Re: The Falcon play - Falcon's present value - Update

in response to

by

posted on

Sep 30, 2013 02:41AM

Developing large acreage positions of unconventional and conventional oil and gas resources

It doesn’t take a Mensa member with an IQ of 200 to figure out what the backroom boys are up to. For weeks, just to get their grubby hands on your investment, they tried to drive the stock price into the ground to no avail. Of course they are not going to give up easily, so they sent in a bunch of “tools” to tell you that Falcon should had a VJ deal by now. Since they don’t have a deal yet, they are suggesting that there are no negotiations going on. Of course that’s poppycock. On the average, negotiations can take as long as 9 months.

For example, in July of 2007 Falcon announced that they are looking to farm out the play in the Makó Trough; it took them 11 months to have Exxon sign a JV deal in April 2008.

In August 2010, I talked on the phone with Falcon’s Corporate Communications officer and was told that Falcon was engaged in serious talks with 5 of the world top ranking energy companies. 9 months later in May 2011, Hess signed a JV deal with Falcon.

So, I don’t see any deal would be signed before the end of this year; it may even stretch into the next year. Actually there’s no urgency to rush this deal because work can’t be started until the end of the wet season, which will last till the end of April in the Beetaloo.

Anyway, back to the backroom boys, it doesn’t take a Mensa member with an IQ of 200 to figure out why they would like to have a larger piece of the estimated 1 trillion dollars worth of resources.

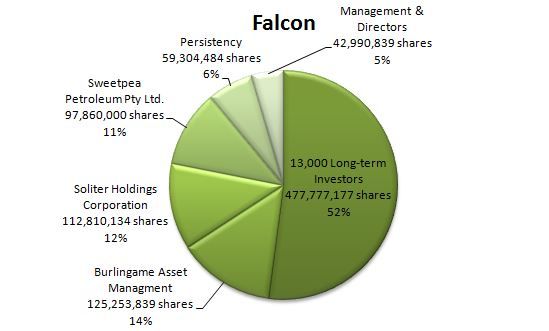

The chart below tells you the story