Image source: Getty Images

At one point in February 2021, investors in PyroGenesis Canada’s (TSX:PYR)(NASDAQ:PYR) stock were sitting on a 229% year-to-date capital gain. The fast-growing high-tech industrial company, which recently listed on the NASDAQ this year keeps delivering good news for its investors. PyroGenesis was one of my top TSX growth stocks to watch in 2021. Shares have delivered beyond expectations so far this year.

Although shares have somewhat consolidated, I believed shares could double in 2021, and a 135% year-to-date gain on PYR stock so far this year exceeds that projection by some significant margin.

Perhaps the best question to ask is, why has PYR’s stock price returned a whopping 1,952% return over the past 12 months?

PyroGenesis develops and markets plasma-based advanced technologies used in metallurgical, chemical, and waste treatment processes, among other growing applications.

The company has won high-value contracts with the U.S. Navy. It recently started pivoting from an aerospace industry focus to addressing the emerging electric vehicle (EV) market’s needs and could soon be booking clients from many more industries, as its extreme heating technology gains wide adoption throughout the world. PYR’s revenue growth rate over the last 12 months was just phenomenal.

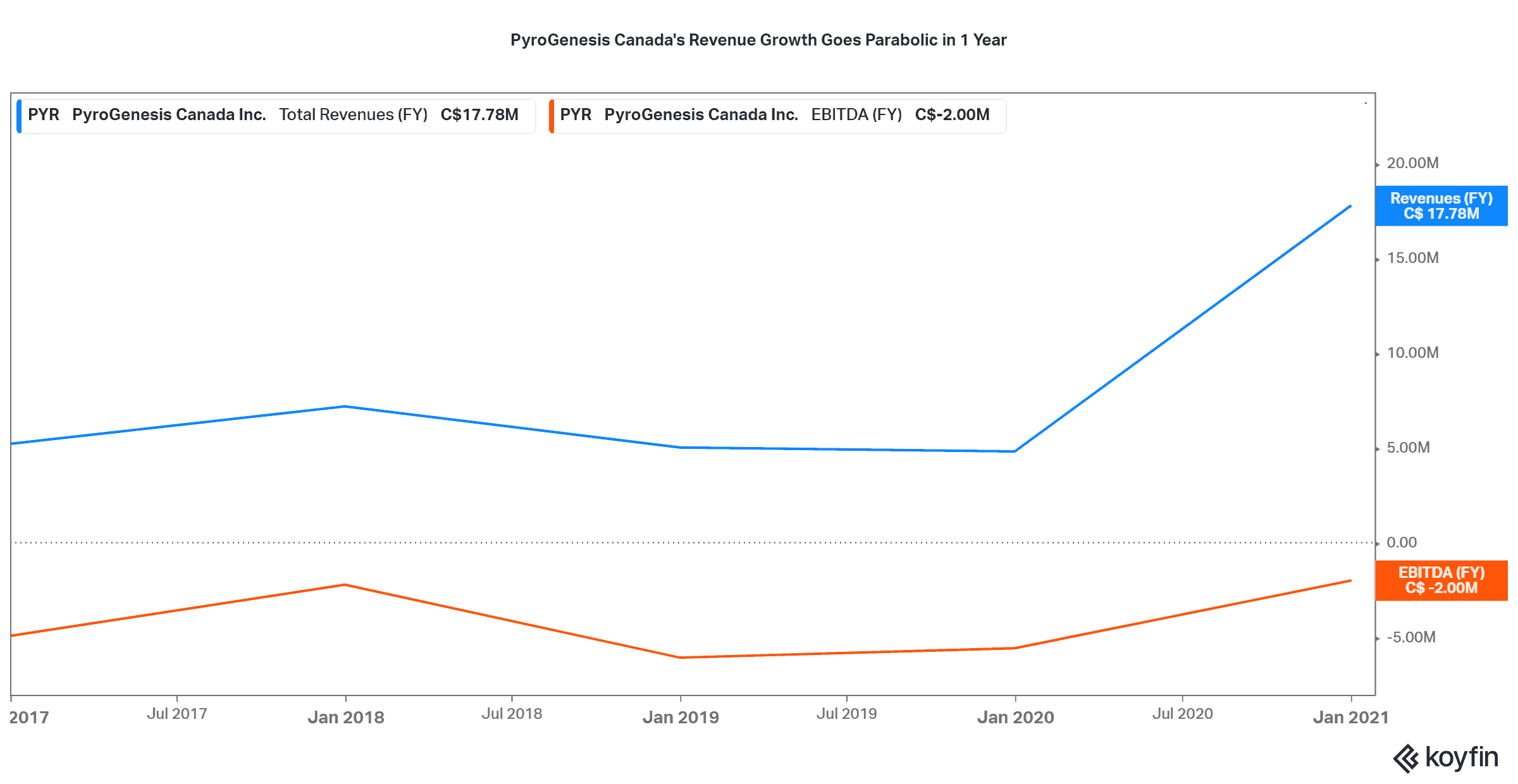

Revenue growth was very strong over the past year, and profitability is tracking along nicely.

PyroGenesis’s parabolic revenue growth in 2020, partly explains stock’s rally.

During the past year, PyroGenesis Canada reported a strong 269% year-over-year growth in sales to $17.8 million by December 31, 2020.

Moreover, gross margins expanded from 27% of sales in 2019 to a staggering 58% in 2020. Even if we adjust for royalties and intellectual property sales, for which no cost of sales may be recognized, the company’s gross margin was still a strong 47.2% of sales last year.

Operating costs may have risen with revenue, but the company has seen its earnings before interest, taxes, depreciation, and amortization charges (EBITDA) improve significantly over 12 months. Revenue growth is being accompanied by profitability gains, and investors love such a solid business trajectory.

Most noteworthy, the company extinguished its balance sheet debts during the past year. A clean balance sheet and its associated interest cost reductions help uplift Pyrogenesis’s stock price.

That said, it’s important to note that the company’s $41.8 million net earnings for the year were fair-value gains on a strategic investment in HPQ Silicon Resources’s stock. HPQ is another nano-tech growth stock that has returned over 1,833% over the past 12 months.

The company looks to have a promising growth trajectory ahead of it.

While new inroads into the emerging EV manufacturing industry should increase PYR’s total addressable market, I am most encouraged by the business’s growth prospects into the traditional manufacturing industries that still burn fossil fuels in furnaces to manufacture products. Iron and steel smelting is one of them.

PyroGenesis could keep receiving calls from potential customers for its patented clean heating technology this decade — more so as climate change awareness campaigns gain momentum globally. Industries and governments face increasing pressure to reduce carbon emissions right now. ESG investing is becoming smarter too, and this trend could force industrialists to switch to green manufacturing technologies.

PYR’s patents will protect it from potential competition.

Moreover, management expects the company to earn significant recurring revenue from plasma torch spares. The company expects to announce a new joint venture “within the next several weeks” related to its DROSRITE™ innovation, which is changing the game in the aluminum industry. And it has plans to enter the renewable natural gas market, too.

PyroGenesis is one top TSX growth stock to keep tabs on in 2021. This Foolish guide could help you uncover similar growth stocks this year.

Investors are taking notice of this amazing company; no wonder PyroGenesis stock has been rallying strongly of late. Shares could maintain momentum in 2021, and the future looks promising for long-term gains. However, the valuation seems too stretched right now though. Due care is necessary when playing this one.