Re: The Falcon play - Falcon's present value - Update

in response to

by

posted on

May 09, 2014 05:02AM

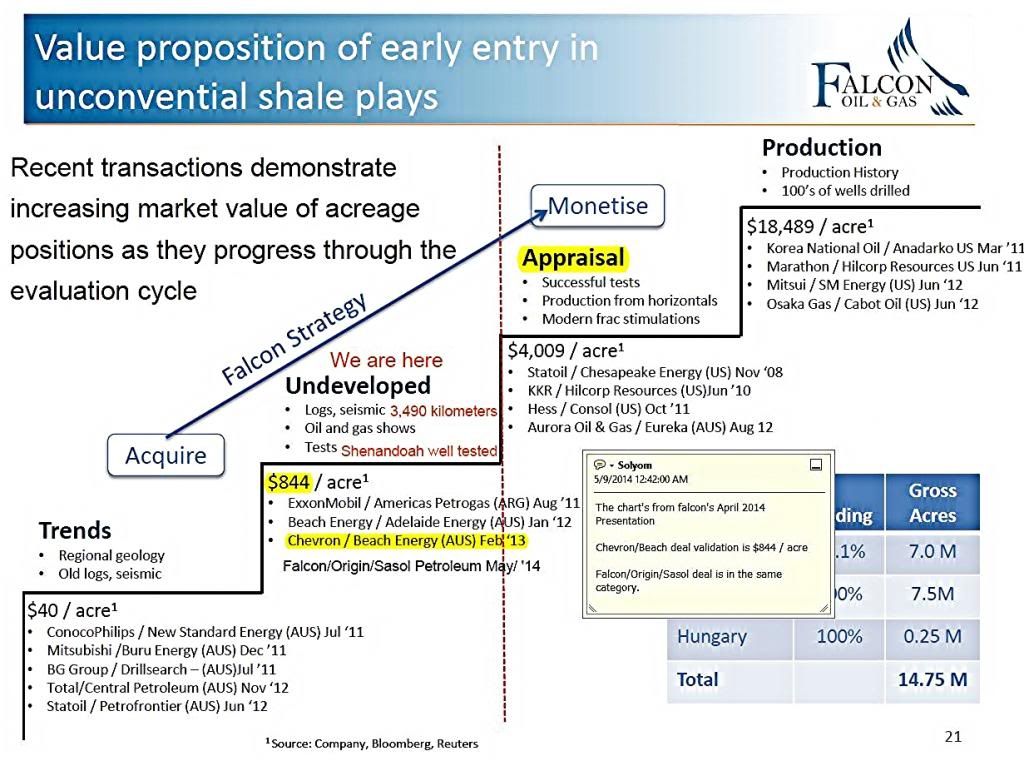

Developing large acreage positions of unconventional and conventional oil and gas resources

Just in case the backroom boys do not read the Oil & Gas Journal.

MELBOURNE, May 6

Falcon Oil & Gas Ltd., Dublin, has farmed out a portion of its exploration permits in the Beetaloo basin onshore Northern Territory to South Africa’s Sasol and Origin Energy of Sydney.

Origin and Sasol will take 35% each with Origin also assuming the operatorship. Falcon will retain a 30% interest.

Origin and Sasol will carry Falcon through a nine-well exploration and appraisal program to be conducted during the next 5 years. The work will comprise three vertical exploration-stratigraphic wells, including core studies, one hydraulic fracture stimulated vertical exploration well plus core study, plus another five hydraulic fracture stimulated horizontal wells.

One of the latter will include commercial study and 3C resource assessment. The other four will be exploration-appraisal wells that include microseismic and 90-day production tests.

Origin and Sasol will each pay Falcon $20 million (Aus.) cash on completion of the farm-in agreements. They may reduce or surrender their interests back to Falcon only after drilling the first five wells.

The prospects are shale gas plays in permits EPs 76, 98, and 117. A fourth permit, EP 99, has been surrendered back to the Northern Territory government as it was not considered core to the unconventional gas play.

Drilling will begin as soon as possible after completion of the agreements.

Falcon has already had some success in the Beetaloo when a well called Shenandoah-1 in EP 98 flowed gas at rates of 50,000-100,000 cfd from a Proterozoic-age reservoir in 2011.

At that point Falcon had signed a farm-out agreement with Hess Australia for Hess to earn 62.5% in EP 98 as well as in EP 76 and EP 117. Hess subsequently withdrew.