Who Might Win a Tesla Contract

posted on

Oct 20, 2020 08:35PM

NI 43-101 Update (September 2012): 11.1 Mt @ 1.68% Ni, 0.87% Cu, 0.89 gpt Pt and 3.09 gpt Pd and 0.18 gpt Au (Proven & Probable Reserves) / 8.9 Mt @ 1.10% Ni, 1.14% Cu, 1.16 gpt Pt and 3.49 gpt Pd and 0.30 gpt Au (Inferred Resource)

Funny how other nickel producers are mentioned quite notably...Except our poor Noront who could probably put many to shame....Get that road done.

TM.

https://seekingalpha.com/article/4379895-look-who-might-win-giant-contract-to-supply-tesla-nickel

Nickel 'battery' demand is forecast to increase by 14x from 2019 to 2030. The demand surge will be for battery grade nickel sulphate best extracted from nickel sulphide ore.

By 2025 if Tesla was making 5 million EVs pa they would need ~275,000 tpa of nickel each year. That is way above what most miners are capable of supplying.

A focus on nickel sulphide miners that can produce economic and environmentally sensitive supply of nickel at a scale to potentially supply Tesla.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

This article first appeared on Trend Investing on September 16, 2020.

In July 2020, Tesla's (TSLA) Elon Musk pleaded for miners to mine more nickel. He promised a "giant contract" for anyone who could mine nickel in an "economical and environmentally" friendly way.

Elon Musk (July 2020) stated:

“Please mine more nickel......Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way.”

Clearly, Elon Musk knows he needs a lot more nickel in the coming years. With Battery Day arriving next week on Sept. 22 the world will hear how Tesla plans to massively scale up lithium-ion battery production to terafactory scale. My recent article discusses this as well as forecasts Tesla to reach 3.8m EVs by 2025. Others such as Rob Maurer of 'Tesla Daily' even think Tesla can reach 5m EVs by 2025.

If we assume each Tesla EV needs about 55kgs of nickel (model S uses 75kgs+) and Tesla makes 5 million EVs pa by 2025 (my forecast is 3.8m, however Semis, Model S & X, Cybertruck and Roadster would use more nickel than 55kgs, so we can go with 5m EVs average 55kgs each); then Tesla will potentially need about 275 million kgs (275,000 tonnes) of nickel per annum in 2025. Clearly, Tesla can give a "giant contract" and really needs to get their nickel supply locked down soon.

Nickel sulphate demand for EV batteries set to surge as the EV boom takes off

2019 to 2030 'battery' demand increase forecast for EV metals - Nickel 'battery' demand is forecast to increase by 14x

Source: Courtesy BloombergNEF

Vale - Based on 43kgs per average EV means that by 2025 we will need over 500kt of additional nickel (assumes 12m EVs pa in 2025)

Major global nickel suppliers from sulphide ore (more environmentally friendly)

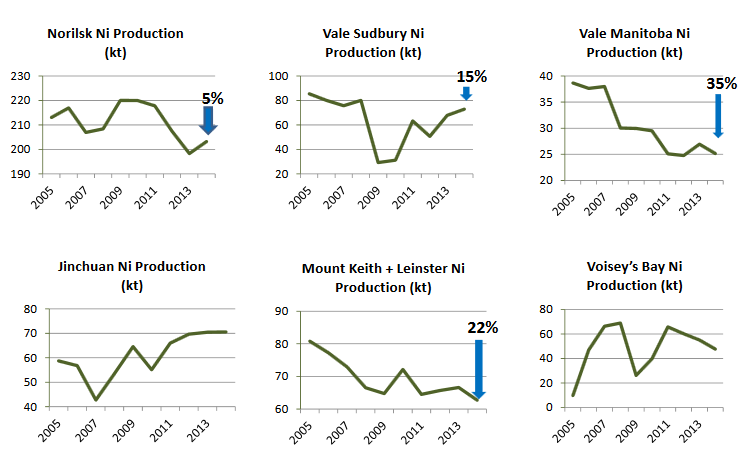

Source: Note the chart is out of date but still gives a guide of who are the main nickel sulphide producers.

Note: The current nickel price is USD 6.99/lb or USD 15,608/tonne.

Up until now Tesla has relied on Panasonic [TYO:6752] (OTCPK:PCRFY) for battery cell production. Panasonic sources from Sumitomo Metal Mining Corp. (OTCPK:SMMYY) who gets most of their nickel from the Philippines. Both the Philippines and Indonesia have nickel laterite ore which requires expensive acid extraction processes resulting in acid waste. I would think Tesla wants to avoid this source if possible. Tesla is also relying on battery supply deals from CATL and LG Chem (OTCPK:LGCLF).

Tesla's future nickel sulphate supplier[s] would need to be capable of large volumes of nickel sulphate production. Ideally, this comes from nickel sulphide mines to make it more economical and environmentally friendly to mine.

I will therefore focus only on nickel sulphide miners that can produce economic and environmentally sensitive supply of nickel at scale.

Norilsk Nickel (MNOD) (OTCPK:NILSY)

Norilsk is the world's largest nickel producer and the world's lowest cost producer, so scale and economics are matched with Tesla's needs. In terms of environment, Norilsk has had some recent issues (a diesel spill into the Arctic) but generally one can debate this aspect as to if Musk would see them as environmentally friendly or not. Being Russia-based may also be a concern, I am not sure. Tesla did recently sign a cobalt supply contract with Glencore (OTCPK:GLCNF) who sources mostly from the DRC so one can argue that Tesla is not too fussy. Norilsk already supplies 2 key cathode producers BASF and Umicore (OTCPK:UMICF). LG Chem uses Umicore cathodes and LG Chem will be supplying some batteries for Tesla.

Norilsk's revenue comes mostly from palladium, copper, and nickel; also with some rhodium and gold. 2019 nickel production was 229,000 tonnes. Norilsk Nickel produces about 50% of palladium, 20% of nickel, 20% of platinum, over 10% of cobalt, 3% of copper in the world.

I question if Tesla prefers not to use the Russian supplier Norilsk, but if Tesla wants large scale and economical nickel it may have to.

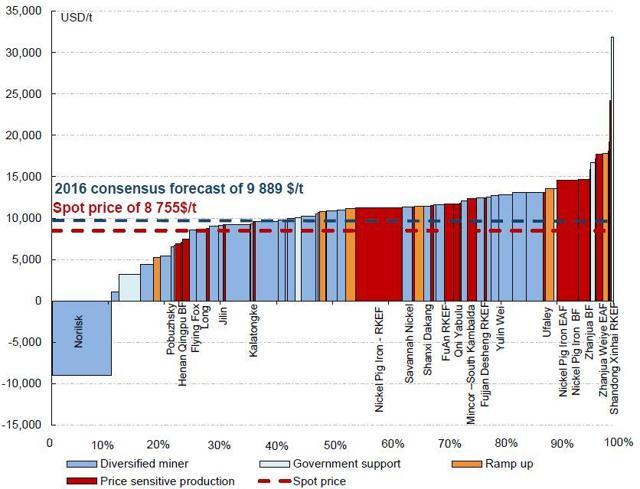

The nickel cost curve shows Norilsk Nickel as the low cost leader

Norilsk has massive mining and processing operations in Russia

Vale SA [BZ: VALE3](VALE)

Vale is the current number 2 global nickel producer (2019 levels) with the large Sudbury, Manitoba (Thompson mine), and Voisey's Bay nickel sulphide mines in Canada, as well as some other laterite projects globally (noting their Indonesia project is on hold). Vale's Canada operations mostly tick all 3 boxes (economical, environmentally friendly, and scale). Vale's Voisey’s Bay has returned to full capacity by early August after a COVID-19 interruption. Vale’s Voisey’s Bay nickel mine is transitioning (expansion) from open pit to underground mining.

Vale's 2019 nickel production was 208,000 tonnes. Vale believes they can ramp this to 400,000 tonnes in the mid-term. Vale has had environmental issues with a severe dam collapse in Brazil.

My view is Vale is probably the number 1 company capable of supplying Tesla with large scale (the ~275kt pa needed by Tesla by 2025) nickel sourced economically and environmentally from Canada.

Investors need to note that Vale's main income source is iron ore from Brazil and Vale has major environmental problems (dam collapse) in Brazil.

Vale has commenced a US$1.7B Voisey's Bay (underground) expansion plan to boost their nickel production

BHP Group Ltd [ASX:BHP] (BHP)

BHP's Nickel West (includes the Mt Keith nickel mine in Australia) has a Measured and Indicated Resource of 4.1Mt with a Total Resource Contained Nickel of 6.3Mt, with an average grade of 0.58% Ni in sulphide ore. Nickel West produced 80 kt of nickel in FY 2020.

BHP has plans to expand nickel sulphate production to meet future battery demand, with Stage 1 at Nickel West targeting expansion to 100ktpa nickel sulphate, and Stage 2 to follow. They also plan to produce some cobalt sulphate. The nickel sulphate plant has had construction delays and is now set to complete in H1 2021 with a capacity of 100,000 tpa of nickel sulphate. You can read more on Nickel West here.

The main drivers of BHP's revenue are iron ore (35.0%), copper (31.4%), coal (21.0%) and petroleum (12.6%), noting BHP recently sold off their US shale assets for USD10.5b to BP.

Investors should note that nickel is NOT a main driver of BHP's revenues. I rate BHP as a good chance to get some of Tesla's future nickel contracts.

BHP's Nickel West nickel sulphide mine in Western Australia

Glencore [LSX:GLEN]

Glencore has several large nickel sulphide mines in Canada including Raglan and their Sudbury mines (and mill and smelter). Glencore also has nickel mines in Australia (Murrin Murrin), and New Caledonia (Koniambo), with both sulphide and laterite ores. 2019 own sourced nickel production was 120,600 tonnes.

In mid-2018, Glencore announced they will be investing ~$1b to find more nickel below their Craig mine in Onaping, Sudbury. The goal here is to be able to expand nickel production in the mid-term.

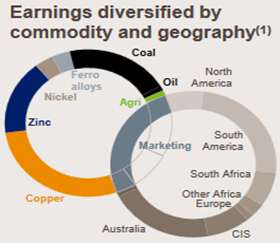

Nickel is only a relatively small percentage of Glencore's total revenues, with the main revenue drivers being their trading business ("marketing"), copper, PGMs, zinc, nickel, and cobalt.

Glencore would be an easy choice for Tesla given they already recently did a cobalt supply deal with them. Of course 120kt from Glencore helps but Tesla will need a lot more (~275 kt) by 2025.

Glencore's revenue breakup (out of date but still an ok guide, nickel is small)

IGO Limited [ASX:IGO] (OTC:IIDDY) (formerly Independence Group)

IGO Limited is a relatively new nickel miner. The reason they are included is because they have a top tier nickel sulphide resource in Australia (albeit with only a current 7-year mine life remaining). Their other big advantage for investors is they are the most pure play nickel miner of the top 5 mentioned here.

IGO's nickel mine is the Nova nickel-copper-cobalt sulphide mine discovered in 2012, located 360km southeast of Kalgoorlie in Western Australia [WA]. Nova should produce about 27-30kt of nickel in FY2020. There is exploration potential in the region. Clearly, the 27-30kt pa is not enough alone to satisfy Tesla's needs by 2025.

IGO Limited FY 2019 production and FY 2020 guidance

IGO also holds a 30% interest in the Tropicana Gold Project in WA which is forecast to produce 500,000 oz of gold this year. IGO also has several exploration projects in Australia.

The Nova nickel-copper-cobalt sulphide mine in WA

Source: Company presentation

Panoramic Resources [ASX:PAN] (OTCPK:PANRF) - Small scale nickel producer (10,800t pa of nickel).

Western Areas Ltd. [ASX:WSA](OTCPK:WNARF) - Small scale nickel producer.

Nickel sulphide projects with >20kt p.a. potential and possible to come into full scale production after about 5 years

Source: Amur Minerals Corp. company presentation

Some nickel miners summarized - Nickel juniors have surged but is this realistic for large scale nickel supply leading up to 2025?

Source: RK Equity via LinkedIn

My view is it would be risky and hence unlikely for Tesla to put its nickel future supply in the hands of any one supplier, especially a junior nickel miner not yet in production. Nickel juniors usually need very large CapEx to reach production as well as at least 5 years (exploration, feasibility studies, product qualification, off-take, funding, construction, production ramp) to achieve battery grade nickel sulphate production at scale. Even then at scale for a junior would be a long way below what Tesla needs. Tesla may sign some supply deals with juniors but really these would only be a side show or to help post 2025.

Tesla needs large scale nickel at battery grade (low impurities) and at rapidly growing amounts per year. My estimate is Tesla may need as much as 275,000 tonnes of nickel per year by 2025. This means Tesla will need to make a nickel supply deal with a large scale nickel producer, as they did with Glencore for cobalt supply.

The only realistic choices for large scale battery grade nickel sulphate is from existing producers Norilsk, Vale, BHP, Glencore and perhaps a smaller deal with IGO Limited. The other is Jinchuan International Group Resources but they source from the DRC. Existing Panasonic supplier Sumitomo Metal Mining sources from the Philippines laterite ores which are not very environmentally friendly. Indonesia is another possible large source of laterite ores. It is possible that better extraction methods or control of the acid waste can make laterite ore mines workable.

My conclusion is that Tesla will probably choose from one or more of the five (Norilsk Nickel, Vale, BHP, Glencore, IGO Limited) for a "giant contract." I think it would be wise if they had at least two sources to be safe. Investors wanting to pre-empt a serious (large scale) "giant contract" from Tesla would be best to focus on these names and not the juniors. I like all five and own four.

I do expect a few juniors may get contracts from Tesla but again they would not be able to reach scale production much before 2025 and then at less than 40kt pa, so would really only be the side show. For nickel juniors, investors could still buy in smaller dollars with a 2025 and beyond view. The best junior names are those with large scale sulphide ore nickel resources such as Amur Minerals, Giga Metals and the others on my top juniors list in the article.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. Sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest Trend Investing articles:

Disclosure: I am/we are long NORILSK NICKEL (LN:MNOD], VALE, BHP, GLENCORE [LN:GLEN], AMUR MINERALS [LSX:AMC], POSEIDON NICKEL [ASX:POS], ARDEA RESOURCES [ASX:ARL], AUSTRALIAN MINES [ASX:AUZ]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.